:

All of the companies mentioned below have seen hedge fund selling during the most recent quarter (13-F filings). These companies also have falling receivables, when compared to quarterly revenue growth.

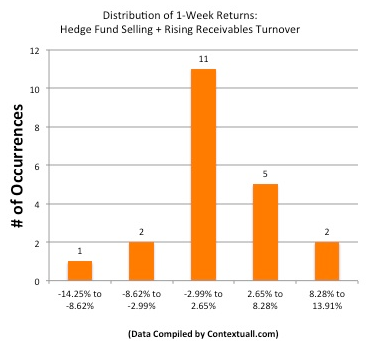

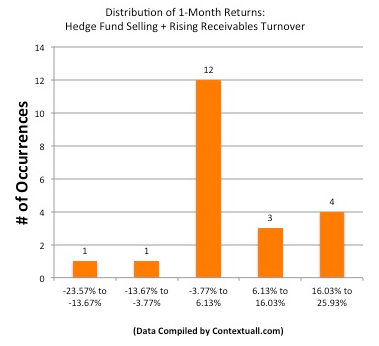

Average Weekly Returns:

Average 1-Week Return of All Stocks Mentioned Below: 1.78%

Average 1-Month Return of All Stocks Mentioned Below: 5.54%

Analysis of List Alpha:

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Week): 10 out of 22 (45.45%)

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Month): 11 out of 22 (50.0%)

Chart: Distribution of 1-Week Returns For All Stocks Mentioned Below

Chart: Distribution of 1-Month Returns For All Stocks Mentioned Below

1. athenahealth, Inc. (ATHN): Provides ongoing billing, clinical-related, and other related services to medical group practices primarily in the United States. Net institutional shares sold during the most recent quarter at 2.0M shares (5.63% of float at 35.55M shares). Revenues increased by 26.45% during the most recent quarter ($105.89M vs. $83.74M y/y), while the size of accounts receivable changed by 13.14% ($53.31M vs. $47.12M y/y). Receivables, as a percentage of current assets, decreased from 26.4% to 20.92% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

2. SouFun Holdings Ltd. (SFUN): Provides marketing, listing, technology, and information consultancy services to real estate and home furnishing industries in the People’s Republic of China. Net institutional shares sold during the most recent quarter at 1.1M shares (7.74% of float at 14.21M shares). Revenues increased by 17.14% during the most recent quarter ($127.24M vs. $108.62M y/y), while the size of accounts receivable changed by 0.80% ($55.56M vs. $55.12M y/y). Receivables, as a percentage of current assets, decreased from 21.72% to 21.29% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

3. Bankrate, Inc. (RATE): Bankrate, Inc. offers online financial data feed management services. Net institutional shares sold during the most recent quarter at 3.9M shares (9.82% of float at 39.71M shares). Revenues increased by 3.44% during the most recent quarter ($116.78M vs. $112.9M y/y), while the size of accounts receivable changed by -12.64% ($60.45M vs. $69.2M y/y). Receivables, as a percentage of current assets, decreased from 43.% to 36.77% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

4. PMFG, Inc. (PMFG): Provides custom-engineered systems and products primarily to power generation, natural gas infrastructure and refining, and petrochemical processing markets worldwide. Net institutional shares sold during the most recent quarter at 3.9M shares (24.61% of float at 15.85M shares). Revenues increased by 13.37% during the most recent quarter ($32.98M vs. $29.09M y/y), while the size of accounts receivable changed by -8.28% ($26.02M vs. $28.37M y/y). Receivables, as a percentage of current assets, decreased from 35.39% to 20.78% during the most recent quarter (time interval comparison 3 months ending 2012-09-29 to 3 months ending 2011-10-01).

5. Aviat Networks, Inc. (AVNW): Engages in the design, manufacture, and sale of a range of wireless networking products, solutions, and services worldwide. Net institutional shares sold during the most recent quarter at 3.2M shares (5.77% of float at 55.45M shares). Revenues increased by 3.23% during the most recent quarter ($115M vs. $111.4M y/y), while the size of accounts receivable changed by -12.35% ($109.3M vs. $124.7M y/y). Receivables, as a percentage of current assets, decreased from 37.58% to 36.18% during the most recent quarter (time interval comparison 3 months ending 2012-09-28 to 3 months ending 2011-09-30).

