Actuant Corporation (NYSE:ATU) delivered better-than-expected results for the third quarter of fiscal 2019 (ended May 31, 2019), with an earnings beat of 12.5%. This was the company’s fifth consecutive quarter of impressive results.

This industrial tool maker’s adjusted earnings per share in the reported quarter were 45 cents, surpassing the Zacks Consensus Estimate of 40 cents. On a year-over-year basis, the bottom line gained 15.4% from the year-ago figure of 39 cents. The improvement came on the back of improving margin profile.

Divestiture Impact Lowers Revenues

Actuant generated sales of $295.3 million in the reported quarter, reflecting decline of 6.9% from the year-ago figure. Divestitures of Cortland Fibron and Precision-Hayes International adversely impacted sales by 6% while forex woes lowered sales by 4%. These were partially offset by the positive impact of 3% from core sales growth.

Also, the top line lagged the Zacks Consensus Estimate of $301 million by roughly 1.9%.

The company reports net sales under two segments — Industrial Tools & Services (IT&S), and Engineered Components & Systems (EC&S). The segmental information is briefly discussed below:

Industrial Tools & Services (56.5% of third-quarter fiscal 2019 net sales): This segment’s revenues totaled $166.7 million, reflecting growth of 5% from the year-ago figure. The segment’s core sales grew 8% and buyouts added 1%. These were partially offset by 4% adverse forex impact.

Continued strength in end markets served boosted the segment’s products and services businesses. Also, the company reaped benefits from commercial investments made earlier.

Engineered Components & Systems (43.5% of third-quarter fiscal 2019 net sales): This segment’s revenues totaled $128.5 million, down roughly 18.8% from the year-ago figure. The segment’s core sales declined 2% as the company faced headwinds in the U.S. agriculture, European truck and the U.S. frac markets.

Also, divestitures of Precision-Hayes International and Cortland Fibron reduced sales by 14%, and forex woes had 3% adverse impact.

Margins Improve Y/Y

In the reported quarter, Actuant’s cost of sales decreased 8.6% year over year to $183.4 million. It represented 62.1% of sales compared with 63.3% in the year-ago quarter. Gross margin improved 115 basis points (bps) year over year to 37.9%. Selling, administrative and engineering expenses decreased 10.1% year over year to $69.6 million. As a percentage of sales, it represented 23.6% versus 24.4% in the year-ago quarter.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $47.1 million, up 6% year over year. Adjusted EBITDA margin in the reported quarter was 15.9% versus 14% in the year-ago quarter. Adjusted operating income increased 17.7% year over year to $39.9 million while adjusted operating margin grew 280 bps to 13.5%.

Balance Sheet and Cash Flow

Exiting third-quarter fiscal 2019, Actuant’s cash and cash equivalents were $201.3 million, up 18.2% from $170.4 million at the end of the last reported quarter. Long-term debt balance increased 2.9% sequentially to $469 million.

In the quarter under review, the company generated cash of $52.5 million from operating activities, down roughly 9% from $57.7 million generated in the year-ago quarter. Capital spending totaled $8.1 million, up 30.5% year over year.

Outlook

Actuant believes that emphasis on the development of products, enhancement of operational efficiency and cost-reduction measures will help it deliver sound results in fiscal 2019. Moreover, its initiatives to restructure the portfolio will work in its favor.

The company further noted that it will retain the remaining Cortland businesses while is working on the idea of selling its Engineered Components & Systems segment and progressing with restructuring actions of the Industrial Tools & Services segment.

For fiscal 2019, the company anticipates adjusted earnings per share to be $1.15-$1.21, higher than previously mentioned $1.09-$1.20. The new projection includes the impact of an increase in tax rate from 10% in fiscal 2018 to 20% in fiscal 2019.

Sales are now projected to be $1.125-$1.135 billion, lower than the earlier $1.15-1.19 billion. The new guidance reflects year-over-year core sales growth of 2-3% (lower than previously estimated 3-5%). On a segmental basis, core sales are likely to grow 6-7% for Industrial Tools & Services, and decline 2-3% for Engineered Components & Systems.

Cash flow from operations is predicted to be $87-$100 million, down from the previously mentioned $105-$115 million. Capital expenditure projection is maintained at $25-$30 million while free cash flow is assumed to be $62-$70 million versus the earlier $80-$85 million.

For the fiscal fourth quarter, adjusted earnings are anticipated to be 25-31 cents per share and sales are likely to be $265-$275 million. Core sales growth is predicted to decline 1-3%, with 7-11% decrease predicted for Engineered Components & Systems, and growth of 1-4% for the Industrial Tools & Services segment.

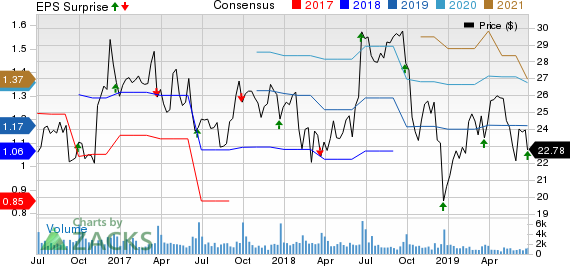

Actuant Corporation Price, Consensus and EPS Surprise

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Actuant Corporation (ATU): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Chart Industries, Inc. (GTLS): Free Stock Analysis Report

Original post