Unemployment data for Spain will be widely read today as the crowd looks for insight on deciding if the recent recovery has peaked for Europe’s fourth-largest economy. Later, two US reports will focus attention on the macro trend ahead of Friday’s jobs report. First up is factory orders for September, followed by last month’s data on auto sales.

Spain: Unemployment Report (0800 GMT): Yesterday’s sentiment data for Spain’s manufacturing sector provides more evidence that growth in Europe’s fourth-largest economy is slowing. Markit’s purchasing managers’ index for October ticked down to 51.3—a sluggish pace of growth that marks the weakest rise in output for nearly two years.

“It’s looking like a low-key end to the year for the Spanish manufacturing sector as growth rates for output, new orders and employment have all slowed to a crawl in recent months,” a Markit economist noted in yesterday’s update.

The soft PMI numbers are especially worrisome because Spain’s rebound that started gaining traction last year is considered an early clue of the broader progress in the Eurozone that followed. But there are mounting signs that suggest that Spain’s recovery has peaked, which implies the same for the euro area.

On the bright side, the Eurozone Manufacturing PMI ticked higher in October, albeit at a slow-growth reading of 52.3. But for the moment, it's debatable if Spain's deceleration is a dark sign for Europe overall.

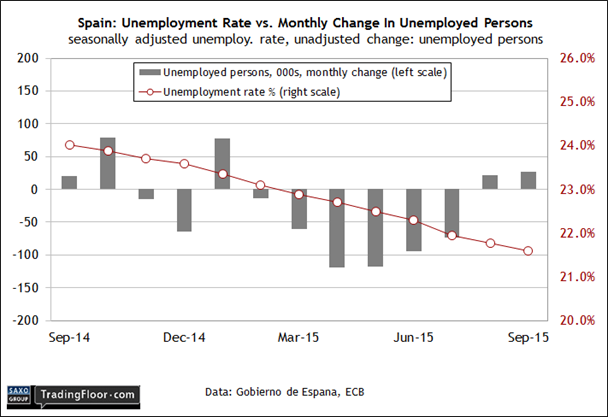

Today’s update on Spain’s unemployment numbers for October will provide a new round of hard data for monitoring the trend in what has recently been hailed as Europe’s growth leader among the major economies. But here too the figures are stumbling. Although the jobless rate has continued to fall, it’s still painfully high at nearly 22% in September. Meanwhile, the number of unemployed workers has started rising, posting modest increases in August and September. That’s the first back-to-back monthly increases in over a year.

If today’s update delivers number-three, the news will raise more questions about the outlook for Spain—and the Eurozone.

US: Factory Orders (1500 GMT): Yesterday’s October update of the ISM Manufacturing Index reflects a sector that’s poised to slip into a recession, if it’s not there already. But a competing data set—Markit’s purchasing managers’ index (PMI)—offers a substantially brighter outlook.

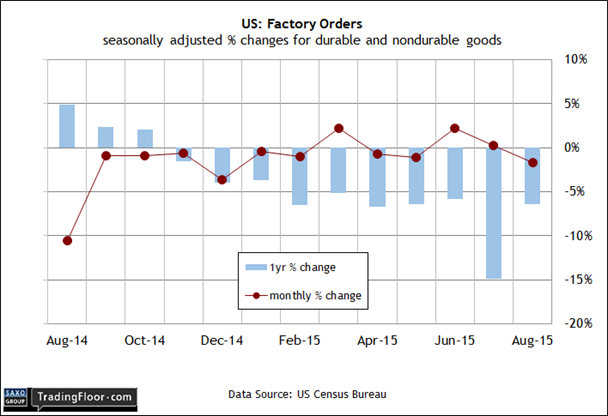

The hard data via factory orders, on the other hand, leaves little room for doubt that a bearish trend dominates. The year-over-year comparison has been negative since late-2014.

Output has been sliding as well. Federal Reserve numbers show that manufacturing production fell for the second month in a row in September.

Today’s September report on factory orders is expected to reflect a reduced pace of decline. But the projected 0.9% monthly drop, based on Econoday.com’s consensus forecast, translates into another hefty decline in year-over-year terms. If the prediction holds up, factory orders are headed for the 11th consecutive year-over-year drop in September.

Curiously, Markit’s PMI numbers tell a different story. “Factory output growth accelerated [in October], equivalent to around a 4% annualised rate of increase, as firms saw the largest monthly jump in new order inflows since March,” the firm’s chief economist said. “Export growth has also revived, suggesting firms are managing to adapt to the stronger dollar, as job creation picked up after slowing in September.”

So far, however, there’s minimal evidence of confirming data from other sources and today’s update on factory orders isn’t expected to tell us otherwise.

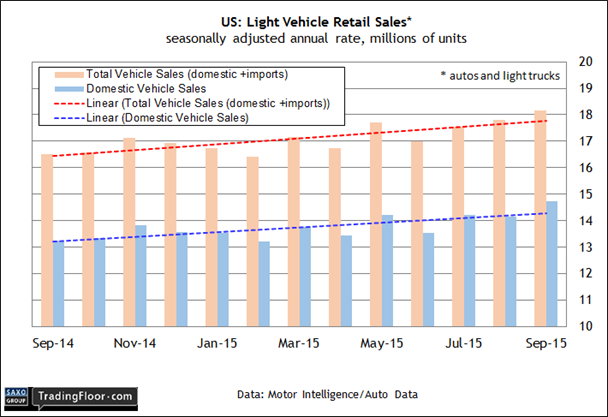

US: Light Vehicle Sales (TBD): In contrast with the (mostly) gloomy numbers in the manufacturing sector, auto sales have been posting upbeat numbers in recent months. More of the same is coming, according to last week’s forecast from Kelley Blue Book, an auto data company.

“Coming off the strongest sales month in a decade in September, sales continue to roll along this month, with double-digit growth expected for the industry in October 2015,” a KBB analyst said. “Key economic indicators for auto sales are still strong, including jobless claims at a historic low as the national unemployment rate approaches 5%, fuel pricing nearing six-year lows and interest rates that remain near zero.”

Maybe so, but today’s hard numbers on total US light-vehicle sales in October via Autodata are expected to post the first month of lower sales since May. Economists are looking for a sizable drop to 17.7 million units from 18.2 million in September (at a seasonally adjusted annual rate), according to Econoday.com’s consensus forecast. That still leaves sales close to September’s 10-year high, but a softer report will feed into worries that the recent weakness in US manufacturing may get weaker still.

Using yesterday’s encouraging report from Nissan (OTC:NSANY), however, suggests that positive momentum is still alive and kicking. The carmaker raised its sales forecast after reporting higher-than-expected operating profit for its second quarter due to solid gains in North America sales. “The strong US demand is making up for weakness in many other markets, including Japan,” said an analyst at Tokai Tokyo Research Center. “But they can't count on the US forever because the market will peak out and their model mix will deteriorate.”

An early installment of the “peak out” factor is expected to arrive in today’s report for US light-vehicle sales.

Disclosure: Originally published at Saxo Bank TradingFloor.com