The United States is the largest Medical Instrumentsmarket in the world, raking in $180-billion dollars in revenues, annually. Abiomed, Inc. (ABMD) and Varian Medical Systems, Inc. (VAR) are two solid contenders in this space.

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

ABIOMED, Inc. (ABMD): Free Stock Analysis Report

Genomic Health, Inc. (GHDX): Free Stock Analysis Report

Original post

Zacks Investment Research

Abiomed flaunts a Zacks Rank #1 (Strong Buy), while Varian Medical carries a Zacks Rank #2 (Buy).Both stocks have a Growth Score B.Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 or 2, are better picks than most.

Here, we take a detailed look at the fundamentals of these companies to determine which stock is currently positioned better in the Medical Instruments space.

With a market cap of $18.04 billion, Abiomed is engaged in developing, manufacturing and marketing of medical products, designed to assist or replace the pumping function during heart failures.

Varian Medical is one of the leading providers of radiotherapy, radiosurgery, proton therapy and brachytherapy in the world. This California-based company currently has a market cap of $11.11 billion.

Price Performance

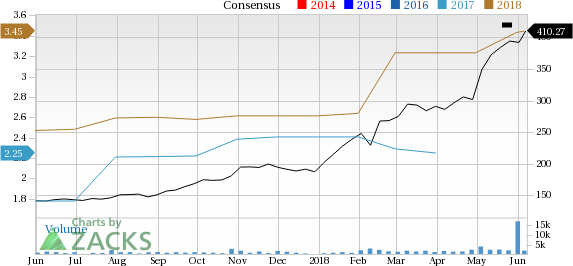

In the past six months, shares of Abiomed have rallied a whopping 114.4%, significantly outperforming the industry’s decline of 6.2%. In comparison, shares of Varian Medical have also outperformed the industry by gaining 9.7% during the same time frame. Notably, bothmstocks have also surpassed the S&P 500 index’s return of 3.7% over the same time frame.

Consequently, Abiomed wins over Varian Medical when price performance is to be considered.

Meanwhile, you can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Growth Projections

For Abiomed, the Zacks Consensus Estimate for the current-year earnings is pegged at $3.45, which reflects year-over-year growth of 40.8%. The stock has a long-term expected earnings growth rate of 27%.

On the other hand, the same for Varian Medical is peggedat $4.5, indicating year-over-year growth of 25%. The stock has a long-term expected earnings growth rate of 8%.

Abiomed wins another round.

Sales Growth Projections

The Zacks Consensus Estimate for Abiomed’s current-year revenues is $763.3 million, showing year-over-year growth of 28.6%. The same for Varian Medical is pegged at $2.87 billion, reflecting year-over-year growth of 2%.

Here too, Abiomed wins over Varian Medical.

What’s Driving These Stocks?

Abiomed

Abiomed has consistently gained from rise of coronary heart diseases in the United States. The company’s diverse product line offers minimally invasive procedures that help patients overcome the stress of open surgeries.

Moreover, the company’s Impella product line has been a solid growth driver. In the last reported quarter, it witnessed increased adoption of Impella products, both domestically and internationally.

All the above positives likely buoyed the company to join the coveted S&P 500 benchmark, very recently. Notably, Abiomed replaced Wyndham Worldwide Corp (NYSE:WYND). (Read more: Abiomedto Replace Wyndham in the S&P 500 Benchmark).

Varian Medical

Besides being a strong player in the U.S. oncology treatment market, Varian Medical also has a robust international presence, particularly in the emerging economies.

Notably, Varian Medical recently completed two major overseas buyouts —Cooperative CL Enterprises (COOP), a leading distributor of radiotherapy equipment in Taiwan, and Sirtex —an Australia-based company focused on interventional oncology therapies.

In a bid to strengthen its Oncology Systems segment, Varian Medical recently announced its plans to demonstrate the company’s comprehensive portfolio of advanced brachytherapy solutions. (Read More: Varian to Demonstrate Brachytherapy Solutions Portfolio)

In Conclusion

Our comparative analysis indicates that Abiomed is well positioned compared with Varian Medical, considering the price performance, earnings growth projections and sales expectations.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Genomic Health (GHDX) and Intuitive Surgical Inc. (ISRG).

