If you’re like most income investors right now, you’ve got one eye on this twitchy market—and the other on red flags like slumping manufacturing numbers, chaos in DC and even the dreaded inverted yield curve.

I’m worried, too. But our best play here is not to sit in cash. With your mattress full, you’ll be forced to stand by as inflation drains your savings.

Worse, you’re certain to miss the next rebound. Because that’s the real mistake perma-bears always make: staying out of the market too long!

That’s why the smart move here is to buy. But we’re still going to take out some portfolio “insurance” by focusing on “crash-resistant” stocks.

These are firms that hold fast in a crash and hand us growing income until the (inevitable) rebound arrives. I’ll have three names—two high-yielding real estate investment trusts (REITs) and a closed-end fund (CEF)—for you shortly.

Each is growing their payout fast—like the 37% “raise” over five years that one lucky group of investors got.

4 Things Every Stock Needs to Beat a Crash

First, for a stock to be “crash-resistant,” it needs four key strengths:

I’ve put hundreds of stocks through this four-step “boot camp.” Here are three survivors, ranked from the lowest yield to the highest:

“Crash-Resistant” Dividend No. 1: Crown Castle International (NYSE:CCI)

Dividend yield: 3.3%

5-year dividend growth: 37.2%

Beta: 0.27

Cell-tower landlord Crown Castle (NYSE:CCI) is a great way for us to piggyback megatrends like ultra-fast 5G networks, artificial intelligence and data analytics.

In fact, this is why CCI often gets lumped in with volatile tech stocks. But this REIT is far from volatile. That has a lot to do with its fast dividend growth, which pries its share price higher, no matter what the economy does.

Check out how CCI’s surging payout drove up its price in the four years leading up to (and through) the crash of late 2018—the pattern is uncanny:

Dividend Growth Powers CCI

And don’t let that dip at the end of the chart above fool you. Zoom in on the late-2018 pullback (the most recent proving ground we have) and you’ll see that CCI—in blue below—dipped far less than the S&P 500:

CCI Rolls Through the Storm …

One thing I love about this management team is that it’s 100% dedicated to payout growth: they declare their intention to grow the dividend 7 to 8% a year on page one of their investor presentation.

They can easily meet this pledge: adjusted funds from operations (AFFO, a better measure of REIT performance than earnings per share) surged 9% in the second quarter as its tenants—including Verizon Communications (NYSE:VZ) and AT&T (NYSE:T)—bolstered their networks to get set for 5G.

The kicker? CCI pays out a low (for a REIT) 77% of AFFO as dividends. So even if a recession hits, management has plenty of room to keep the payout rising.

“Crash-Resistant” Dividend No. 2: National Health Investors (NYSE:NHI)

Dividend yield: 5.1%

5-year dividend growth: 36.4%

Beta: 0.29

Healthcare is a go-to when times get rough, and with good reason: US healthcare spending is soaring (despite Democrats’ Medicare-for-All proposals) because Americans are getting older.

According to the Census Bureau, in 2035, people aged 65 and older will outnumber those under the age of 18 for the first time ever.

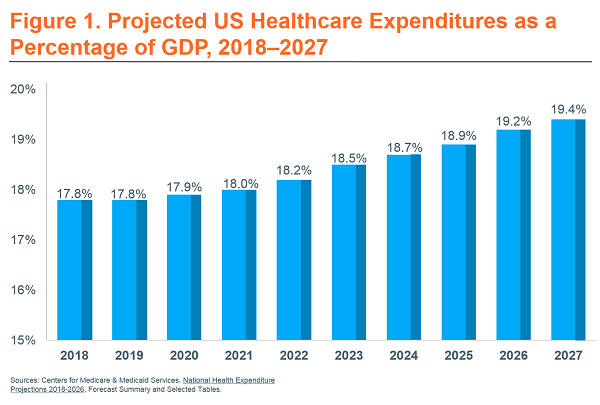

That’s part of the reason why the Centers for Medicare and Medicaid Services see healthcare spending growing at a 5.5% yearly clip, hitting nearly $6 trillion by 2027—and accounting for an outsized 19.4% of GDP:

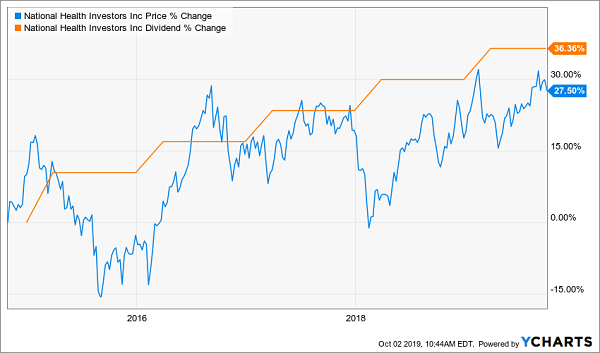

Enter NHI, which invests in seniors’ housing, medical centers and skilled-nursing facilities. The stock has proven its mettle in a correction, delivering a steady total return in late 2018, while the market dove:

NHI Investors Skipped the Last Pullback

The beauty of NHI is that it gives you a high 5.1% dividend now and strong dividend growth, too.

Another Dividend Magnet

Just like with Crown Castle (NYSE:CCI), you can see the share price rising to meet that payout as it pops higher (and yes, that gap at the end represents our price upside).

NHI has plenty of room to keep the payout growing: its dividend is 77% of the midpoint of projected 2019 FFO. That’s more than manageable for NHI, which gets predictable interest and lease income from its tenants and borrowers.

“Crash-Resistant” Dividend No. 3: Reaves Utility Income Fund (NYSE:UTG)

Dividend yield: 5.9%

5-year dividend growth: 30.9%

Beta: 0.5

Everyone knows utilities are a rock in unsteady times. But there are two problems with utilities now:

- Ho-hum dividends: The benchmark Utilities Select Sector ETF (XLU) yields 2.9% today.

- Utilities’ safety is no secret, which is why XLU has beaten the market this year, leaving few bargains in the space—except one.

That would be the Reaves Utility Income Fund (UTG), a CEF holding rock-steady utilities like NextEra Energy (NYSE:NEE), Verizon (NYSE:VZ) and Sempra Energy (NYSE:SRE).

Just by picking UTG over XLU, you’re getting double the dividend (5.9%). UTG also lived up to its beta of 0.5 last year, dipping only half as much as the market.

And the management team at Reaves, an investment firm with nearly 60 years of history, has delivered upside most investors can only dream of, crushing the S&P 500 since inception—no small feat for a fund focused on low-volatility utilities.

UTG: A True Tortoise-and-Hare Story

Best of all, much of that return was in cash, thanks to UTG’s higher yield.

There’s more to come: UTG trades at a 1.2% discount to its NAV—meaning its market price is slightly below the value of its portfolio. That doesn’t sound like much, but this fund traded at a 4.9% premium as recently as mid-August.

With more volatility ahead, you can bet UTG’s premium will snap back above 5%. When it does, it will pull the fund’s price along with it.

Yours Now: 19 “Crash-Proof” Stocks With Safe Cash Payouts Up to 10.4%

The above three stocks are ideal “dividend lifeboats” because their high—and growing—payouts give you more of your profits in cash, rather than here-today, gone-tomorrow paper gains.

Stocks like these ensure your nest egg pays your bills now and grows for the future.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets.