Rolls-Royce’s IMS has followed the usual pattern of maintaining the guidance set out at the interims, despite a small negative revenue impact in Marine as a result of the timing of deliveries. With the strategy supported by long-term investment and a visible pipeline of deliveries, particularly in civil aerospace, the group is well set to deliver sustained profitable growth over the next decade. Further opportunities to enhance margins are provided by continued process improvements in manufacturing, new facilities such as Seletar and the inclusion of Tognum to enhance the Marine and Energy businesses. With a stable strategy focused on long-term returns, we believe Rolls-Royce warrants its premium to the wider aerospace and defence sector.

IMS In Line With H1 Guidance

The IMS was typically conservative, with guidance maintained as delivered at the interims despite a small negative impact on Marine revenues from delivery phasing. Given the concerns aired by some peers regarding volatility in civil aftermarket revenues, we feel this is a positive announcement and it highlights the benefits of the smoothing effects of Rolls’ long-term contracting approach. New orders were won since the interims, including to engine 20 A350 and five A380 aircraft for Singapore Airlines and the US Navy’s Ship to Shore hovercraft programme, highlighting that even in the tight defence market, opportunities continue to present themselves.

Strategic Developments Continue

The announcement also highlighted some key developments that support the ongoing investment programme. The group’s first US defence operations centre opened in Indianapolis, providing a route to expand long-term military service contracts, and the first Trent assembled and tested at Seletar was unveiled by the Duke and Duchess of Cambridge in September. This paves the way for the ramp up of the facility to meet future demand that will effectively double Trent capacity worldwide.

Valuation: Long-Term Value Play

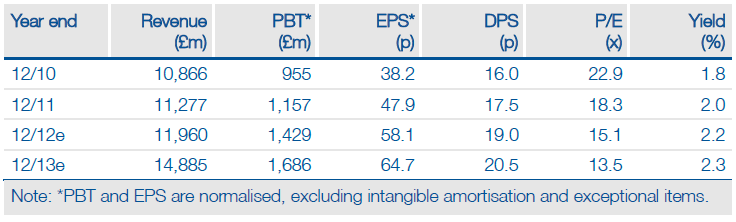

We continue to view Rolls-Royce as a sustained long-term value play. While the current rating of 13.4x CY13 EPS sits at a 27% premium to the wider UK A&D sector, we believe that this is justified by the long-term, sustained and visible growth profile of the group. We therefore consider a DCF-based approach as appropriate, yielding a fair value in excess of 1,000p per share.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Look At Rolls-Royce Holdings

Published 11/15/2012, 11:40 AM

Updated 07/09/2023, 06:31 AM

A Look At Rolls-Royce Holdings

Guidance Maintained

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.