:

All of the companies mentioned below have seen hedge fund buying during the most recent quarter (13-F filings). These companies also have rising inventory turnover ratios.

Average Weekly Returns:

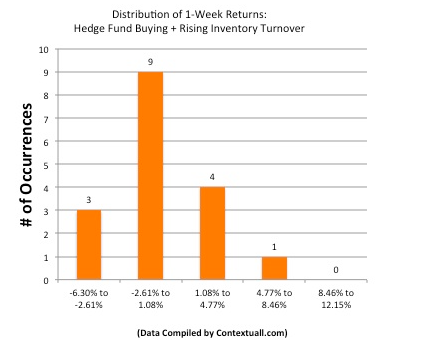

Average 1-Week Return of All Stocks Mentioned Below: 0.65%

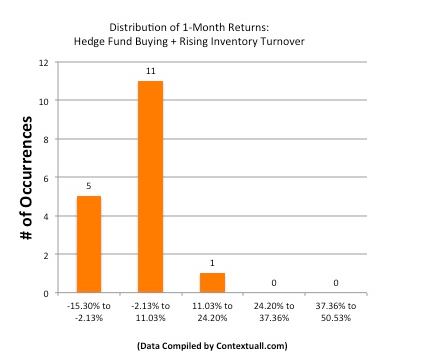

Average 1-Month Return of All Stocks Mentioned Below: 4.49%

Analysis of List Alpha:

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Week): 6 out of 18 (33.33%)

Number of Stocks in This List Generating Excess Return vs. SP500 (Beta Adjusted Over Last Month): 9 out of 18 (50.0%)

Chart: Distribution of 1-Week Returns For All Stocks Mentioned Below

Chart: Distribution of 1-Month Returns For All Stocks Mentioned Below

1. Abercrombie & Fitch Co. (ANF): Operates as a specialty retailer of casual apparel for men, women, and kids. Net institutional shares bought during the most recent quarter at 5.1M shares (6.97% of float at 73.18M shares). Revenues increased by 8.72% during the most recent quarter ($1,169.65M vs. $1,075.86M y/y), while the size of inventory changed by -21.05% ($536.32M vs. $679.34M y/y). Inventory, as a percentage of current assets, decreased from 48.8% to 46.16% during the most recent quarter (time interval comparison 13 weeks ending 2012-10-27 to 13 weeks ending 2011-10-29).

2. Headwaters Inc. (HW): Provides products, technologies, and services in the building products, construction material, and energy industries primarily in the United States and Canada. Net institutional shares bought during the most recent quarter at 3.7M shares (6.25% of float at 59.24M shares). Revenues increased by 6.64% during the most recent quarter ($190.11M vs. $178.28M y/y), while the size of inventory changed by -4.99% ($31.59M vs. $33.25M y/y). Inventory, as a percentage of current assets, decreased from 17.33% to 14.71% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

3. Western Refining Inc. (WNR): Operates as an independent crude oil refiner and marketer of refined products in Texas, Arizona, New Mexico, Utah, Colorado, and the Mid-Atlantic region. Net institutional shares bought during the most recent quarter at 3.7M shares (6.62% of float at 55.91M shares). Revenues increased by 2.05% during the most recent quarter ($2,446.32M vs. $2,397.14M y/y), while the size of inventory changed by -23.65% ($328.15M vs. $429.79M y/y). Inventory, as a percentage of current assets, decreased from 33.59% to 22.21% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

4. Medifast Inc. (MED): Engages in the production, distribution, and sale of weight management and disease management products, and other consumable health and diet products in the United States. Net institutional shares bought during the most recent quarter at 1.2M shares (9.80% of float at 12.25M shares). Revenues increased by 19.59% during the most recent quarter ($90.97M vs. $76.07M y/y), while the size of inventory changed by -5.82% ($18.28M vs. $19.41M y/y). Inventory, as a percentage of current assets, decreased from 29.85% to 20.87% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

