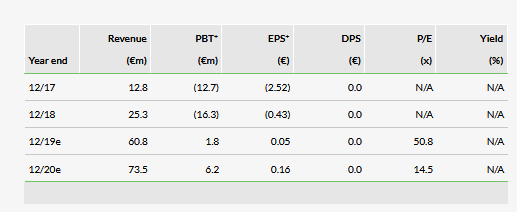

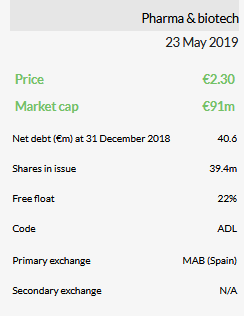

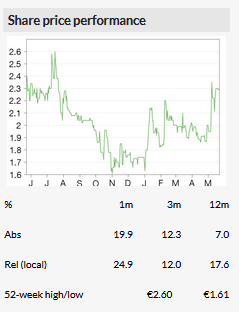

ADL Bionatur Solutions SA (MC:ADLB) (ADL-BS) recently reported Q119 results, showing positive €0.11m EBITDA, and over 134% year-on-year revenue growth to €10m, driven by 180% growth in contract manufacturing (CMO). After increasing our margin assumptions and rolling forward our estimates, we now obtain an NPV of €163.1m, translating into an equity valuation of €3.02 per share (from €2.37 previously) after adjusting for net debt.

CMO drives near-term growth

CMO contributed over 80% of Q119 revenue (and over 60% of 2018 revenue) and the robust growth validates management’s strategy in recent years to orient the firm’s industrial fermentation facilities increasingly towards CMO production for third parties. Much of the revenue visibility for ADL-BS’ CMO business has been contractually committed through multi-year (or renewable) contracts. ADL-BS will have 2,400m3 of total fermentation capacity available in H219 by bringing its two remaining 225m3 fermenters online (six are currently operating). Management expects contractually committed capacity at its eight 225m3 fermenters to rise to 100% by YE19, which underpins the company’s margin growth expectations.

Guiding for a doubling of revenues in 2018

ADL-BS also provided 2019 revenue guidance of between €50m and €55m, and positive EBITDA (targeting 15% margin in 2019, and potentially over 30% long term). We believe this revenue guidance is somewhat conservative and although we have lowered our 2019 revenue forecast to €60.8m, our forecasts in future years is little changed. Offsetting the change in our revenue assumptions are increases in our margin expectations, which are still below management’s targets. If the company reaches its profitability targets, there can be further upside to our estimates.

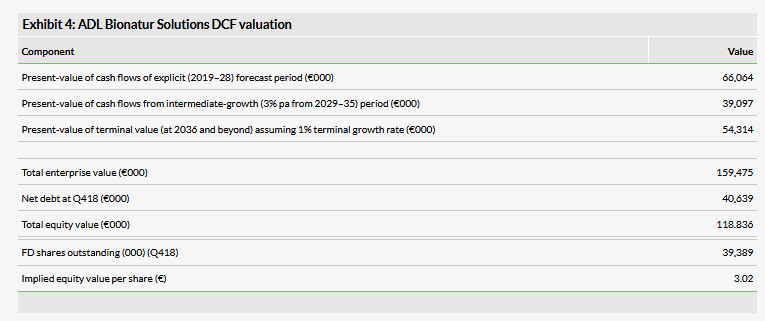

Valuation: Raising rNPV to €159.5m

The firm’s gross margins in 2018 exceeded our prior estimates and its 2019 EBITDA margin target is well above our prior 8.9% forecast. We have raised our margin forecasts, resulting in higher operating profit and EBITDA estimates for coming years. After rolling forward our estimates, we now derive an enterprise value (EV) of €159.5m, versus €138.8m previously. After removing €40.6m in Q418 net debt, we now determine an equity valuation of €118.8m, or €3.02 per share (vs €2.37, previously).

Business description

Based in Spain, ADL Bionatur Solutions provides contract manufacturing (CMO) of fermentation-based products and services focused on the health, beauty and wellness sectors. It has established CMO/API business lines and its own proprietary development line of novel or innovative products.

