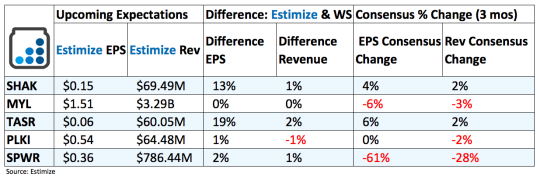

Shake Shack (NYSE:SHAK): In its early days in the market, many investors were convinced that Shake Shack was well on its well to replacing Chipotle (NYSE:CMG) as the new face of fast casual. Thanks to a string of slower-than-expected quarters those notions have receded. The burger chain has struggled to sustain high growth and rapid expansion as it goes through the maturation process. These growing pains are likely to continue for the near future until revenue and margins are commensurate with its value. Despite high growth expectations for the quarter, those have declined significantly when compared to the fact that Q2 2015 - Q1 2016 produced YoY profit growth rates in the triple digits. Same-Shack Sales have also fallen, to 4.5% last quarter from 9.9% in the first quarter of 2016. At the moment the stock is considered well overvalued given what they deliver quarter after quarter. Shake Shack shares have fallen 18% year to date.

Mylan (NASDAQ:MYL): Mylan has been at the center of controversy in recent months after management inexplicably raised the price of its flagship epipen products. Heather Bresch immediately reversed the decision and testified on Capitol Hill to explain her reasoning. Analysts are revising down estimates this quarter on fears that Mylan could be in store for a prolonged downturn. Drug prices and margins should continue to come under pressure from continued federal investigations and greater adoption of generics. The combination of these factors have led to a 30% decline in the stock over 2016. Shares have historically remained flat through an earnings report but given the recent state of affair it wouldn’t be surprising to see a sell off tomorrow afternoon.

TASER International (NASDAQ:TASR): TASER has witnessed strong demand for its smart weapons and boy cameras as public scrutiny rises with regards to police brutality. The hope is that body cameras and non-deadly tasers will help curtail the epidemic of shootings. TASER’s recent AXON body camera is winning orders thanks to state-of-the-art technology that links and stores videos in the cloud. Analysts are revising estimates higher as there appears to be a prolonged need for TASER’s products. Shares are also up nearly 30% in 2016 and historically gains 4% immediately through the print.

Popeyes Louisiana Kitchen (NASDAQ:PLKI): The rebound in the quick-service industry hasn’t translated to Popeyes, which has seen shares drop 7% in 2016. Popeyes is coming off a string of consecutive misses that have featured decelerating top line growth. Regardless analysts expectations have remained flat since the chicken chain’s most recent report in August. Popeyes is frequently releasing new promotion items and menu innovations in an efforts to offset the recent slowdown. Its recent $5 box and the $4 Wicked Good Deal should help support the top line.

SunPower Corporation (NASDAQ:SPWR): Solar energy is expected to be one of the most heavily leaned on industries as we move toward more sustainable energy resources. However this isn’t coming soon enough as evidenced by the struggles of popular names like First Solar (NASDAQ:FSLR), SolarCity (NASDAQ:SCTY) and SunPower. The three companies are down nearly 50% this year on waning demand, mounting losses and decelerating revenue growth. First Solar set an unfavorable tone for the solar industry with a massive miss on the top line that is expected to impact SunPower’s report tomorrow afternoon. Analysts are frantically talking down estimates in anticipation for a weaker-than-expected earnings report, which will likely hammer the stock as well. Shares of SunPower are down 75% in what has been widely considered a bullish year for the markets.

How do you think these names will report?