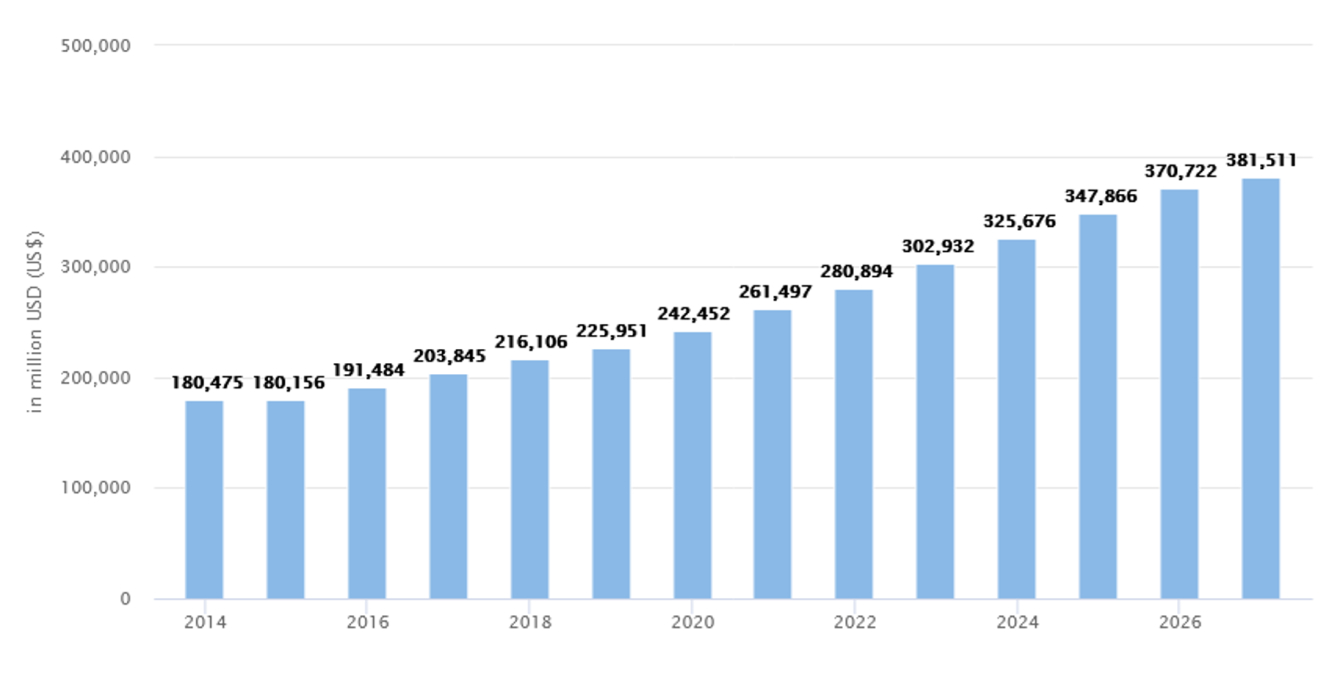

The global market for baby and infant nutrition products is flourishing, with excellent prospects for rapid expansion and room for innovation. An increase in the working mother population, increasing spending on newborn health, and the rising demand for organic baby food are driving the market forward. The global baby food market is predicted to generate revenue of $280 billion in 2022, according to Statista, and is expected to grow at a CAGR of 6.31% through 2027.

