Growth at cheap price ratios is one of the keys for a sucessful long-term investment.

A cheap stock is the basis for successful future returns. Beside cheap fundamentals and pricing ratios of a company, the expected growth is an additional important item for investors. After the ongoing turbulence due to the euro debt crises and the fiscal cliff in America, there should be some bargains in relation to growth right now.

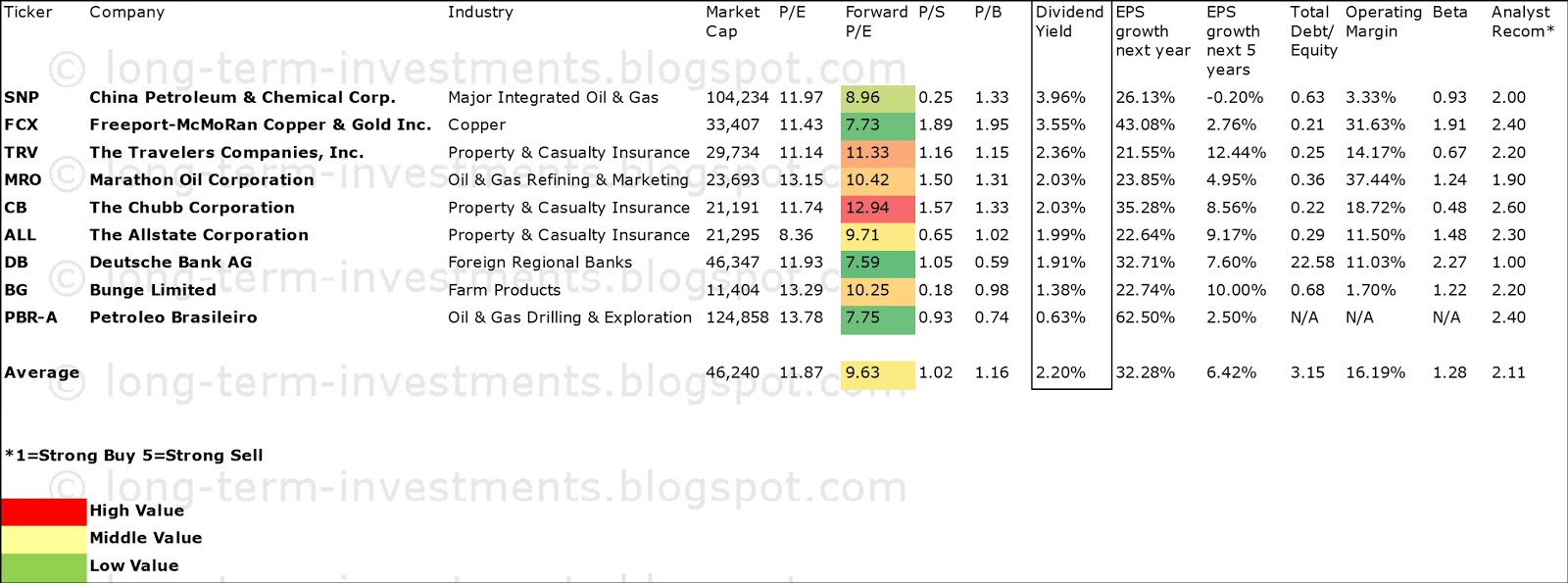

I made a screen of America’s cheapest large cap stocks with the highest expected growth for the upcoming fiscal year. Stocks from the sheet have a market capitalization of more than USD 10 billion and earnings per share are expected to grow for at least 15 percent. Despite the strong growth, they still have a P/E ratio of less than 15 and a P/S and P/B ratio of less than two. Eleven companies fulfilled the mentioned criteria of which ten companies have a buy or better recommendation. Nine of the results pay dividends.