Growth trajectory in full swing

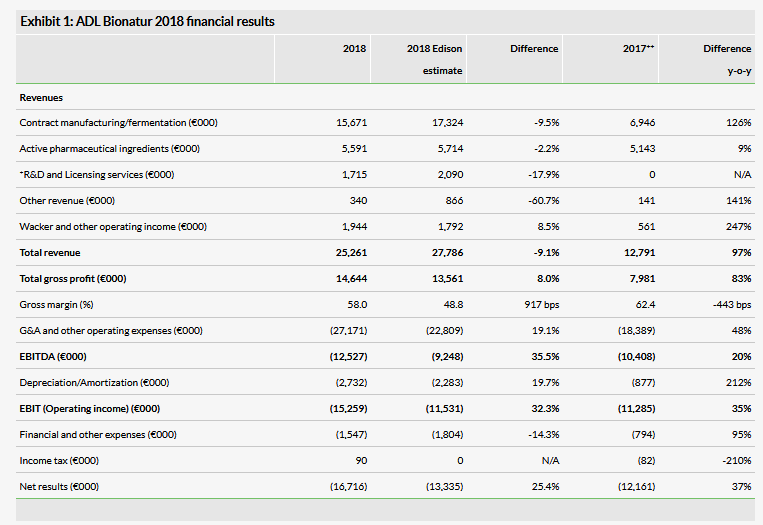

ADL-BS reported 2018 financials in mid-April, with revenue mildly below our forecast, but still indicative of substantial growth in its contract manufacturing (CMO) business. Following the completion of the merger between ADL Biopharma and Bionaturis (BNT) in April 2018, the firm has revised its unit reporting structure and it now classifies its operations under three primary business lines (CMO, Pharmaceutical, and R&D and Licensing Services), along with other operating income, which we assume is largely driven by the firm’s agreement with Wacker Biosolutions León (Wacker) whereby Wacker pays operating, usage and maintenance-related costs to ADL-BS. We estimate the BNT’s prior product lines (CRO division/Biobide, Division of Animal health, and ZIP Solutions/CDMO) are now all combined under the “R&D and Licensing services” reporting unit. We note that due to the timing of the BNT/ADL merger, BNT’s operations prior to May 2018 were not included in the reported financials.

CMO growth was up 126% year-on-year to €15.7m, and is indicative of continued success in management’s strategy (since 2015) to orient the firm’s industrial fermentation facilities increasingly towards CMO production for third parties, with a focus on higher-value end-products (which can be more complex and carry higher margins than simpler or more commoditised products produced by fermentation, such as alcohols). Gross profit of €14.6m was above our estimate of €13.6m, with gross margins over 9% higher than our prior estimate. The EBITDA loss of €12.5m was higher than our estimate of a €9.2m loss, but of the firm’s operating expenses there were €3.5m of non-recurring expenses, which the firm specifies as:

expenses associated with trading on the Alternative Stock Market (MAB),

extraordinary provisions not linked to operations,

compensation arising from the reorganisation and optimisation of structures after the merger,

expenses associated with the capital increase of July 2018, and

other non-ordinary and non-recurring expenses.

Excluding such expenses, the 2018 EBITDA loss would have been c €9m. Please note that our calculations of EBITDA and operating income differ slightly from those reported by the company because we remove items such capital grants and impairment/disposal gains or losses from these calculations.

Contractually committed revenue underpins future CMO expectations

Much of the revenue visibility for ADL-BS’s CMO business has been contractually committed through multi-year (or renewable) contracts; we estimate the two largest of these are a six-year €146m flucosil-lactose deal (signed in H217), and a renewable two-year contract signed with Amyris (AMRS, Nasdaq) in early 2018 and then expanded twice in under a year, to produce fermentation-derived products for the health & wellness, beauty and flavours and fragrances markets. The sequential growth trend in CMO revenue growth is particularly robust, as we estimate H218 CMO revenue was €10.85m, up from €4.82m in H118, driven by sharply increased capacity utilisation.

