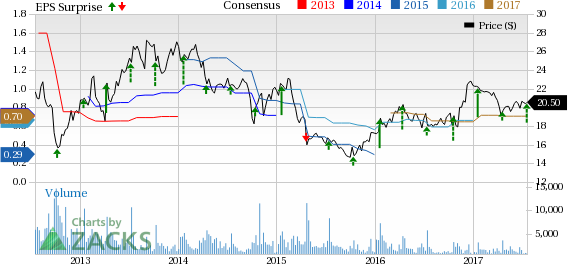

Communication network solution provider ADTRAN Inc. (NASDAQ:ADTN) reported second-quarter 2017 results, wherein both the top line and the bottom line surpassed the Zacks Consensus Estimate.

The company’s earnings (including stock-based compensation expenses) came in at 27 cents per share, beating the Zacks Consensus Estimate of 22 cents. Total revenue of $184.7 million was up 13.5% year over year. The top line also beat the consensus mark of $183.1 million and was primarily driven by 20.6% increase in Service sales to $29.1 million in the reported quarter. In addition, Product sales increased 12.3% year over year to $155.5 million.

Quarterly gross margin came in at 45.8% compared with 48.5% in the prior-year quarter. Operating income in the reported quarter totaled $16.4 million compared with $14.8 million in the last-year quarter.

At the end of the second quarter, ADTRAN generated $20.6 million of cash from operations, a marginal decrease from the year-ago figure. ADTRAN exited second-quarter 2017 with cash and cash equivalents of $88.8 million compared with $70.9 million at Jun 2016 end.

Dividend

The company declared a cash dividend of 9 cents per share in the second quarter, to be paid on Aug 17 to shareholders of record as of Aug 3.

Zacks Rank & Key Picks

ADTRAN carries a Zacks Rank #3 (Hold). Better-ranked stocks in the broader Computer and Technology sector are Applied Optoelectronics (NASDAQ:AAOI) , Arista Networks, Inc. (NYSE:ANET) and Adobe Systems Incorporated (NASDAQ:ADBE) . While Applied Optoelectronics flaunts a Zacks Rank #1 (Strong Buy), Arista and Adobe Systems carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Applied Optoelectronics, Arista and Adobe Systems have rallied over 100%, 16% and 13%, respectively in the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

ADTRAN, Inc. (ADTN): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post