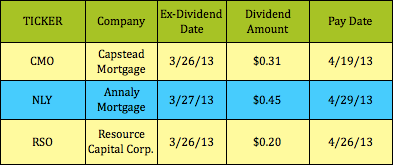

There are several dividend stocks going ex-dividend next week, (3/25/13 – 3/3/29/13) from the Financials section of our High Dividend Stocks By Sector Tables. The following 3 stocks are mortgage Real Estate Investment Trusts, or “mREITS”, as they are popularly known. They invest in mortgage-related securities, issued by government agencies, such as Fannie Mae and Freddie Mac, and use leverage to achieve high dividend yields.

Dividends: Capstead Mortgage (CMO) increased its quarterly dividend to $.31, from $.30, while Annaly Capital Management (NLY) and Resource Capital Corp. (RSO) maintained their dividend payouts this quarter. RSO maintained a $.25 quarterly dividend from late 2009 through 2011, but it dropped its quarterly payout to $.20 in 2012. Prior to the housing crisis, RSO paid as high as $.41. NLY dropped its dividend payout twice in 2012, to $.55, and then to $.50, before seemingly stabilizing at $.45 in Dec. 2012.

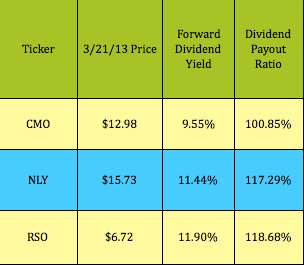

As REITs, they must pay out at least 90% of their income, in exchange for paying no corporate income taxes, hence their high dividend yields. Even with the decrease in dividend payouts, these yields are still quite high:

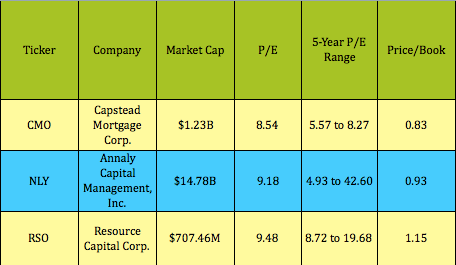

Current Valuations: The smallest stock by Market Cap, RSO’s P/E is closest to the low end of its 5-year P/E range, but CMO is the cheapest on a Price/Book basis:

Options: Although all 3 of these stocks have options, we don’t list them in our Covered Calls Table or our Cash Secured Puts Table, due to low options yields. However, there over 30 other high yield trades in each of those free tables, which are maintained daily.

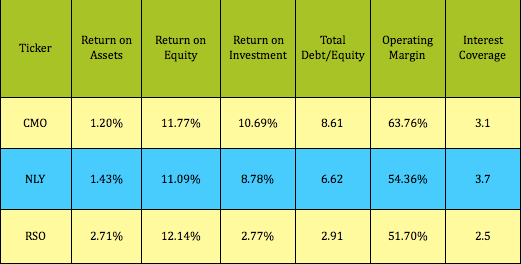

Financials: All 3 firms have similar Returns On Equity. RSO carries the least debt, and lags in Return On Investment and Interest Coverage:

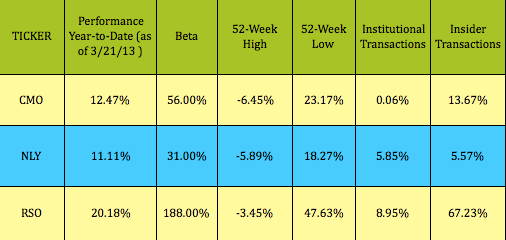

Performance/Ownership: RSO has outperformed CMO and NLY in 2013, and over the past 52 weeks, partly due to its higher support from institutional and inside buyers:

Disclaimer: This article was written for informational purposes only and is not intended as investment advice.

Disclosure: The author owned CMO and NLY shares at the time of this writing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 High Dividend Stocks Going Ex-Dividend Next Week

Published 03/22/2013, 01:23 AM

Updated 07/09/2023, 06:31 AM

3 High Dividend Stocks Going Ex-Dividend Next Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.