6. Meredith Corp. (MDP): Engages in magazine publishing and related brand licensing, television broadcasting, integrated marketing, interactive media, and video production businesses in the United States. Net institutional shares sold during the most recent quarter at 3.9M shares (12.82% of float at 30.42M shares). Revenues increased by 8.01% during the most recent quarter ($354.16M vs. $327.91M y/y), while the size of accounts receivable changed by 4.39% ($222.82M vs. $213.44M y/y). Receivables, as a percentage of current assets, decreased from 62.72% to 58.06% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

7. Transcat Inc. (TRNS): Engages in the distribution of handheld test and measurement instruments, as well as provides calibration, repair, and weighing system services. Net institutional shares sold during the most recent quarter at 1.3M shares (20.67% of float at 6.29M shares). Revenues increased by 6.39% during the most recent quarter ($26.79M vs. $25.18M y/y), while the size of accounts receivable changed by 0.94% ($13.89M vs. $13.76M y/y). Receivables, as a percentage of current assets, decreased from 61.05% to 58.93% during the most recent quarter (time interval comparison 3 months ending 2012-09-29 to 3 months ending 2011-09-24).

8. Molina Healthcare Inc. (MOH): Provides Medicaid-related solutions to meet the health care needs of low-income families and individuals, as well as assists state agencies in their administration of the Medicaid program. Net institutional shares sold during the most recent quarter at 1.8M shares (6.44% of float at 27.93M shares). Revenues increased by 30.89% during the most recent quarter ($1,540.19M vs. $1,176.72M y/y), while the size of accounts receivable changed by 2.49% ($190.44M vs. $185.82M y/y). Receivables, as a percentage of current assets, decreased from 17.96% to 14.49% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

9. Duke Energy Corporation (DUK): Operates as an energy company in the Americas. Net institutional shares sold during the most recent quarter at 112.4M shares (15.99% of float at 702.84M shares). Revenues increased by 69.58% during the most recent quarter ($6,722M vs. $3,964M y/y), while the size of accounts receivable changed by 48.54% ($2,846M vs. $1,916M y/y). Receivables, as a percentage of current assets, decreased from 30.54% to 28.16% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

10. Carter’s, Inc. (CRI): Designs, sources, and markets branded children’s wear. Net institutional shares sold during the most recent quarter at 2.8M shares (6.53% of float at 42.89M shares). Revenues increased by 4.54% during the most recent quarter ($668.66M vs. $639.62M y/y), while the size of accounts receivable changed by -6.71% ($200.16M vs. $214.56M y/y). Receivables, as a percentage of current assets, decreased from 29.68% to 22.84% during the most recent quarter (time interval comparison 13 weeks ending 2012-09-29 to 13 weeks ending 2011-10-01).

11. Eastern Co. (EML): The Eastern Company manufactures and sells industrial hardware, security products, and metal products in North America. Net institutional shares sold during the most recent quarter at 916.7K shares (16.94% of float at 5.41M shares). Revenues increased by 9.84% during the most recent quarter ($39.64M vs. $36.09M y/y), while the size of accounts receivable changed by -11.31% ($19.68M vs. $22.19M y/y). Receivables, as a percentage of current assets, decreased from 34.03% to 27.69% during the most recent quarter (time interval comparison 13 weeks ending 2012-09-29 to 13 weeks ending 2011-10-01).

12. Meru Networks, Inc. (MERU): Engages in the development and marketing of a virtualized wireless LAN solution. Net institutional shares sold during the most recent quarter at 865.9K shares (7.48% of float at 11.58M shares). Revenues increased by 6.86% during the most recent quarter ($25.39M vs. $23.76M y/y), while the size of accounts receivable changed by -50.23% ($5.41M vs. $10.87M y/y). Receivables, as a percentage of current assets, decreased from 16.85% to 11.27% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

13. Winner Medical Group Inc. (WWIN): Engages in the research, development, manufacture, and marketing of cotton-base medical dressings and medical disposables. Net institutional shares sold during the most recent quarter at 484.3K shares (7.84% of float at 6.18M shares). Revenues increased by 16.01% during the most recent quarter ($48.19M vs. $41.54M y/y), while the size of accounts receivable changed by 12.30% ($30.31M vs. $26.99M y/y). Receivables, as a percentage of current assets, decreased from 35.58% to 34.61% during the most recent quarter (time interval comparison 3 months ending 2012-06-30 to 3 months ending 2011-06-30).