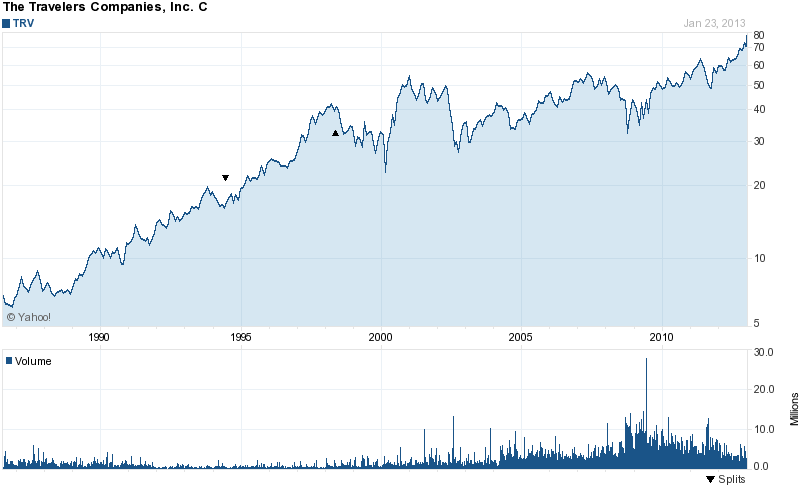

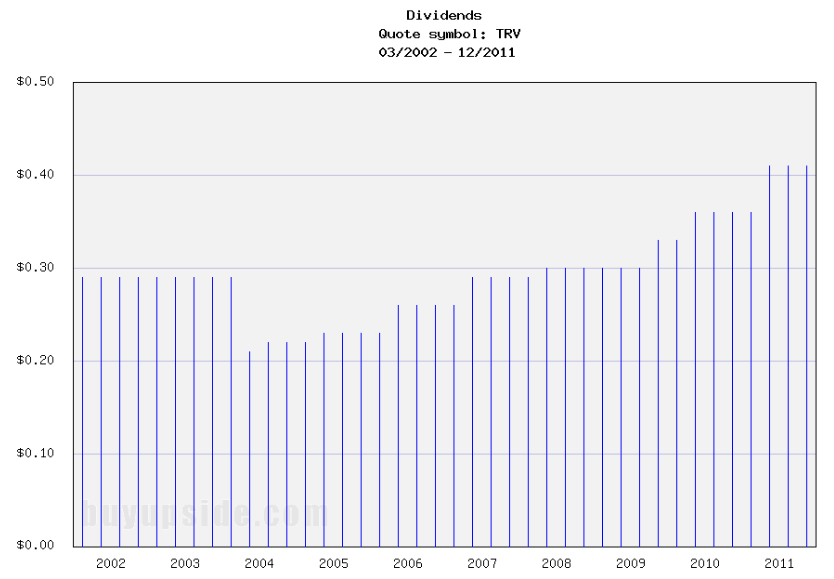

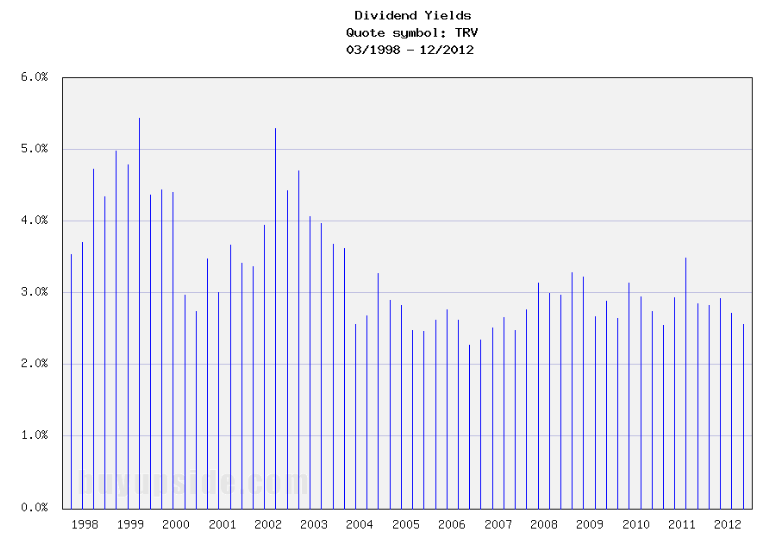

The Travelers Companies (TRV) has a market capitalization of $29.73 billion. The company employs 30,000 people, generates revenue of $25.446 billion and has a net income of $1.426 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6.416 billion. The EBITDA margin is 25.21 percent (the operating margin is 5.31 percent and the net profit margin 5.60 percent).

