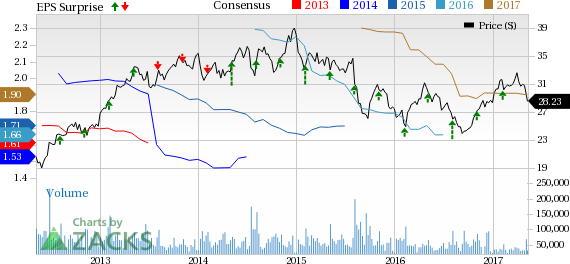

Twenty-First Century Fox, Inc. (NASDAQ:FOXA) reported better-than-expected earnings for the fourth straight quarter. The company’s third-quarter fiscal 2017 earnings from continuing operations came in at 54 cents, surpassing the Zacks Consensus Estimate of 47 cents and increased 14.9% year over year driven by robust performance of Cable Network Programming and Television.

Including one-time items, Twenty-First Century Fox’s earnings came in at 44 cents a share, flat year-over-year

Though total revenues of $7,564 million improved 4.6% year over year, it missed the Zacks Consensus Estimate of $7,681 million due to lower content revenues at the Filmed Entertainment division. The company’s top line has lagged the Zacks Consensus Estimate in the trailing eight out of nine quarters.

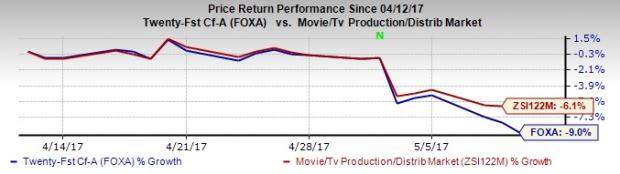

Following mixed results Twenty-first Century Fox’s shares declined 3.1% during after-hours trading session on May 10. In the past one month the stock has declined 9%, compared with the Zacks categorized Movie/TV Production/Distribution industry’s decrease of 6.1%.

Segment wise, Cable Network Programming revenues gained 2.1% to $4,024 million on the back of robust affiliate revenues growth.

Filmed Entertainment revenues were down 2.8% to $2,256 million, while Television segment net revenues were up 30.1% to $1,690 million, both on a year-over-year basis.

The company’s adjusted total segment operating income before depreciation and amortization (OIBDA) advanced 2.9% year over year to $1,938 million in this fiscal quarter. Increase in OBIDA was due to higher contribution from the Cable Network Programming and Television segments.

Detailed Discussion

OIBDA at Cable Network Programming climbed 5% to $1,446 million owing to 2.1% increase in revenues. The increase was partially overshadowed by higher entertainment programming and marketing costs at FX Networks and National Geographic Channels. Higher right costs at National Association for Stock Car Auto Racing (“NASCAR”) at FOX Sports 1 (“FS1”) and National Basketball Association (“NBA”) drove the expenses higher.

OIBDA contribution from domestic was flat year over year as higher ratings impact at Fox News and FS1 was offset by decline in revenues at the National Geographic Partners businesses.

At the domestic cable channels, affiliate revenues grew 8% driven by sustained growth across FS1, FX Networks, Fox News Channel and RSNs. Domestic advertising revenues were flat year-over-year.

OIBDA contribution from International cable channels jumped 44% due to decline in costs at STAR India coupled with robust performance of Fox Networks Group International. Affiliate revenues climbed 5% owing to growth in local currency. International advertising revenues slumped 18% primarily caused by fall in advertising revenues at STAR India. Demonetization in India also hampered the advertising market.

Filmed Entertainment’s OIBDA decreased 21% to $373 million in the quarter owing to decline in film studio contributions on account of tough year over year comparison. The prior-year period gained from the remarkable performance of Deadpool and The Martian.

Television segment’s OIBDA rose 52% to $190 million buoyed by 30% growth in revenues. The segment also benefited from increased sports advertising revenues, higher retransmission consent revenues and higher content revenues.

Other Financial Details

Twenty-First Century Fox, which shares space with The Walt Disney Company (NYSE:DIS) ended the quarter with cash and cash equivalents of $5,572 million. Total borrowings came in at $19,789 million and shareholders’ equity, excluding non-controlling interest of $1,235 million, was $15,017 million.

Other Developments

Rupert Murdoch’s Twenty-First Century Fox has made a “Possible Offer” to purchase remaining 61% stake in Europe’s leading pay-TV broadcaster Sky plc. The company already owns 39.1% stake in Sky. The buyout will strengthen the company’s position in pay-TV network in Britain, Ireland, Austria, Germany and Italy. The deal has received go-ahead from European Commission.

As of 2016, Sky already has 21 million pay-TV subscribers and 30,000 employees. The deal will strengthen Sky’s position in entertainment and sport, strengthening its adjusted earnings and free cash flow.

Zacks Rank & Other Stocks to Consider

Twenty-First Century Fox carries a Zacks Rank #3 (Hold). Better-ranked stocks include Nexstar Media Group, Inc. (NASDAQ:NXST) and Central European Media Enterprises Ltd. (NASDAQ:CETV) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past one year, Nexstar Media Group shares have increased 21%.

Shares of Central European Media Enterprises have soared 65% in the past six months.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 ""Strong Buys"" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 ""Strong Sells."" Even though this list holds many stocks that seem to be solid, it has historically performed 6X worse than the market. See these critical buys and sells free >>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Central European Media Enterprises Ltd. (CETV): Free Stock Analysis Report

Nexstar Broadcasting Group, Inc. (NXST): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post