Monday’s major jump in stocks is the beginning of a trend that will catch a lot of investors by surprise: fundamental strength thanks to trade war fears abating.

We aren’t out of the woods yet, as Tuesday showed us. While the market cheered the tentative cease-fire between Xi and Trump on Monday, the lack of details and confusion hit the market on Tuesday.

And that’s a good thing, because it’s set up investors for an opportunity to buy equities cheap before the relief rally around the corner.

Trade Ceasefire Opens Buy Window …

The way I see it, the trade-war ceasefire is likely the beginning of a deal coming down the pipe in the next three months. That means the market’s biggest anxiety is nearly over—and we’re nicely set up for more upside!

You’re probably wondering why I’m so confident.

For one, the fear that the US and China, two of the largest trading partners on earth, would fail to reach some kind of deal has always been irrational.

Second, the recent market stumble has been way out of step with the sky-high earnings growth we’ve seen (S&P 500 profits rose 25.9% in the third quarter, even stronger than the record-high growth in the first half of the year) and breakneck sales growth (revenues jumped 9.3% in Q3, again above expectations).

But the best thing about the market now is something we hear nothing about: tardy fund managers.

… And the Race Back in Is On!

Here’s what I mean: market hysteria resulted in a steady selloff of assets among equity funds, and that didn’t stop, even as the data got better. For instance, Thanksgiving week saw fund managers dump stocks all around, resulting in $8.5 billion in cash flowing out of equity funds for the week.

All told, it was the worst Thanksgiving week for fund outflows since 2011.

This is a clear case of late selling on the trade-war noise. Now that a deal looks like it’s in the offing, fund managers will slowly buy back in.

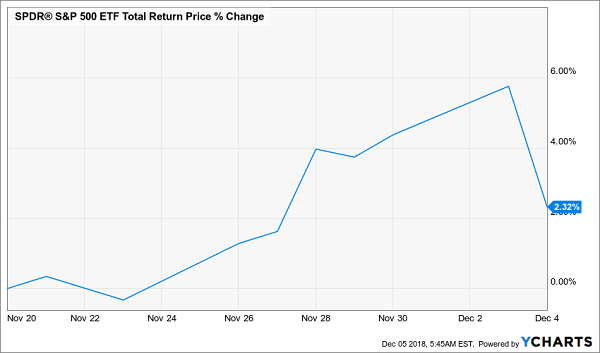

And you know what that means: rising stock prices. We’re already seeing them:

(Some) Fund Managers Get the Memo

If fund managers are likely to pile into stocks in the next few weeks, wouldn’t it make sense to buy in now, before they do?

The answer is yes—and here are 3 equity-focused closed-end funds (CEFs) that should be near the top of your list.

3 Comeback Kids Paying Up to 9.6%

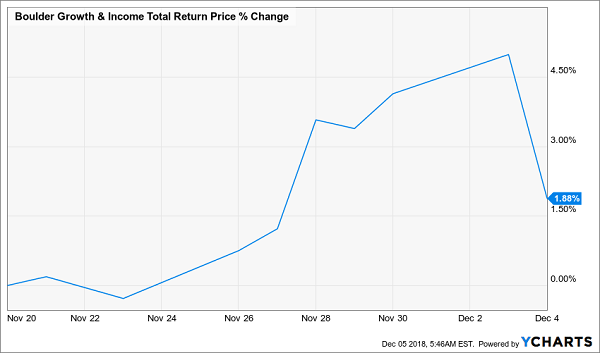

If you want to play this oversold market for capital gains and market-busting income, the options are plenty. In a November 19 article—“An ‘Instant’ 3-Fund Portfolio for 9.8% Dividends and 40% Upside”—I mentioned the Boulder Growth and Income Closed Fund (NYSE:BIF) as a buy because of its attractive, value-driven portfolio and the fact that it trades at a huge discount to the value of that portfolio.