Source: Statista

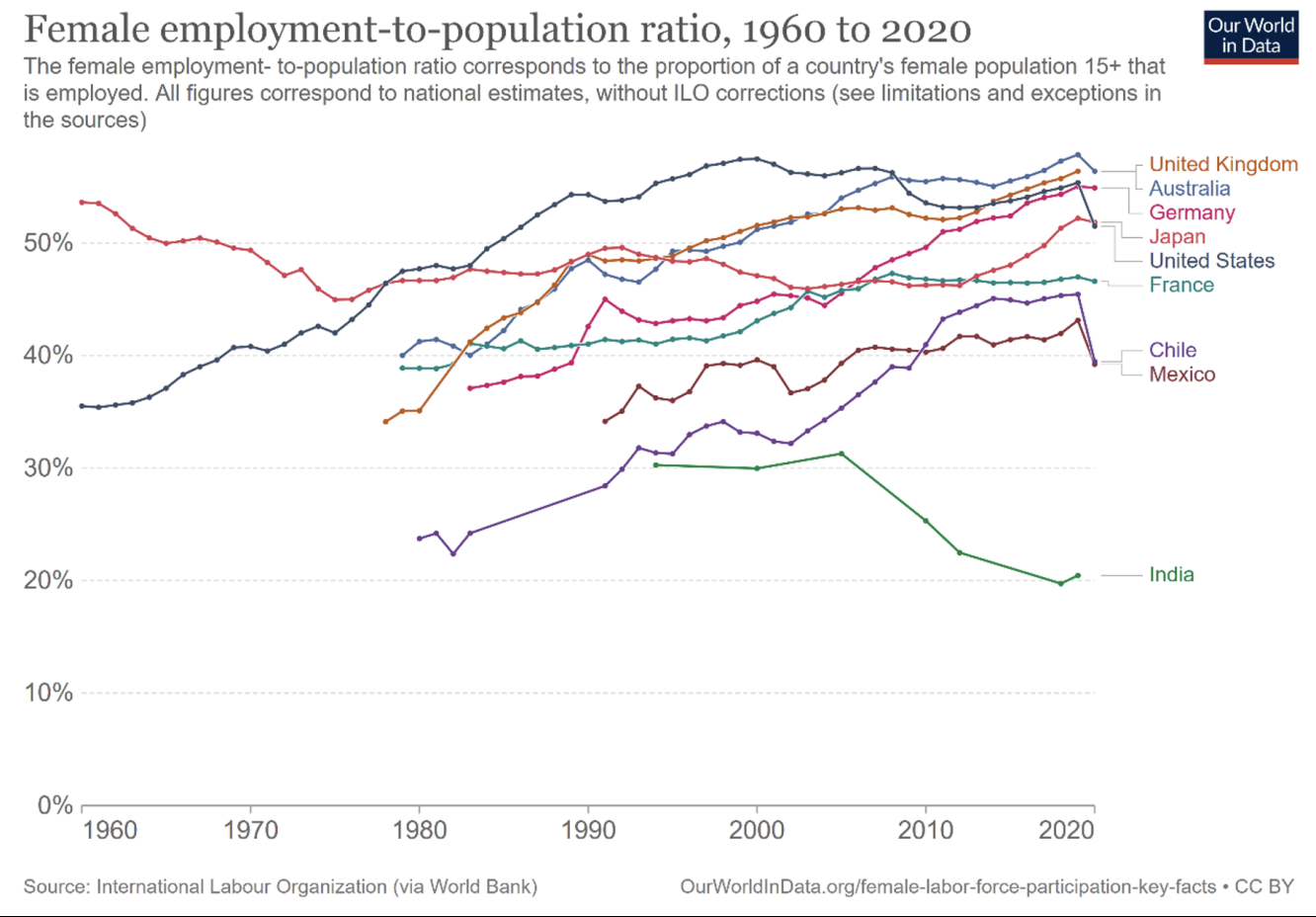

One of the most significant economic changes of the last century has been the rise in female workforce participation. According to McKinsey & Company, at the start of 2020, women's representation in corporate America grew fast. The number of women in senior-vice-president roles increased from 23 to 28%, and the C-suite increased from 17 to 21%.

Source: Our World in Data

In addition, in 2020, working mothers made up roughly a third of the female workforce in the United States. According to the Bureau of Labor Statistics, in 2020, the participation rate for mothers with children under six was 65.8%, with 77.5% of mothers working full time.

