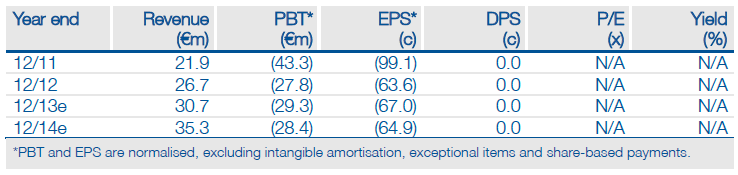

Ablynx’s (ABLYNX NV) investment case in the near term hinges on its ability to partner its IL-6R Nanobody, ALX-0061, using the final results from the Phase I/II study in rheumatoid arthritis (RA). The 24-week data suggests that ALX-0061 might have a superior efficacy and safety profile to Roche’s tocilizumab (Actemra, an IL-6R monoclonal antibody) and other IL-6 inhibitors in development. The partnering of ALX-0061 could still be challenging because of the competitive nature of RA, but Ablynx has raised €31.5m to maintain momentum in the programme. We value the company at €431m, which rises to €497m if ALX-0061 is out-licensed.

Final Phase I/II results promising

Ablynx has reported promising 24-week data from the Phase I/II study with intravenous ALX-0061 in RA. The 24 patients that received an unmodified dose of the Nanobody throughout the 24 weeks achieved ACR20, ACR50 and ACR70 scores of 83%, 71% and 58%; also 63% of patients entered remission based on DAS28 criteria. There were no significant differences between the different dosing schedules, including between four-weekly and eight-weekly dosing. The Nanobody was well tolerated throughout trial and no anti-drug antibodies were detected.

ALX-0061 possibly better than Actemra

The data from the study suggests that ALX-0061 might have a better efficacy and safety profile than tocilizumab and other IL-6 inhibitors in development. The level of ACR70 response and DAS28 remission achieved with ALX-0061 compares favourably with that published on other IL-6 inhibitors. The tolerability data also suggests that adverse events seen with the other therapies (changes in lipid levels, neutropenia) are not caused by the Nanobody. These characteristics should lead to interest from potential partners, however the RA field is highly competitive.

€31.5m raised to maintain momentum in ALX-0061

Ablynx has raised €31.5m, as part of a €45m placing. This will allow the company to continue with the ALX-0061 programme, while it looks for a partner. A Phase IIb study with the Nanobody might start by the end of 2013 and a sub-cutaneous formulation will be developed, so the programme is not delayed and its value is enhanced.

Valuation: DCF valuation of €431m

We have reduced our valuation of Ablynx by €90m to €431m, despite the progress with ALX-0061, as the company has been unable to partner ozoralizumab or ALX-0141. However, there appears to be no expectation in the market about these products. If ALX-0061 is partnered our valuation should rise to €497m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ablynx: DCF valuation of €431m

Published 03/13/2013, 07:12 AM

Updated 07/09/2023, 06:31 AM

Ablynx: DCF valuation of €431m

Focus moves to partnering

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.