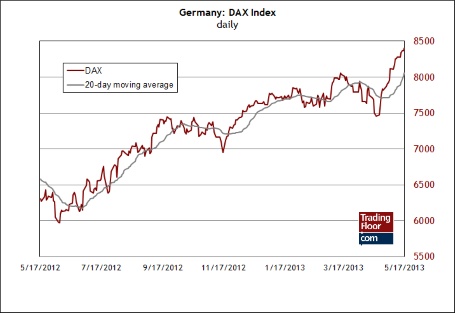

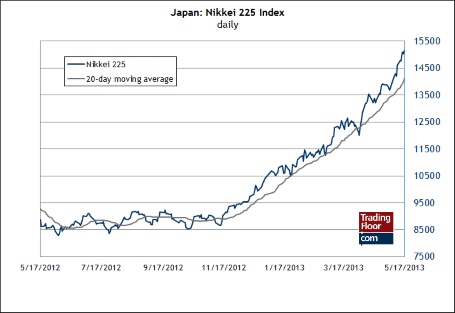

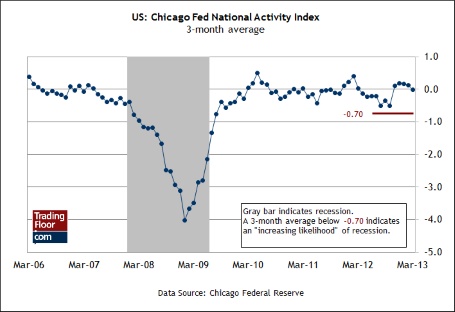

Monday is a light day for scheduled economic news, but the week ahead will see several key updates for Germany. It will be interesting to see how the high-flying DAX Index anticipates the approaching numbers, including Thursday’s flash PMI Composite and Friday’s Ifo ZEW Survey. Speaking of bull markets in equities, also keep an eye on Japan’s Nikkei 225 Index, which has been in a near non-stop vertical surge for months. The extraordinary programme of monetary stimulus of late is widely credited as spurring a buying frenzy in the country’s stock market. As a result, the Bank of Japan’s monetary policy announcement on Tuesday will be closely watched for clues on what comes next. For the US, the only economic update today is the April release for the Chicago Fed National Activity Index (CFNAI), which will dispense new perspective on the business cycle.

Germany DAX The bull run in stocks in the heart of Europe may seem like an odd trend after the recent round of discouraging economic news. Last week’s flash GDP report for the Eurozone (pdf) revealed that Germany just barely skirted recession in the first quarter with unexpectedly weak growth of 0.1 percent. But that looks better than the news for France, which suffered a 0.2 percent contraction in GDP in Q1.

Why is the DAX rallying amid gloomy macro numbers? It’s not only equities in Germany, by the way, but across the Eurozone generally. The Stoxx Europe 600 Index closed near a five-year high last week. One theory is that the wobbly data for Europe has inspired new hope that monetary policy must become considerably more accommodative… soon. The European Central Bank cut its policy rate by 25 basis points earlier this month, but that looks meek by Japan’s new monetary standards, which has turned aggressively stimulative and can now point to real economic progress (see below). That raises speculation that the Eurozone’s monetary mavens may be forced to follow suit. Apparently, the equity bulls are betting on no less. For the moment, bad news is good news for bullish stock market momentum.

Japan Nikkei 225 Last week’s news that Japan’s economy grew by a better-than-expected 3.5 percent (seasonally adjusted annual rate) in the first quarter convinced many analysts that Abenomics is working. "The Japanese economy is beginning to fire on all cylinders,” notes one economist. Although skeptics initially objected to the idea of injecting extraordinary amounts of money into the economy, the critics have been marginalised, at least for now.

The virtually non-stop melt-up in Japanese equities this year suggests that market sentiment sees the virtuous cycle of a weaker yen and a stronger economy as a productive linkage that will persist for the near term. Tuesday’s monetary policy announcement from the Bank of Japan (BoJ) isn't expected to bring any changes to the current game plan, although the market will be listening closely to any references to the uptick in Japanese government bond yields of late. The 10-year bond, for instance, last week popped to 0.92 percent before settling at 0.79 percent on Friday. But that’s still up from 0.60 percent a month earlier. Is the rise in rate a sign of complication for Abenomics?

The goal is to raise rates gently, over time, primarily with the lever of improving macro expectations via real economic progress. So far, so good. But when the blunt tool of choice in this quest is front-loaded with raising inflation expectations, there's a risk that the market could suddenly turn anxious and dump bonds en masse. In turn, rates will rise too far, too fast and perhaps choke off the recovery. Rising rates are no trivial issue for the heavily indebted Japanese economy, which has the highest debt-to-GDP ratio among developed nations - 230 percent in 2011, for instance. The question is whether rising yields are an issue for the central bank's plans? Perhaps the BoJ will drop some clues in tomorrow's monetary update.

US Chicago Fed National Activity Index (12:30 GMT) This benchmark of the business cycle stands alone for economic news in the US today and so it will receive a fair amount of attention. Recent updates show that recession risk has been low, based on the CFNAI. In the March report, the index’s three-month average was -0.01, or well above the danger zone of -0.70.

Recent economic updates from other corners have pointed to a slowdown in growth, with industrial production in April posting an outright contraction versus March, for instance. The sluggish numbers of late look weak, but today’s CFNAI report isn’t likely to show that the economy slipped over to the dark side. In fact, my econometric modelling anticipates a modest improvement in CFNAI’s April three-month average. That may appear counter-intuitive, given a few high-profile indicators for last month. But a broader review still suggests that the trend is holding up. Indeed, that was the message in Friday’s upbeat news in the Conference Board’s Leading Economic Index for April and a comparable signal is expected today from the Chicago Fed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Numbers To Watch: DE DAX, JP NIKKEI 225, US CFNAI

Published 05/20/2013, 05:12 AM

Updated 03/19/2019, 04:00 AM

3 Numbers To Watch: DE DAX, JP NIKKEI 225, US CFNAI

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.