Finance stocks have been gaining momentum on the back of the recent interest rate hikes by the Fed since the end of 2016. A decent interest-rate environment has favored almost all the industries under the Finance sector (except REITs). The sector’s stocks have witnessed solid revenue growth driven by higher investment income. The investment companies, banks, consumer loan companies, etc., have substantially benefitted from the rate hikes.

The Fed’s decision to reduce its $4.2 trillion portfolio of Treasury bonds and mortgage-backed securities to strengthen its balance sheet has also favored the Finance sector.

So far in 2017, the unemployment rate has dipped to 4.2% accompanied by 2.9% year-over-year growth in the wage rate. These have positively impacted overall disposable income leading to higher consumer spending. The Fed also provided an optimistic unemployment outlook. Unemployment rate is further expected to decline to 3.9% in 2018.

Notably, the strengthening of the global economy has fuelled investment activities in the Finance sector that have boosted the stocks’ long-term growth potential. Expectations of continued increase in interest rates along with reforms proposed by the Trump administration are likely to keep the momentum alive. Progressing economy, encouraging employment data, stringent underwriting standards as well as capital influx continues to infuse confidence in investors.

Why Berkshire Is a Benchmark

Berkshire Hathaway Inc. (NYSE:BRKa) BRK.A BRK.B is a conglomerate with more than 90 subsidiaries engaged in businesses ranging from ice cream to insurance. Holding shares of Berkshire Hathaway render dynamism to a shareholder’s portfolio. Moreover, Warren Buffett’s investment strategies through this company have created a tremendous value for shareholders over the last 51 years.

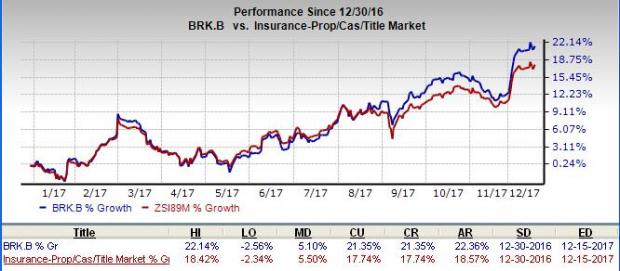

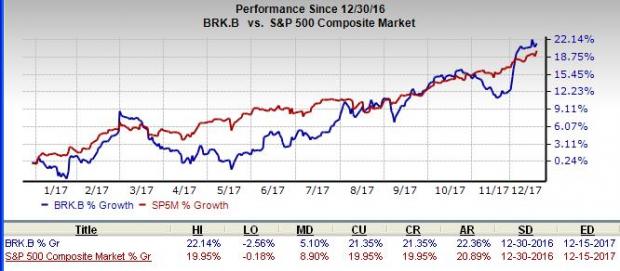

The company’s shares have rallied 21.3% year to date, outperforming the Zacks Property & Casualty Insurance industry’s gain of 17.7%. The stock slightly underperformed nearly 23% gain of the S&P 500.

However, the company’s earnings do not have a record of beating estimates. It delivered negative earnings surprises in three of the last four quarters with an average miss of 17.02%. The company failed to beat expectations in the quarters due to huge catastrophe losses and a reduction in operating earnings from Insurance Operations, plus Finance & Financial products.

There are stocks which may not be as big as Berkshire Hathaway but can be worth considering on the back of their solid performance. (Looking for the Best Stocks for 2018? Be among the first to see our Top Ten Stocks for 2018 portfolio here.)

Stocks That Warrant a Look

We have zeroed in on five stocks from the finance sector with market capitalization of at least $1 billion that have outperformed Warren Buffett’s Berkshire year to date. The stocks have also surpassed expectations in each of the last three quarters. Each of these stocks is buy rated and has a favorable VGM Score. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Equity Investment Life Holding Company (NYSE:AEL) is a life insurance company with a market cap of $2.9 billion. The Zacks Rank #1 insurer has gained nearly 40% year to date, outpacing Berkshire Hathaway. Also, the stock has a VGM Score of A. American Equity’sthree-quarter average beat is 28.8%.

Jones Lang LaSalle Inc. (NYSE:JLL) is a real estate company with a market cap of $6.8 billion. Its shares have rallied 47%, outperforming Berkshire year to date. The stock also sports a Zacks Rank #1 and has a VGM Score of A. The company’s three-quarter average beat is 23.5%.

Lazard Ltd. (NYSE:LAZ) is an investment management company with market cap of $6.7 billion. The stock has returned 25.4% year to date, outperforming Berkshire Hathaway. The Zacks Rank #2 (Buy) insurer has a VGM Score of A. Lazard’s three-quarter average beat is 14.2%.

Evercore Inc. (NYSE:EVR) is an investment bank with market cap of $3.5 billion. Its shares have gained 30.6%, outpacing Berkshire Hathaway year to date. The company carries a Zacks Rank #2 and has a VGM Score of A. Evercore’s three-quarter average beat is 16.7%.

Federated Investors, Inc. (NYSE:FII) is an Investment management company with market cap of $3.5 billion. This Zacks Rank #2 company has gained 25.5% year to date, outperforming Buffett’s Berkshire. The stock has a VGM Score of B. The company’s three-quarter average beat is 5.3%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Evercore Inc (EVR): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Lazard Ltd. (LAZ): Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL): Free Stock Analysis Report

Original post

Zacks Investment Research