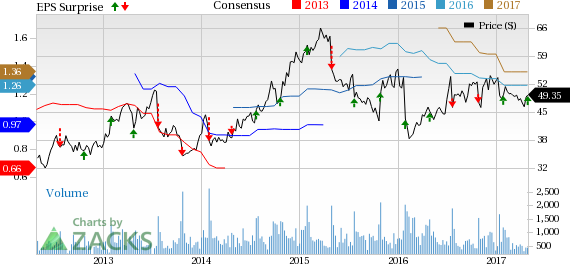

Abaxis, Inc. (NASDAQ:ABAX) – a global provider of point-of-care blood analyzers – reported fourth-quarter fiscal 2017 adjusted earnings per share of 33 cents, a penny ahead of the Zacks Consensus Estimate. However, it remained 15.4% below the year-ago figure.

For the full year, earnings per share came in at $1.44, a 5.8% improvement from the prior year.

Total Revenue

In the fiscal fourth quarter, Abaxis recorded revenues of $58.2 million, a 2.1% increase year over year. The top line remained almost in line with the Zacks Consensus Estimate of $59 million. According to the company, foreign currency exchange rate fluctuations had a 1% impact on Abaxis’ top line. This apart, a reduction in instruments revenues due to lower Piccolo instrument sales also acted as a deterrent.

Fiscal 2017 revenues were $227 million, up 4% from the previous year.

Segments in Detail

In the quarter, on a geographic basis, revenues from North America (accounting for 79.9% of total revenue) grew 0.2% to $46.5 million. Revenues from the international markets (accounting for the rest) improved 4.5% to $11.7 million.

Abaxis operates under three main segments, namely, Veterinary, Medical and Other. In the reported quarter, Veterinary sales accounted for 81.4% of total sales, Medical sales contributed 16.3% while the remaining 2.2% was generated from Other.

Veterinary market revenues improved 2% year over year to $47.4 million, driven by a 2% improvement in veterinary consumable revenues. Veterinary instrument revenues were down 4% year over year to $8.5 million.

Revenues from the medical market were flat year over year at $9.5 million as the strength in medical rotors was offset by weakness in instrument sales. Also, revenues for North American medical division were down 3% year over year. On a global basis, Abaxis sold 212 Piccolos in the quarter compared with 320 in the year-ago period.

Abaxis exhibited strong consumable growth, up 4% year over year to $44.8 million, accounting for approximately 76.9% of the company’s total worldwide revenues in the quarter. However, total instruments’ sales decreased 10% to $10 million.

Operational Updates

Fiscal fourth-quarter’s gross profit dropped 0.4% to $32.2 million. Gross margin contracted 140 basis points (bps) to 55.3%.

Research and development expenses increased 7.3% year over year to $4.9 million while sales and marketing expenses rose 7.3% to $11.5 million. General and administrative expenses, however, declined 1.8% to $4.6 million. The resultant operating income was down 7.2% to $15.8 million for the quarter while operating margin declined 275 bps to 27.1%.

Financial Update

Abaxis exited the fiscal quarter with cash, cash equivalents and short-term investments of $142.9 million compared with $137.9 million in the prior quarter.

Our Take

Abaxis’ fiscal fourth-quarter results were a mixed bag. Earnings were ahead of our estimates and revenues remained almost in line. Despite the several woes discussed above, we are looking forward to improved consumable revenues that boosted veterinary sales performance of Abaxis during the quarter.

Meanwhile, we are encouraged to note that the company is initiating new sales and marketing strategies. It is rigorously working on portfolio expansion strategies. In the veterinary market, it launched VetScan VUE, an app-based rapid assay reader in the third quarter of fiscal 2017 and VetScan Phenobarbital Profile in Mar 2017. The company expects additional new product launches in fiscal 2018, including VetScan FUSE connectivity system. According to Abaxis, addition of these products should potentially improve its growth performance over the long run. Also, strong cash position buoys optimism in the stock.

Zacks Rank & Key Picks

Abaxis currently has a Zacks Rank #4 (Sell). Better-ranked stocks in the broader Medical space include Inogen, Inc. (NASDAQ:INGN) , ZELTIQ Aesthetics, Inc. (NASDAQ:ZLTQ) and Hill-Rom Holdings, Inc. (NYSE:HRC) . While Inogen and ZELTIQ Aesthetics sport a Zacks Rank #1 (Strong Buy), Hill-Rom carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inogen gained 53.4% in the last one year, compared with the S&P 500’s gain of 15.6%. The company reported a stellar four-quarter positive average earnings surprise of over 49.08%.

ZELTIQ Aesthetics surged 88.9% in the last one year, compared with the S&P 500’s gain. Its four-quarter average earnings surprise was a positive of 12.03%.

Hill-Rom gained over 52.7% in the past one year, better than the S&P 500 mark. It posted a trailing four-quarter positive average earnings surprise of 3.1%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trade>>

Inogen, Inc (INGN): Free Stock Analysis Report

ABAXIS, Inc. (ABAX): Free Stock Analysis Report

Hill-Rom Holdings Inc (HRC): Free Stock Analysis Report

ZELTIQ Aesthetics, Inc. (ZLTQ): Free Stock Analysis Report

Original post

Zacks Investment Research