Here’s what it’s done since then:

A Fast Recovery

BIF is only getting started, so it remains an attractive option, as its market price trades at a 16.8% discount to net asset value (NAV, or the value of its underlying portfolio), and its 3.6% income stream is growing.

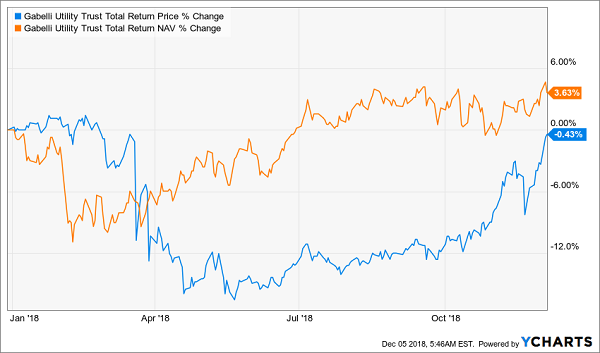

Another option: the Gabelli Utility Closed Fund (NYSE:GUT), which has been one of the strongest performers in its class. The market, however, has punished it with a big selloff. But that’s changing, and GUT is starting to attract more buyers:

A Great Fund on Sale—But Not for Long!

You don’t have much time to get into this fund before the market closes the gap, which is why you should consider jumping in now for a 9.6% dividend yield and capital gains that will likely come hard and fast in the coming weeks.

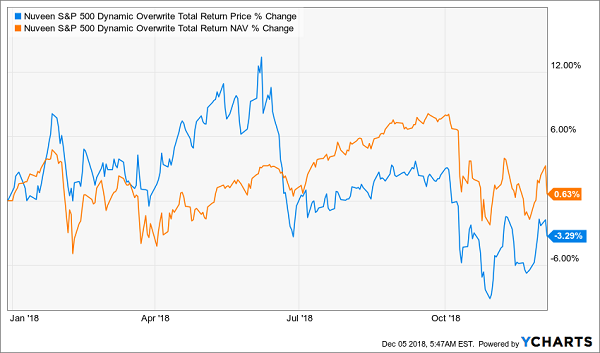

Finally, our third fund: the Nuveen S&P 500 Dynamic Overwrite Fund (NYSE:SPXX), which uses a covered-call strategy to boost its yield to 6.9% while giving you exposure to the broad index.

Recent volatility has made the fund a decent performer, but the market doesn’t care, which is why SPXX’s price return is negative and its NAV return is slightly positive, resulting in a 2% premium to NAV, far lower than the 15% premium it had back in May or the 5% average premium it’s had over the last couple years.

A Rare Buying Opportunity Appears

With the market’s slowness to respond to fundamentals, these are 3 funds you could buy with confidence now, both for their income and their upside potential—but hurry before the fund managers catch on!

5 Better Buys Than SPXX (for 28%+ profits in 2019)

SPXX, GUT and BIF are all great funds, but they’re not cheap enough to snag us the very biggest gains in 2019—and that’s why they didn’t make it into the new Special Report I’ve released.

It contains nothing less than my 5 very best CEF picks for critical year ahead. Best of all, I’ll GIVE you a copy when you click here now.

In this exclusive volume, you’ll get the full story on these 5 amazing CEFs, all of which trade at ridiculous discounts to their true value, due in no small part to trade worries.

The bottom line? My team and I fully expect this 5-fund “mini-portfolio” to gain 20%+ next year, in addition to its 8% average payout!

Put it all together and you’re looking at a 28% total return, with a healthy slice of that in cash, thanks to these funds’ amazing 8% average dividend!

But a word of warning: as trade-war fears fade, these 5 undercover funds are edging higher with each passing day. If you don’t want to miss out on the biggest gains, you need to act right away.

I’m ready to GIVE you this breakthrough report now. All you have to do is CLICK HERE to get your copy and get the full story on these 5 amazing cash machines, including their names, tickers, buy-under prices and my complete research.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."