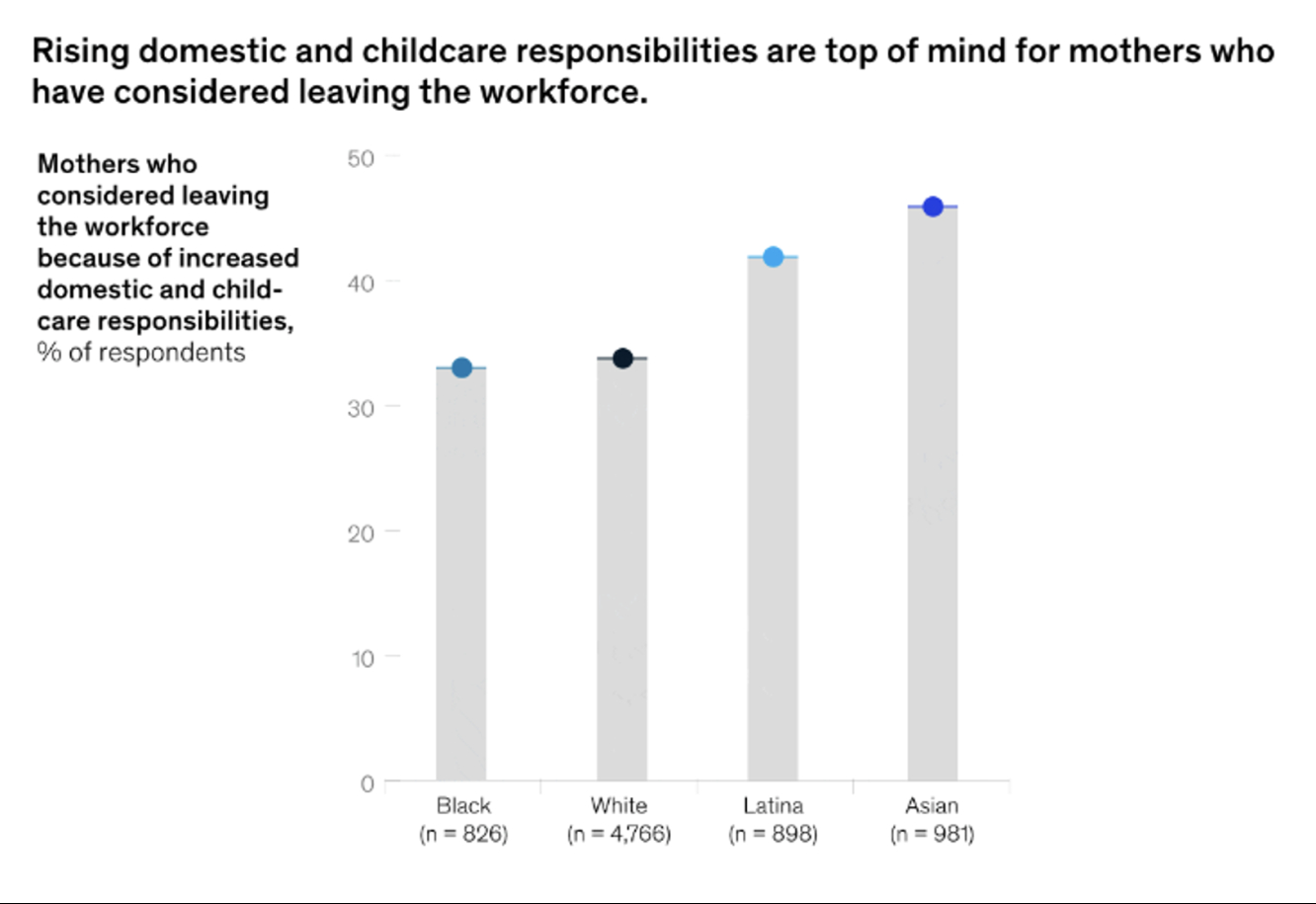

The numbers are, however, much lower than they were pre-pandemic. The pandemic led to a considerable increase in unemployment, particularly in the case of working mothers. One reason is that pandemic-related limitations and social distancing measures added to an already overburdened "double shift." Typically, women are responsible for more housework and childcare than men, leaving them with no choice except to go part-time or leave the workforce.