Financial Analysis: The total debt represents 6.31 percent of the company’s assets and the total debt in relation to the equity amounts to 26.98 percent. Due to the financial situation, a return on equity of 5.67 percent was realized. Twelve trailing months earnings per share reached a value of $7.00. Last fiscal year, the company paid $1.59 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 11.13, the P/S ratio is 1.14 and the P/B ratio is finally 1.22. The dividend yield amounts to 2.41 percent and the beta ratio has a value of 0.67.

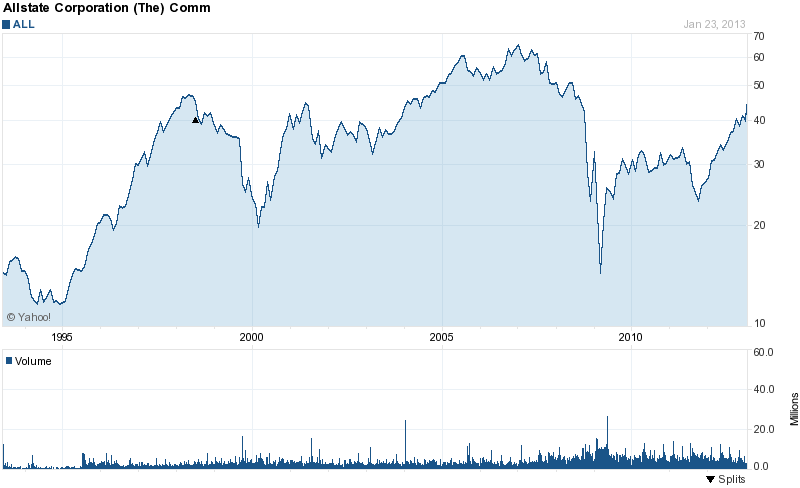

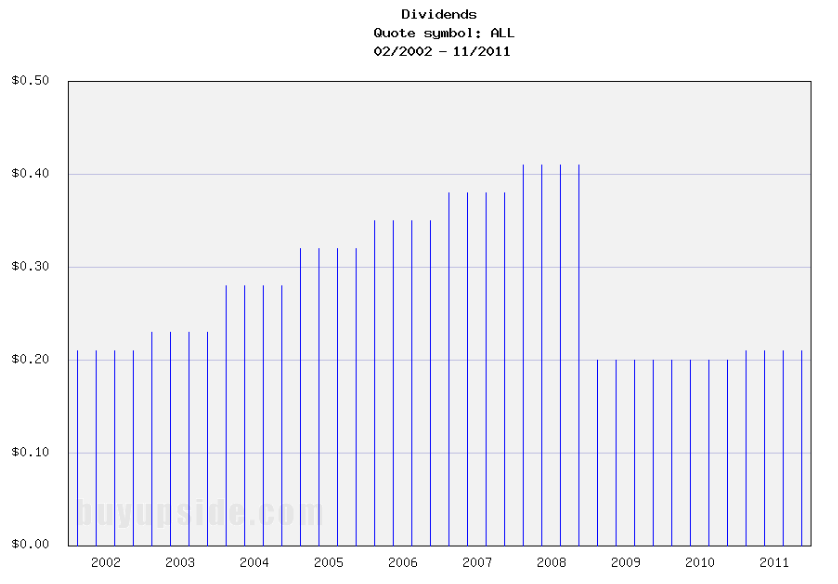

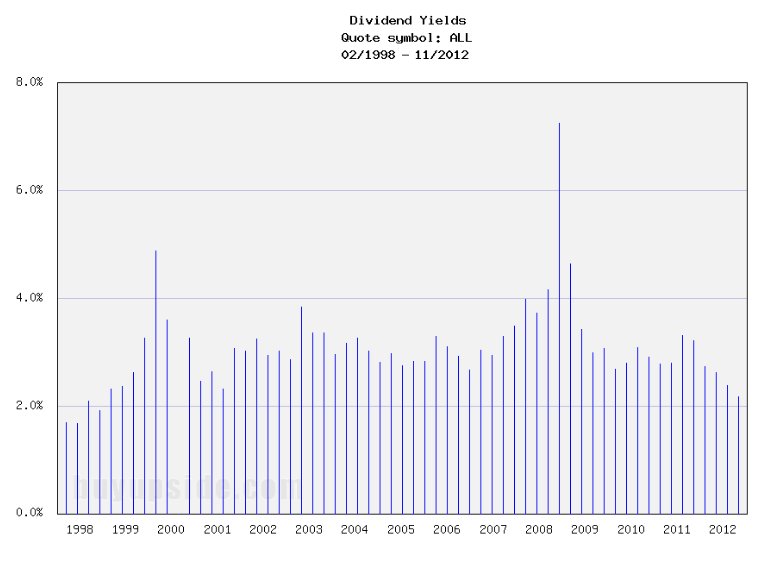

The Allstate Corporation (ALL) has a market capitalization of $18.49 billion. The company employs 37,000 people, generates revenue of $32.654 billion and has a net income of $788.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $9.309 billion. The EBITDA margin is 28.51 percent (the operating margin is 2.99 percent and the net profit margin 2.41 percent).

Financial Analysis: The total debt represents 4.71 percent of the company’s assets and the total debt in relation to the equity amounts to 31.64 percent. Due to the financial situation, a return on equity of 4.18 percent was realized. Twelve trailing months earnings per share reached a value of $5.29. Last fiscal year, the company paid $0.84 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 8.36, the P/S ratio is 0.64 and the P/B ratio is finally 1.16. The dividend yield amounts to 2.04 percent and the beta ratio has a value of 1.48.

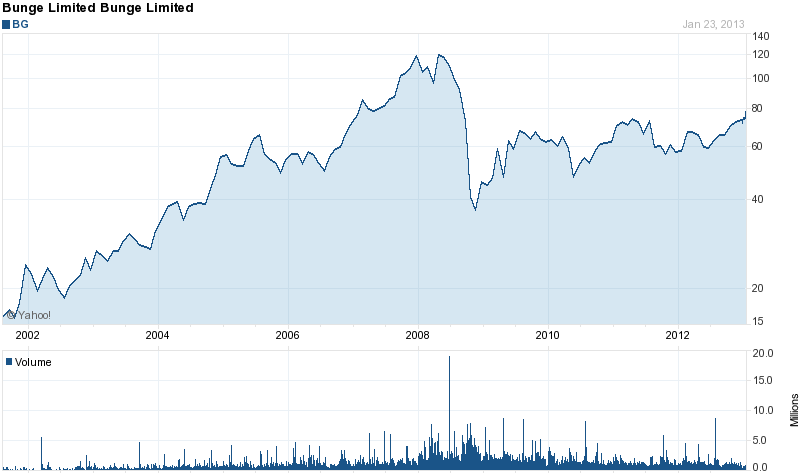

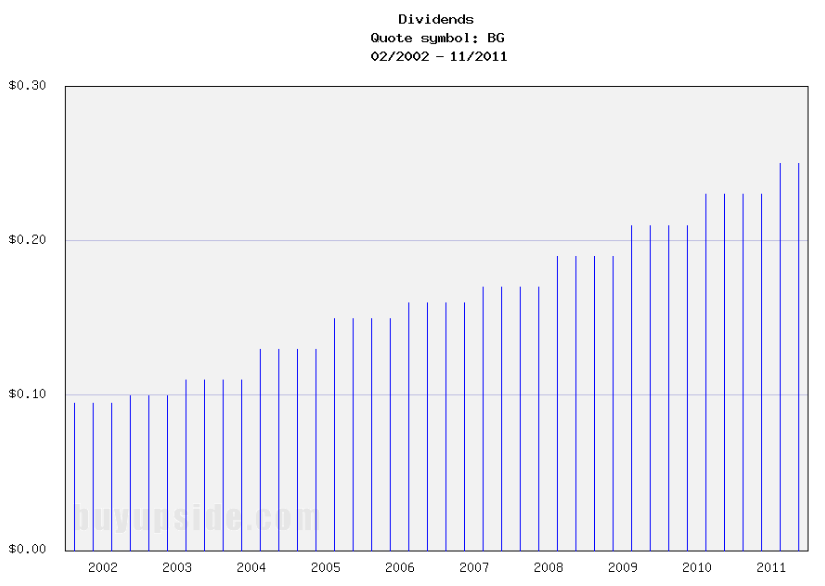

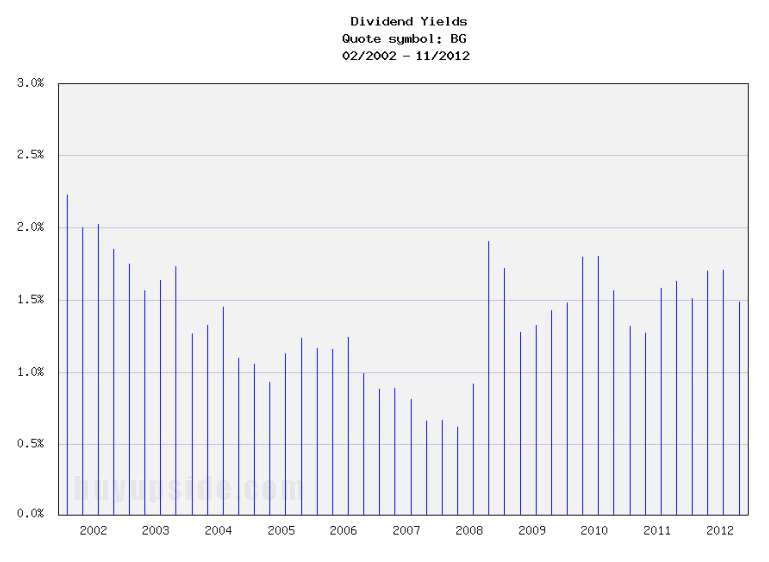

Bunge Limited (BG) has a market capitalization of $11.40 billion. The company employs 35,000 people, generates revenue of $58.743 billion and has a net income of $896.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1.685 billion. The EBITDA margin is 2.87 percent (the operating margin is 1.60 percent and the net profit margin 1.53 percent).

Financial Analysis: The total debt represents 17.53 percent of the company’s assets and the total debt in relation to the equity amounts to 34.86 percent. Due to the financial situation, a return on equity of 8.05 percent was realized. Twelve trailing months earnings per share reached a value of $5.87. Last fiscal year, the company paid $0.98 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 13.30, the P/S ratio is 0.19 and the P/B ratio is finally 1.02. The dividend yield amounts to 1.40 percent and the beta ratio has a value of 1.22.

Take a look at the full list of cheap large capitalized stocks with highest expected earnings per share growth. The average P/E ratio amounts to 11.87 while the forward P/E ratio is 9.63. P/S ratio is 1.02 and P/B ratio 1.16. The expected earnings growth for next year amounts to 32.28 and 6.42 percent for the upcoming five years.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

SNP, FCX, TRV, MRO, CB, ALL, DB, BG, PBR-A

* I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

9 Cheapest Dividend Paying Large Caps With High Growth Potential

Published 01/24/2013, 02:09 AM

Updated 07/09/2023, 06:31 AM

9 Cheapest Dividend Paying Large Caps With High Growth Potential

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.