As a reminder, ADL-BS will have 2,400m3 of total fermentation capacity available in H219. Much of this will be provided through eight 225m3 fermenters, six of which are currently online and in production (we estimate c 85% capacity utilisation at YE18, up from c 40% in H118, for these six fermenters). The two remaining 225m3 fermenters are expected to be available for commercial production in H219 following recent upgrades and reconditioning.

Management expects contractually committed capacity at its eight 225m3 fermenters to rise to 100% by YE19. We highlight that committed capacity differs somewhat from full operating utilisation. The company’s arrangements with contracted customers allow certain fermentation facility allocations to be committed to a given client, without requiring the allocated capacity to be up and running 100% of the time (as there is some natural downtime needed between production batches). ADL-BS expects over time to optimise run times as efficiently as possible to augment overall utilisation at all of its fermenters while ensuring the production mix is geared as much as possible towards high-margin products. This underpins the firm’s companywide EBITDA margin expansion targets; it is targeting EBITDA margins over 15% for 2019, and over 30% in the long term (ie. 2021 and beyond).

Q119 financials show robust growth

ADL-BS in early May 2019 reported Q119 top-line results, with revenue of €9.97m (up 134% year-on-year), driven largely by increased capacity utilisation at its contract manufacturing (CMO) business. CMO revenues were €8.02m (up 180% vs Q118), whereas the active pharmaceutical ingredient (API) segment was down 14% yearly to €0.90m, due in part to seasonality for β-lactam antibiotics. Other revenue, which includes R&D and licensing services and other operating income, was up 205% to €1.05m. The strong CMO growth drove a swing to positive €0.11m EBITDA (up from a €2.85m loss in Q118). ADL-BS continues to expect positive overall EBITDA for 2019.

ADL-BS also provided 2019 revenue guidance of between €50m and €55m, which, while below our prior 2019 estimate (€64.8m), still represents a more than doubling of 2018 sales. As in Q119, the bulk of ADL-BS revenue growth for the year is expected to be driven by increased utilisation at the firm’s CMO business. Further, we believe the firm is being conservative in its revenue guidance and could be on track to exceed the current guided range.

Working towards high-value new proprietary products

While ADL-BS’s near-term goal is to generate predictable positive EBITDA and cash flows from its CMO fermentation operations, one of the rationales for the merger between BNT and ADL Biopharma was to leverage BNT’s R&D resources and its experience in developing differentiated proprietary products with ADL’s production capabilities.

To this end, management has decided to orient its new product development resources beyond BNT’s prior focus on veterinary products (such as microbiome regulators, vaccines, etc), and now towards product for human use applications, particularly in the health, beauty, and wellness sectors. In the medium to long term, ADL-BS expects to develop and market proprietary high-value products for these sectors. In particular, the company plans to develop microbiome-related products for human health applications, which is consistent with its recent announcement of a strategic alliance with Nutricion Center NC, which has launched a new line of weight-control products that help to manage the gastrointestinal microbiome. The firm is also looking at using its fermentation resources to produce cannabinoid products (such as cannabidiol (CBD) and delta-9-Tetrahydrocannabinol or their corresponding acids) for therapeutic purposes. In our model, we do not include substantial new proprietary human product lines to our forecasts, but we highlight that successful development can potentially provide upside to our estimates. Our forecasts for growth within the R&D and Licensing services line continue to be derived from existing growth avenues from BNT, including probiotics intended for cows and for companion animals and vaccines such as BNT005, and the Mupipet antibiotic product for pets (all described in our initiation report).

Within the company’s Pharmaceutical line (also called Active Pharmaceutical Ingredient, or API), which historically focused on β-lactam antibiotics, ADL-BS plans to produce new generations of generic antibiotics (such as pristinamycin, daptomycin and fidaxomicin, which have recently gone or are soon expected to be ‘off-patent’). These drugs have been shown to be more effective against multi-drug resistant strains. It is also in discussions for producing oncology or immunosuppressant APIs as well for clients.