5. Solta Medical, Inc. (SLTM): Designs, develops, manufactures, and markets energy-based medical device systems for aesthetic applications. Net institutional shares bought during the most recent quarter at 6.3M shares (31.02% of float at 20.31M shares). Revenues increased by 27.80% during the most recent quarter ($35.03M vs. $27.41M y/y), while the size of inventory changed by 9.23% ($16.45M vs. $15.06M y/y). Inventory, as a percentage of current assets, decreased from 20.88% to 20.69% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

6. Conns Inc. (CONN): Operates as a specialty retailer of home appliances, consumer electronics, home office equipment, lawn and garden products, mattresses, and furniture in the United States. Net institutional shares bought during the most recent quarter at 2.9M shares (11.93% of float at 24.30M shares). Revenues increased by 10.60% during the most recent quarter ($206.4M vs. $186.62M y/y), while the size of inventory changed by -20.22% ($77.15M vs. $96.7M y/y). Inventory, as a percentage of current assets, decreased from 20.52% to 15.69% during the most recent quarter (time interval comparison 3 months ending 2012-10-31 to 3 months ending 2011-10-31).

7. Dorman Products, Inc. (DORM): Dorman Products, Inc. supplies original equipment dealer automotive replacement parts, and fasteners and service line products primarily for the automotive aftermarket. Net institutional shares bought during the most recent quarter at 965.2K shares (5.85% of float at 16.51M shares). Revenues increased by 19.78% during the most recent quarter ($156.41M vs. $130.58M y/y), while the size of inventory changed by 4.11% ($134.3M vs. $129M y/y). Inventory, as a percentage of current assets, decreased from 44.11% to 36.97% during the most recent quarter (time interval comparison 13 weeks ending 2012-09-29 to 13 weeks ending 2011-09-24).

8. American Eagle Outfitters, Inc. (AEO): Operates as an apparel and accessories retailer in the United States and Canada. Net institutional shares bought during the most recent quarter at 16.0M shares (9.36% of float at 170.90M shares). Revenues increased by 11.10% during the most recent quarter ($910.37M vs. $819.42M y/y), while the size of inventory changed by -13.28% ($481.21M vs. $554.9M y/y). Inventory, as a percentage of current assets, decreased from 46.02% to 40.17% during the most recent quarter (time interval comparison 13 weeks ending 2012-10-27 to 13 weeks ending 2011-10-29).

9. American Vanguard Corp. (AVD): Engages in the manufacture, development, and marketing of specialty chemical products for agricultural and commercial uses in the United States and internationally. Net institutional shares bought during the most recent quarter at 1.5M shares (6.28% of float at 23.90M shares). Revenues increased by 23.01% during the most recent quarter ($90.76M vs. $73.78M y/y), while the size of inventory changed by 14.84% ($92.81M vs. $80.82M y/y). Inventory, as a percentage of current assets, decreased from 43.85% to 40.22% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

10. ViaSat Inc. (VSAT): Engages in the design, production, and marketing of satellite and other wireless communication, and networking systems for government and commercial customers. Net institutional shares bought during the most recent quarter at 1.5M shares (5.14% of float at 29.18M shares). Revenues increased by 26.81% during the most recent quarter ($282.82M vs. $223.02M y/y), while the size of inventory changed by 8.62% ($132.89M vs. $122.34M y/y). Inventory, as a percentage of current assets, decreased from 29.15% to 23.92% during the most recent quarter (time interval comparison 3 months ending 2012-09-28 to 3 months ending 2011-09-30).

11. USANA Health Sciences Inc. (USNA): Develops, manufactures, distributes, and sells nutritional and personal care products worldwide. Net institutional shares bought during the most recent quarter at 1.4M shares (21.94% of float at 6.38M shares). Revenues increased by 15.11% during the most recent quarter ($165.18M vs. $143.5M y/y), while the size of inventory changed by -8.01% ($33.3M vs. $36.2M y/y). Inventory, as a percentage of current assets, decreased from 40.23% to 24.02% during the most recent quarter (time interval comparison 3 months ending 2012-09-29 to 3 months ending 2011-10-01).

