T2108 Status: 66.2%

VIX Status: 11.5

General (Short-term) Trading Call: Short (fade rallies after some confirmation of weakness)

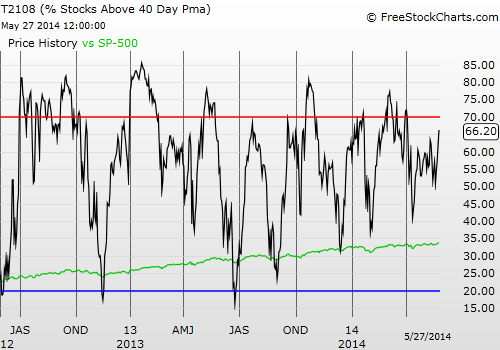

Active T2108 periods: Day #223 over 20%, Day #75 over 40%, Day #2 over 60% (over-period), Day #35 under 70% (under-period)

Commentary

Perhaps Rocket Fuel (FUEL) really did mark the bottom for high multiple stocks. Perhaps Netflix (NASDAQ:NFLX) was indeed trying to confirm that the tide had turned.

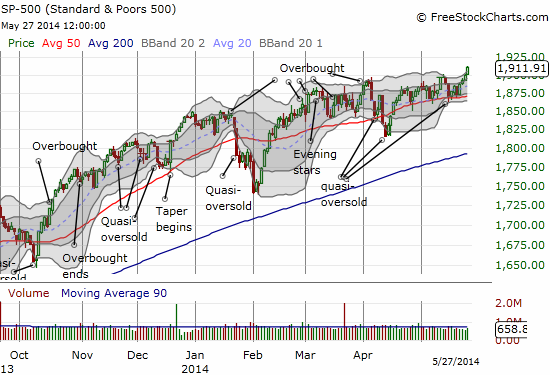

NFLX finally had a down day yesterday, but the rest of the stock market, especially in technology, has clearly heard the message. All across the stocks I watch, high-multiple, momentum, etc. stocks clocked in large one-day gains as part of what is an on-going relief rally. The technicals are stretched in nearly every direction as T2108 closes in on overbought levels. At 66.2%, T2108 is at levels last seen on April 4, 2014 when my favorite indicator tumbled from overbought conditions and provided the last good selling signal for the (SPDR) S&P 500 (ARCA:SPY). The S&P 500 (SPY) rallied just 0.6% but the move stretched it above its upper-Bollinger® Band (BB).

Adding to the stretch is the volatility index, the VIX, that has accelerated to the lows of a trading range in place since late 2012/early 2013. The VIX managed a marginal gain on the day, but it is still stretching toward lows last seen in 2007 just ahead of the financial crisis. The bottom line is that the market is hurtling toward levels of complacency that even makes central bankers nervous.

Given the current stretches, I will NOT be inclined to flip bullish if T2108 goes overbought (70% and above) – the classic extended overbought rally. Overbought combined with ultra-low volatility combined with tech stocks printing 4 to 7% a day combined with major indices stretching above their upper-Bollinger Bands smells like a lethal recipe. I am keeping the trading bias at fade rallies for this reason. I have removed the focus on technology stocks since the monster gains being seen in this sector again make it extremely difficult to place fades; playing breakdowns makes more sense now. For example, only shorting after a stock or index breaks the low of the last strong buying day…in many cases, that will be yesterday’s low.

Despite the deafening alarm bells I am hearing, I have to stretch out kudos to Apple (NASDAQ:AAPL). I really should have pointed out the Bollinger Band (BB) squeeze in the making last week. The breakout to the upside is VERY impressive.

The bumrush back into Apple is in full throttle.

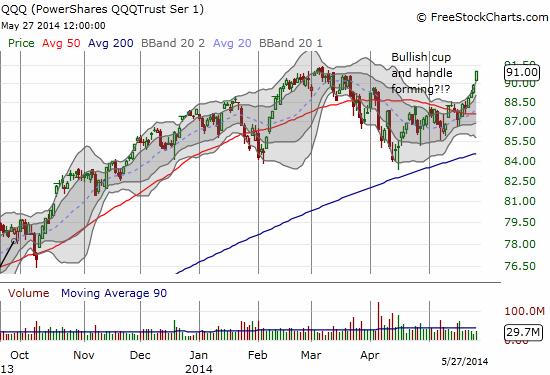

No doubt this breakout helped push the NASDAQ to its breakout above its 50DMA and above its own upper-Bollinger Band. These moves have created a particularly dramatic transformation in PowerShares QQQ (NASDAQ:QQQ). Suddenly, QQQ has gone from an ETF trapped under stiff resistance to an index on the verge of printing a very impressive and bullish cup and handle breakout pattern.

Of course, this bullish run has been all about price and almost nothing to do with volume. Even AAPL is barely printing average volume in the current run-up. While low volume has mattered little for many years now, high volume would have at least made me more interested in considering the bullish case. Instead, I am staying on volatility watch.

Finally, to make reading the tea leaves even more difficult, I end with this nice breakout for Google (NASDAQ:GOOG) that technically tells me to buy the dip often and aggressively. (This is one I really should have nailed after I pointed out the critical nature of the 200DMA test.)

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

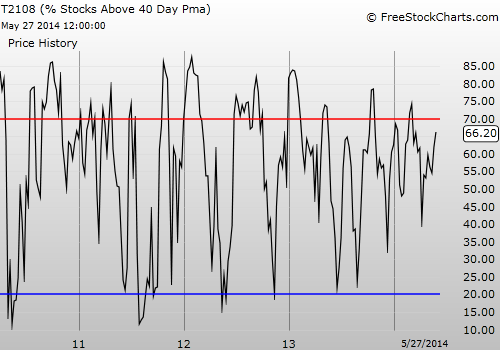

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Be careful out there!

Disclosure: long SSO puts, long QID calls, long AAPL shares, short NFLX shares, long NFLX call spread, long FUEL