Financials

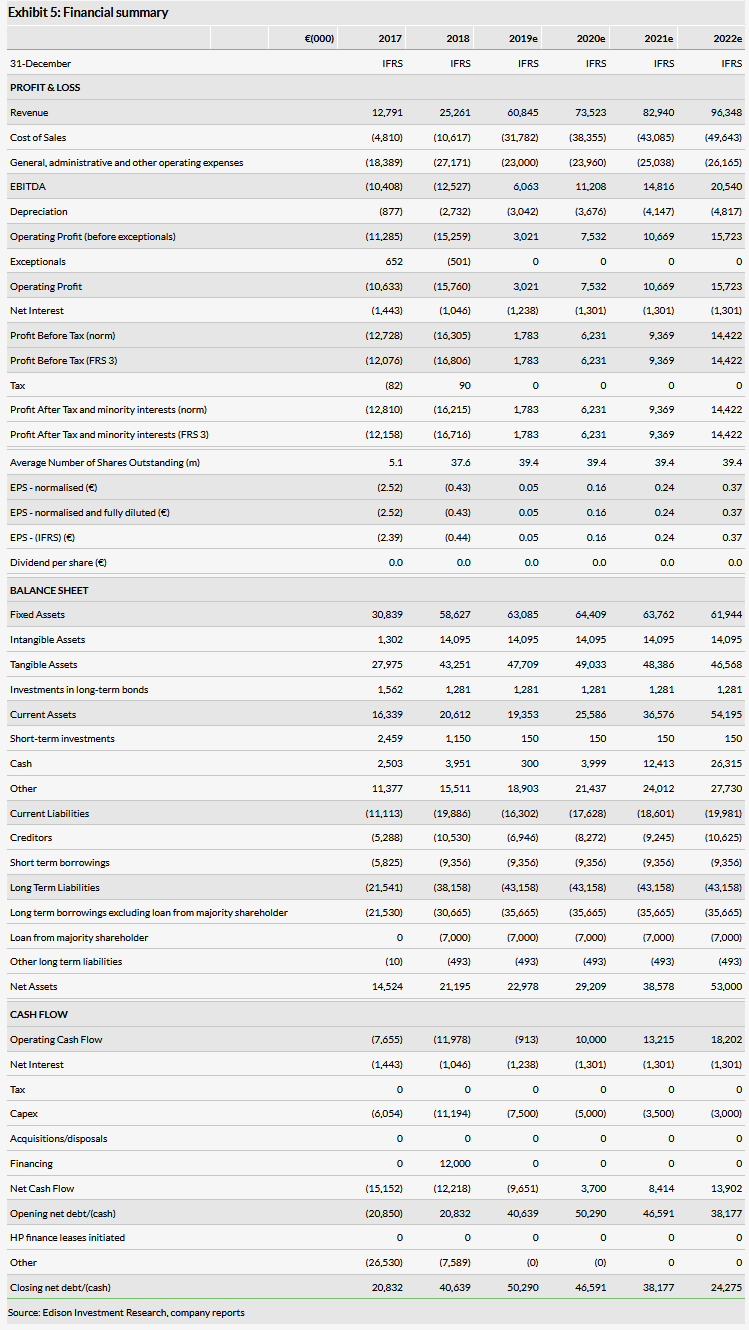

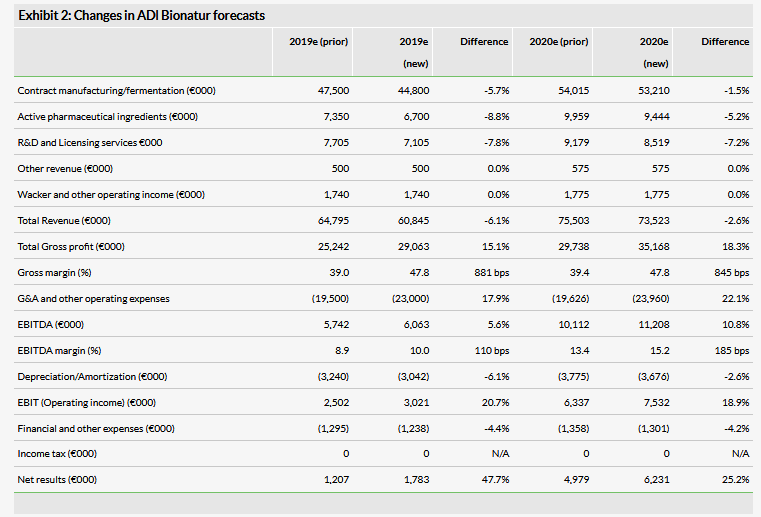

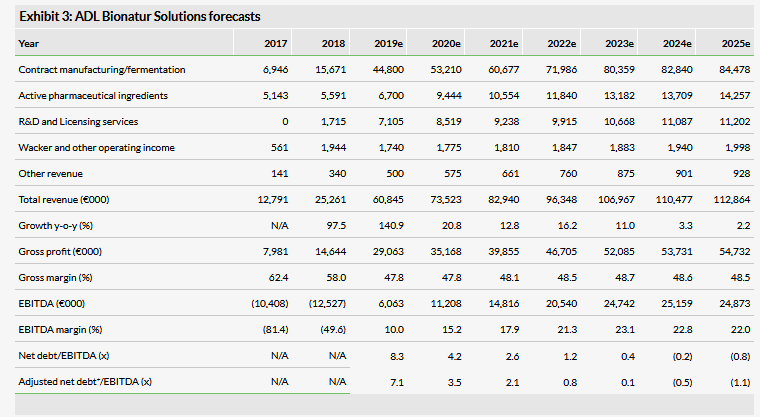

Given 2018 and Q119 results, we have slightly decreased our CMO revenue estimates for 2019 to €44.8m (from €47.5m, previously), but this still assumes robust 186% y-o-y growth, and have pushed forward some of our future expected growth to 2020 and later years, so our longer-term CMO forecasts are largely unchanged. We have also lowered our 2019 Pharmaceutical (API) segment forecasts given the slower than expected start to Q119 and also mildly revised lower our growth expectations for the R&D and Licensing services line (primarily due to our taking a more conservative estimate for a probiotic from this division intended for Middle East markets).

However, we have raised our gross margin expectations by 8–9% given the higher than expected levels reported in 2018. We also increased our G&A and other operating expense forecasts by 5–7% due to the recent trends shown in the 2018 results, even after removing some of the one-time items that occurred in 2018 relating to the ADL/BNT combination and listing and financing costs. We believe these new estimates are better aligned with ADL-BS’s current overall operating cost structure. Altogether these changes result in higher EBITDA and operating income forecasts for coming years than previously assumed. We note that our EBITDA margin forecasts are still somewhat lower and more conservative than management’s most recent target (for >15% EBITDA margin in 2019). If the firm’s H119 results (which we expect to be reported in August 2019) confirm management guidance, we may further review our margin forecasts with an upside bias for H219 and future years. We have also increased our near-term capex expectations mildly, rising from €5.0m in 2019 and €4.0m in 2020, respectively, to €7.5m and €5.0m, respectively.