12. Calumet Specialty Products Partners LP (CLMT): Produces and sells specialty hydrocarbon products in North America. Net institutional shares bought during the most recent quarter at 2.3M shares (6.07% of float at 37.87M shares). Revenues increased by 51.69% during the most recent quarter ($1,179.82M vs. $777.78M y/y), while the size of inventory changed by 10.66% ($494.11M vs. $446.51M y/y). Inventory, as a percentage of current assets, decreased from 65.03% to 51.31% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

13. Vascular Solutions Inc. (VASC): Develops solutions to interventional cardiologists and interventional radiologists worldwide. Net institutional shares bought during the most recent quarter at 1.0M shares (7.0% of float at 14.28M shares). Revenues increased by 1.03% during the most recent quarter ($24.55M vs. $24.3M y/y), while the size of inventory changed by -9.01% ($13.74M vs. $15.1M y/y). Inventory, as a percentage of current assets, decreased from 28.99% to 28.07% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

14. Health Management Associates Inc. (HMA): Engages in the operation of general acute care hospitals and other health care facilities in non-urban communities in the United States. Net institutional shares bought during the most recent quarter at 13.1M shares (6.29% of float at 208.29M shares). Revenues increased by 18.08% during the most recent quarter ($1,440.11M vs. $1,219.62M y/y), while the size of inventory changed by 2.08% ($218.97M vs. $214.5M y/y). Inventory, as a percentage of current assets, decreased from 17.39% to 15.37% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

15. NGL Energy Partners LP (NGL): Operates as a vertically-integrated energy business. Net institutional shares bought during the most recent quarter at 4.0M shares (16.43% of float at 24.35M shares). Revenues increased by 440.62% during the most recent quarter ($1,135.51M vs. $210.04M y/y), while the size of inventory changed by 146.61% ($264.56M vs. $107.28M y/y). Inventory, as a percentage of current assets, decreased from 61.61% to 35.93% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

16. Kimball International, Inc. (KBALB): Kimball International, Inc. manufactures and sells electronic assemblies and furniture in the United States and internationally. Net institutional shares bought during the most recent quarter at 2.4M shares (8.36% of float at 28.70M shares). Revenues increased by 6.49% during the most recent quarter ($288.19M vs. $270.63M y/y), while the size of inventory changed by -9.65% ($125.93M vs. $139.38M y/y). Inventory, as a percentage of current assets, decreased from 37.6% to 32.48% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

17. Cynosure, Inc. (CYNO): Develops, manufactures, and markets aesthetic treatment systems to the dermatology, plastic surgery, and general medical markets. Net institutional shares bought during the most recent quarter at 861.4K shares (7.45% of float at 11.56M shares). Revenues increased by 31.12% during the most recent quarter ($37.08M vs. $28.28M y/y), while the size of inventory changed by 15.60% ($34.3M vs. $29.67M y/y). Inventory, as a percentage of current assets, decreased from 26.45% to 25.67% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

18. magicJack VocalTec Ltd. (CALL): Net institutional shares bought during the most recent quarter at 815.1K shares (9.98% of float at 8.17M shares). Revenues increased by 63.75% during the most recent quarter ($40.79M vs. $24.91M y/y), while the size of inventory changed by -17.49% ($6.65M vs. $8.06M y/y). Inventory, as a percentage of current assets, decreased from 12.88% to 11.39% during the most recent quarter (time interval comparison 3 months ending 2012-09-30 to 3 months ending 2011-09-30).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

18 Stocks With Rising Inventory Turnover Ratios

Published 12/13/2012, 01:20 AM

Updated 07/09/2023, 06:31 AM

18 Stocks With Rising Inventory Turnover Ratios

Screen Criteria

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.