Source: McKinsey & Company

In contrast to the last two years, Diversity, Equality, and Inclusion (DEI) is becoming a major trend today. It is considered one of the main focus areas of businesses this year. According to studies, companies that embrace gender diversity on their executive teams are more likely to be competitive, profitable, and outperform their peers in terms of long-term value creation. Given this understanding, companies are significantly boosting their efforts to embrace gender diversity and introducing programs and policies to support mothers in staying in the workforce. This will be a big factor in expanding the growth of the baby nutrition market. In addition, as more young working moms embrace convenience-oriented lifestyles, they become increasingly reliant on processed infant nutrition products, making prepared baby foods and baby formula more appealing.

Formula sales are soaring as more mothers choose infant formula over breastfeeding for various reasons, including increased lactation issues, lack of trained lactation experts, and work pressure. According to the World Health Organization (WHO) and the United Nations Children's Fund (UNICEF), the rate of breastfeeding is less than the standard recommendations around the world. With companies investing billions every year to improvise and innovate their formulations and promote baby food products, there will be a positive impact on the infant formula market growth.

Here are the top 4 players in the babycare and baby nutrition market to look out for this year.

1. Nestle

Nestle (OTC:NSRGY) is the world's largest food and beverage maker with a 156-year history. Nestle’s early growth drivers were infant formula products, and the company has expanded into many more verticals in the last few decades to remain relevant. The company has continued to perform well, gaining market share across the board in most geographies, with organic growth in developed markets reaching 7.2% in 2021. The Infant Nutrition segment saw negative growth in 2021 due to a drop in sales in China and decreased birth rates worldwide, while sales of human milk oligosaccharides (HMOs) products remained strong. Nestle, on the other hand, has a large global presence and holds 22% of the infant formula market, and is currently focused on the creation of new infant goods to maintain its market dominance. The company has significant pricing power and comparatively higher profit margins in the baby food industry. These characteristics paint a promising picture of what the future holds for the company.

2. Abbot Laboratories

Abbott Laboratories (NYSE:ABT) is an American multinational healthcare company well-known for its pediatric and adult nutrition brands, including Pedialyte, Ensure, Glucerna, and Similac. Abbott competes in many different areas, which is a crucial pillar of its resiliency, and this is one of the characteristics that makes it an intriguing investment prospect. In Q4 2021, Abbott reported a 5.5% growth in Nutrition segment revenue, driven by the excellent performance of Abbott's market-leading brands Ensure, Glucerna, and Pedialyte.

3. Else Nutrition

Else Nutrition Holdings (OTC:BABYF) is a plant-based food and nutrition company founded in Israel that caters to toddlers. With the rise in cases of dairy intolerance in babies, the demand for a sustainable new source of protein is increasing. The all-natural and plant-based ingredients are predicted to support the organic and clean-labeled infant nutrition product market growth. Else Nutrition Holdings enjoys a first-mover advantage in this market with its patented 100% natural, plant-based, and healthy nutritional products. The company’s products are made of almonds, buckwheat, and tapioca, free from hormones, antibiotics, gluten, or other harmful substances. Else Nutrition saw an almost 300% year-over-year increase in revenue in 2021 thanks to rapid online sales growth, particularly from Amazon (NASDAQ:AMZN) customers. In September 2021, the company launched education and marketing programs to help pediatricians and parents understand the nutritional benefits of plant-based infant products. Else Nutrition remains laser-focused on building an ecosystem around its products by educating the world about these technologically advanced diets solutions for babies.

4. Bubs Australia

Bubs Australia (ASX:BUB) specializes in infant formula and organic baby food products, and the company is a significant producer of goat dairy products for the domestic and foreign markets as well, including goat milk-based formulae for adults' everyday use, formulations, and adult immunity support. The company is focused on expanding its footprint into family nutrition and specialty nutrition markets in the future, and innovation remains a key feature of the company culture.

Conclusion

The infant nutrition market is at a tipping point, with the industry looking well-positioned to grow in the next few years aided by favorable macroeconomic developments. Strategically investing in companies introducing much-needed innovative baby nutrition products could help investors book handsome returns in the future.