- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Which stocks will surge next?

A Look At What To Expect In Next 12 Months

As the global central banks and U.S. Fed attempt to come to the rescue during the COVID-19 crisis, the reality is that monetary policy works better when consumers are able to actually go out and engage in spending and economic activity. If the COVID-19 virus event contracts global consumer activity, as it has recently, for an extended period of time (4 to 6+ months), then we have a real issue with how QE efforts and consumer activity translate into any real recovery attempt.

The real risks to the global markets is an extended risk that the COVID-19 virus creates a contracting economic environment for many months/quarters and potentially fosters an environment where extensive collateral damage to corporations, consumer activity, credit/debt markets, and other massive financial risks boil over.

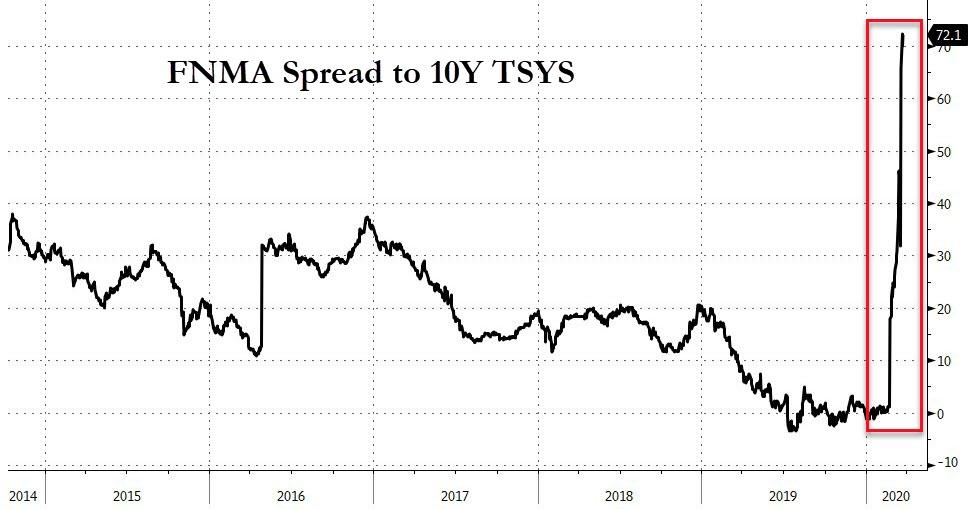

News is already starting to hit that QE is not helping the deteriorating situation in the mortgage banking business. Remember, this is the same segment of the financial industry that started the 2007-08 credit crisis event. News that mortgage lenders and bankers are already starting to experience margin calls and have attempted to contract their exposure to the risks in the markets (a bit late) are concerning. This is a pretty big collateral damage risk for the global markets.

Additionally, as we expected, applications for new mortgages have collapsed to their lowest level since 2009. Until consumers feel confident in their ability to get out, engage in real economic growth and take on home loans they know are relatively secure in their ability to repay – there is going to be a continued market contraction. The next phase of this contraction is a price reduction, forced selling/foreclosures and a glut of assets waiting for a bottom.

“Home-purchase applications dropped by 14.6% while refinancing applications plummeted 33.8%."

I think the most important aspect of this global virus event is to remember that we will survive it (in some form) and we will live to rebuild after this event completes. Yet, the reality is that we were not prepared for this event to happen and we don't know the total scope of this virus event. We simply don't know how long it will take to remove the threat of the virus and for societies to re-engage in normal economic activity – and that is the key to starting a real recovery.

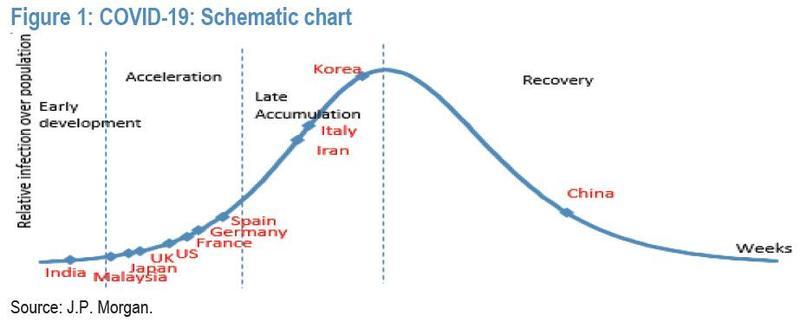

Hong Kong has recently reported a “third wave” of COVID-19 infections. I believe we should attempt to learn from places like Hong Kong, where news is moderately accurate and reported via social media and other resources. If we want to learn what to expect in the U.S. and how the process of containing this virus may play out, we need to start learning from other nations that are ahead of us in the curve.