14. TeleCommunication Systems Inc. (TSYS): Develops and applies secure mobile communication technology in the United States and internationally. Net institutional shares sold during the most recent quarter at 5.1M shares (11.44% of float at 44.59M shares). Revenues increased by 24.37% during the most recent quarter ($140.06M vs. $112.62M y/y), while the size of accounts receivable changed by -1.43% ($92.29M vs. $93.63M y/y). Receivables, as a percentage of current assets, decreased from 54.03% to 47.95% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

15. American Greetings Corp. (AM): Engages in the design, manufacture, and sale of greeting cards and other social expression products worldwide. Net institutional shares sold during the most recent quarter at 1.4M shares (5.03% of float at 27.81M shares). Revenues increased by 6.39% during the most recent quarter ($393.84M vs. $370.19M y/y), while the size of accounts receivable changed by -12.65% ($97.56M vs. $111.69M y/y). Receivables, as a percentage of current assets, decreased from 15.06% to 15.05% during the most recent quarter (time interval comparison 3 months ending 2012-08-24 to 3 months ending 2011-08-26).

16. Convergys Corporation (CVG): Provides relationship management solutions worldwide. Net institutional shares sold during the most recent quarter at 10.8M shares (10.05% of float at 107.41M shares). Revenues increased by 2.90% during the most recent quarter ($507.6M vs. $493.3M y/y), while the size of accounts receivable changed by -17.44% ($311.1M vs. $376.8M y/y). Receivables, as a percentage of current assets, decreased from 37.54% to 26.61% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

17. SIRIUS XM Radio Inc. (SIRI): Provides satellite radio services in the United States and Canada. Net institutional shares sold during the most recent quarter at 174.3M shares (5.52% of float at 3.16B shares). Revenues increased by 13.74% during the most recent quarter ($867.36M vs. $762.55M y/y), while the size of accounts receivable changed by 7.86% ($190.74M vs. $176.84M y/y). Receivables, as a percentage of current assets, decreased from 17.12% to 10.24% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

18. Shuffle Master Inc. (SHFL): Develops, manufactures, and markets technology and entertainment-based products for the gaming industry worldwide. Net institutional shares sold during the most recent quarter at 3.1M shares (5.66% of float at 54.75M shares). Revenues increased by 8.67% during the most recent quarter ($63.39M vs. $58.33M y/y), while the size of accounts receivable changed by -2.71% ($40.17M vs. $41.29M y/y). Receivables, as a percentage of current assets, decreased from 34.69% to 33.55% during the most recent quarter (time interval comparison 3 months ending 2012-07-31 to 3 months ending 2011-07-31).

19. Lam Research Corporation (LRCX): Engages in designing, manufacturing, marketing, and servicing semiconductor processing equipment used in the fabrication of integrated circuits. Net institutional shares sold during the most recent quarter at 21.4M shares (12.55% of float at 170.51M shares). Revenues increased by 33.28% during the most recent quarter ($906.89M vs. $680.44M y/y), while the size of accounts receivable changed by 22.36% ($640.22M vs. $523.24M y/y). Receivables, as a percentage of current assets, decreased from 16.71% to 15.36% during the most recent quarter (time interval comparison 13 weeks ending 2012-09-23 to 13 weeks ending 2011-09-25).

20. Lihua International, Inc. (LIWA): Engages in the production of copper replacement cable and wire products in the People’s Republic of China. Net institutional shares sold during the most recent quarter at 715.2K shares (5.75% of float at 12.43M shares). Revenues increased by 53.49% during the most recent quarter ($238.79M vs. $155.57M y/y), while the size of accounts receivable changed by 16.32% ($59.36M vs. $51.03M y/y). Receivables, as a percentage of current assets, decreased from 29.5% to 27.82% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

21. RDA Microelectronics, Inc. (RDA): Designs, develops, and markets radio-frequency and mixed-signal semiconductors for cellular, broadcast, and connectivity applications. Net institutional shares sold during the most recent quarter at 181.6K shares (5.29% of float at 3.43M shares). Revenues increased by 30.24% during the most recent quarter ($109.31M vs. $83.93M y/y), while the size of accounts receivable changed by -25.46% ($28.23M vs. $37.87M y/y). Receivables, as a percentage of current assets, decreased from 16.22% to 10.71% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

22. Concord Medical Services Holdings Limited (CCM): Operates a network of radiotherapy and diagnostic imaging centers in the People’s Republic of China. Net institutional shares sold during the most recent quarter at 9.6M shares (60.99% of float at 15.74M shares). Revenues increased by 65.22% during the most recent quarter ($206.06M vs. $124.72M y/y), while the size of accounts receivable changed by -13.65% ($211.66M vs. $245.12M y/y). Receivables, as a percentage of current assets, decreased from 33.14% to 28.29% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

22 Stocks With Rising Receivables Smart Money Investors Are Now Dumping

Published 12/14/2012, 02:46 AM

Updated 07/09/2023, 06:31 AM

22 Stocks With Rising Receivables Smart Money Investors Are Now Dumping

Screen Criteria

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.