Bitcoin has delivered super impressive price returns that would make even the best traders and investors green with envy. In the year-to-date period, anybody with a basic understanding of what Bitcoin is, and who is bold enough to purchase the cryptocurrency, would have scored about 600% price gains.

In contrast, the top traders and investors on Wall Street are still busy themselves with how to outperform the measly low-end double-digit gains that Wall Street has delivered in the year-to-date period as seen in the chart below.

If you have bought Bitcoin on January 2nd 2017 and you didn’t sell until today, your investment would have gained about 1,100% as seen in the NYSE Bitcoin index. In contrast, if you had put your money in traditional Wall Street investments, you would have 17.95% gains from the S&P 500, 26.43% from NASDAQ, and 22.80% gains from the Dow Jones Industrials.

However, despite the obvious gains in Bitcoin, many Wall Street financial advisers will preach against making Bitcoin investments because of the huge volatility that the cryptocurrency experiences. Honestly, Bitcoin does suffer huge price volatility.

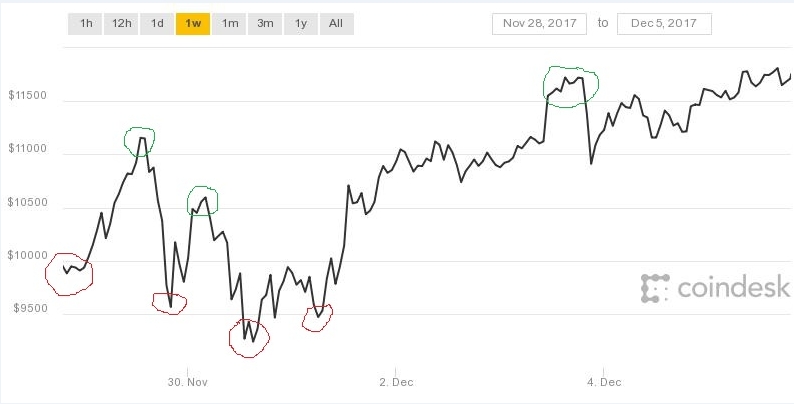

In November, the cryptocurrency made a new all-time high of $7,721.98 and then it crashed all the way down to $5616.69 in about 3 days. The cryptocurrency went on to cross the $10,000 barrier and it is trading in a range above $11,000 per BTC as seen in the chart below.

It is rational to be somewhat scared about the inherent volatility of Bitcoin. Nonetheless, the volatility in Bitcoin is an opportunity for bold investors to profit on the rising popularity of blockchain technology.

If you're interested in making profits off blockchain solutions without necessarily buying Bitcoin, below are four companies that should get the attention of your due diligence.

BTCS Inc. (OTC:BTCS)

BTCS Inc, previously known as Bitcoin Shop Inc works on creating e-commerce platforms where people can use cryptocurrencies such as Bitcoin to purchase goods and services.

BTCS Inc is currently beta testing an e-commerce marketplace that accepts a wide range of cryptocurrencies as part of efforts to drive the mass-market adoption of cryptocurrencies for transactions. BTCS recently secured $1 million in funding, out of which $250,000 was provided as Bitcoin.

360 Blockchain Inc. (SNX:CODE)

360 Blockchain Inc. formerly 360 Capital Financial Services Group provides Wall Street investors with a structured approach to blockchain investments. The firm is now pivoting to provide financial services to both private and public companies planning to enter the Blockchain industry.

360 Blockchain will help blockchain firms with merchant banking, IPO consulting, business advisory, and finance advisory among other things. U.S. investors can access 360 Blockchain on the OTC markets where it trades up around $0.2196 per share.

CanYa

CanYa, is another blockchain worthy of your attention. CanYa is trying to disrupt the gig economy with a blockchain solution that decentralizes projects with smart contracts. In May, the results of a market research by Intuit (NASDAQ:INTU) revealed that "The gig economy...is now estimated to be about 34% of the workforce and expected to be 43% by the year 2020," In another report, researchers at McKinsey observed that there are roughly 68 million freelancers in the U.S. alone.

CanYa also goes a step further to hedge cryptocurrency transactions on its platform against potential fluctuations in the price of the underlying cryptocurrency used in the dead.

One of the reasons most people are buying cryptocurrencies such as Bitcoin for speculation instead of using it as a means of exchange as money is the inherent volatility in the cryptocurrencies.

With CanYa's cryptocurrency hedging escrow contract, CanYa helps freelancers and clients use cryptocurrency easily by providing a consistent value for contracts. CanYa's CAN token serves as a tool to automatically create a hedged smart contract to lock in the value of the agreed upon price.

CanYa will also further help stakeholders in a global gig economy explore opportunities beyond their borders by helping them to bypass the volatility of their currencies and avoid currency exchange commissions.

CanYa is not a publicly traded company but it will soon open up its doors to investors in a public coin sale that will be conducted over four stages.

First BITCoin Capital Corp. (OTC:BITCF)

First, Bitcoin Capital provides another opportunity to enter the blockchain industry, especially for people who want a venture capital type of exposure to the blockchain industry. First Bitcoin Capital busies itself with the acquisition of Bitcoin startups, and it provides funding to startups creating blockchain hardware and software.

The firm also has a number of blockchain products in the pipeline. The firm is specifically working on products such as CoinQX, Bitessentials, BitClassTravel, Bitcoin.cc & Bitcoin ATM among others.

Conclusion

While Bitcoin have seen an outstanding growth ovver the course of last year