Genomic Health has an expected earnings growth rate of 187.5%. The stock flaunts a Zacks Rank of 1.

Intuitive Surgical has an expected long-term earnings growth rate of 12.1% and sports a Zacks Rank #1.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

The United States is the largest Medical Instrumentsmarket in the world, raking in $180-billion dollars in revenues, annually. Abiomed, Inc. (NASDAQ:ABMD) and Varian Medical Systems, Inc. (NYSE:VAR) are two solid contenders in this space.

Abiomed flaunts a Zacks Rank #1 (Strong Buy), while Varian Medical carries a Zacks Rank #2 (Buy).Both stocks have a Growth Score B.Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 or 2, are better picks than most.

Here, we take a detailed look at the fundamentals of these companies to determine which stock is currently positioned better in the Medical Instruments space.

With a market cap of $18.04 billion, Abiomed is engaged in developing, manufacturing and marketing of medical products, designed to assist or replace the pumping function during heart failures.

Varian Medical is one of the leading providers of radiotherapy, radiosurgery, proton therapy and brachytherapy in the world. This California-based company currently has a market cap of $11.11 billion.

Price Performance

In the past six months, shares of Abiomed have rallied a whopping 114.4%, significantly outperforming the industry’s decline of 6.2%. In comparison, shares of Varian Medical have also outperformed the industry by gaining 9.7% during the same time frame. Notably, bothmstocks have also surpassed the S&P 500 index’s return of 3.7% over the same time frame.

Consequently, Abiomed wins over Varian Medical when price performance is to be considered.

Meanwhile, you can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Growth Projections

For Abiomed, the Zacks Consensus Estimate for the current-year earnings is pegged at $3.45, which reflects year-over-year growth of 40.8%. The stock has a long-term expected earnings growth rate of 27%.

On the other hand, the same for Varian Medical is peggedat $4.5, indicating year-over-year growth of 25%. The stock has a long-term expected earnings growth rate of 8%.

Abiomed wins another round.

Sales Growth Projections

The Zacks Consensus Estimate for Abiomed’s current-year revenues is $763.3 million, showing year-over-year growth of 28.6%. The same for Varian Medical is pegged at $2.87 billion, reflecting year-over-year growth of 2%.

Here too, Abiomed wins over Varian Medical.

What’s Driving These Stocks?

Abiomed

Abiomed has consistently gained from rise of coronary heart diseases in the United States. The company’s diverse product line offers minimally invasive procedures that help patients overcome the stress of open surgeries.

Moreover, the company’s Impella product line has been a solid growth driver. In the last reported quarter, it witnessed increased adoption of Impella products, both domestically and internationally.

All the above positives likely buoyed the company to join the coveted S&P 500 benchmark, very recently. Notably, Abiomed replaced Wyndham Worldwide Corp. (Read more: Abiomed to Replace Wyndham in the S&P 500 Benchmark).

Varian Medical

Besides being a strong player in the U.S. oncology treatment market, Varian Medical also has a robust international presence, particularly in the emerging economies.

Notably, Varian Medical recently completed two major overseas buyouts —Cooperative CL Enterprises (COOP), a leading distributor of radiotherapy equipment in Taiwan, and Sirtex —an Australia-based company focused on interventional oncology therapies.

In a bid to strengthen its Oncology Systems segment, Varian Medical recently announced its plans to demonstrate the company’s comprehensive portfolio of advanced brachytherapy solutions. (Read More: Varian to Demonstrate Brachytherapy Solutions Portfolio)

In Conclusion

Our comparative analysis indicates that Abiomed is well positioned compared with Varian Medical, considering the price performance, earnings growth projections and sales expectations.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Genomic Health (NASDAQ:GHDX) and Intuitive Surgical Inc. (NASDAQ:ISRG) .

Genomic Health has an expected earnings growth rate of 187.5%. The stock flaunts a Zacks Rank of 1.

Intuitive Surgical has an expected long-term earnings growth rate of 12.1% and sports a Zacks Rank #1.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

ABIOMED, Inc. (ABMD): Free Stock Analysis Report

Genomic Health, Inc. (GHDX): Free Stock Analysis Report

Original post

Zacks Investment Research