ADL-BS reported YE18 total debt of €47.0m, offset by cash, equivalents and financial investments of €6.4m, resulting in net debt of €40.6m. The firm’s gross debt includes a €7.0m shareholder loan from its majority shareholder, Black Toro Capital (BTC), which carries a variable interest rate tied to the company achieving earnings before interest and taxes (EBIT) in excess of €30m. Excluding this shareholder loan, the firm’s adjusted net debt at year-end FY18 would be approximately €33.6m. While further capital raises may not be absolutely required for the firm to attain consistent profitability, ADL-BS may seek modest funding to further modernise some of its facilities. Our model continues to assume the firm will raise an additional €5m in illustrative debt in 2019.

Valuation

We value ADL Bionatur Solutions using a discounted cash flow (DCF) approach and, as per our usual policy for operating healthcare firms with a non-insignificant amount of net debt within their capital structure, we apply a 10.0% cost of capital (CoC).

To determine the enterprise value (EV) of ADL-BS, we continue to apply a 10% CoC to three forecast periods. Our explicit forecasts cover our estimates for the period FY19–28, followed by an intermediate growth period (3% pa company-wide growth between FY29 and FY35), and finally a terminal value from FY36 (1.5% pa growth). Given the firm’s €4.8m in non-current deferred tax assets and based on our discussions with management, our model does not anticipate the firm will pay income taxes until 2023.