Screen Criteria:

List of Aerospace stocks that also have significant and rising revenues, when compared to quarterly accounts receivables growth (i.e. rising receivable turnover ratios).

Average Weekly Returns:

Average 1-Week Return of All Stocks Mentioned Below: -0.06%

Average 1-Month Return of All Stocks Mentioned Below: 4.91%

Analysis of List Alpha:

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Week): 2 out of 5 (40.0%)

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Month): 2 out of 5 (40.0%)

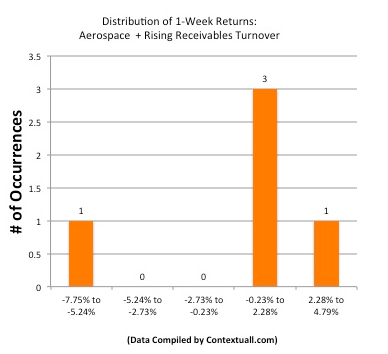

Chart: Distribution of 1-Week Returns For All Stocks Mentioned Below

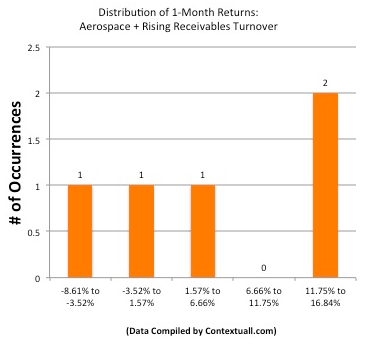

Chart: Distribution of 1-Month Returns For All Stocks Mentioned Below

(List sorted by monthly performance, from best to worst)

1. Elbit Systems Ltd. (ESLT): Engages in the design, development, manufacture, and integration of defense systems and products worldwide. Revenues increased by 2.07% during the most recent quarter ($677.47M vs. $663.71M y/y), while the size of accounts receivable changed by -1.08% ($853.6M vs. $862.95M y/y). Receivables, as a percentage of current assets, decreased from 48.79% to 45.99% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

2. AAR Corp. (AIR): Provides products and services for the aviation, government, and defense markets worldwide. Revenues increased by 13.39% during the most recent quarter ($550.5M vs. $485.5M y/y), while the size of accounts receivable changed by -4.58% ($282.8M vs. $296.38M y/y). Receivables, as a percentage of current assets, decreased from 31.39% to 27.36% during the most recent quarter (time interval comparison 3 months ending 2012-08-31 to 3 months ending 2011-08-31).

3. Boeing Co. (BA): Engages in the design, development, manufacture, sale, and support of commercial jetliners, military aircraft, satellites, missile defense, human space flight, and launch systems and services worldwide. Revenues increased by 12.87% during the most recent quarter ($20,008M vs. $17,727M y/y), while the size of accounts receivable changed by -12.67% ($5,755M vs. $6,590M y/y). Receivables, as a percentage of current assets, decreased from 14.22% to 10.7% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

4. Triumph Group, Inc. (TGI): Engages in the design, engineering, manufacture, repair, overhaul, and distribution of aircraft components. Revenues increased by 18.68% during the most recent quarter ($938.18M vs. $790.53M y/y), while the size of accounts receivable changed by 8.96% ($397.26M vs. $364.59M y/y). Receivables, as a percentage of current assets, decreased from 28.6% to 27.79% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

5. Smith & Wesson Holding Corporation (SWHC): Offers metal processing services and manufactures firearms and handcuffs as well as apparel and sportsmen’s articles. Revenues increased by 47.95% during the most recent quarter ($136.56M vs. $92.3M y/y), while the size of accounts receivable changed by 7.57% ($63.24M vs. $58.79M y/y). Receivables, as a percentage of current assets, decreased from 30.52% to 30.12% during the most recent quarter (time interval comparison 3 months ending 2012-10-31 to 3 months ending 2011-10-31).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

5 Aerospace Stocks With Rising Receivables Turnover Ratios

Published 12/14/2012, 02:28 AM

Updated 07/09/2023, 06:31 AM

5 Aerospace Stocks With Rising Receivables Turnover Ratios

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.