It appears that any attempt to resume somewhat normal economic activities while the virus is still active spouts a new wave of infections. This would suggest that the only way to attempt to re-engage in any somewhat normal economic activity would be when a vaccine or true medical cure is in place to allow nations to attempt to eradicate the virus as these waves continue.

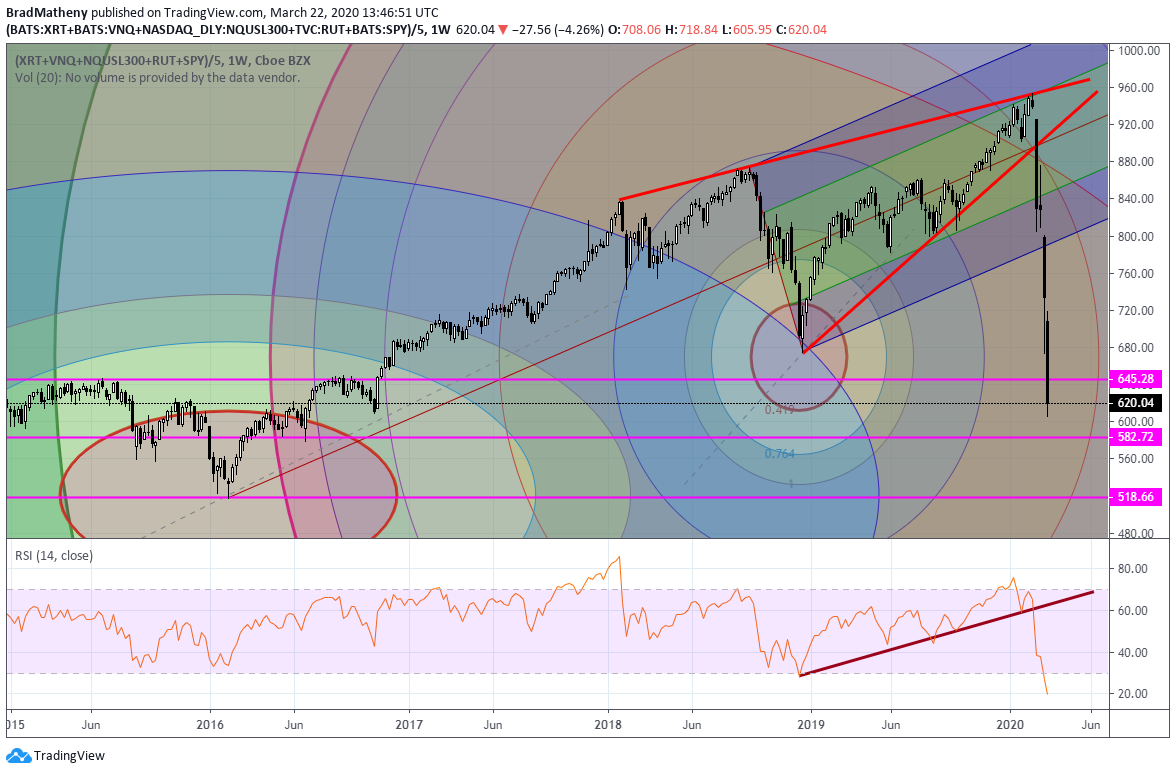

The price collapse in 2008-09 represented a 56% decline from top to bottom. Currently, the S&P has fallen by just over 35%. We don't believe the bottom in the U.S. stock market has setup just yet and we do believe there is a greater downside price risk ahead. We don't believe the housing market will be able to sustain any of the current price levels for much longer. We believe the collateral damage of this event is just starting to be known and we believe a greater economic contraction is unfolding not only in the U.S. but throughout the globe.

Skilled traders need to understand the total scope of this event. An economic contraction, like the COVID-19 virus event, could contract global GDP by as much as 8 to 15% over an extended 16-to-36-month span of time. Are we concerned about the real estate market? You bet! Are we concerned about global markets? You bet! Are we prepared for this as traders? You bet! Are the central banks prepared for this? We certainly hope so.

Related Articles

In Q1 2024, the US crossed the historic milestone of paying over $1 trillion on interest payments. As a consequence of an unprecedented $5 trillion money supply boost since 2020,...

Yen falls to fresh multi-decade lows after BoJ rate decisionUS GDP flashes mixed signals, dollar retreats in aftermathStocks recover on solid tech earnings, gold resumes uptrend...

Gold Consolidates Just Below 2,340 Ahead of the Critical US PCE ReportThe gold (XAU) price gained 0.69% on Thursday as the US Dollar Index (DXY) dropped following the release...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.