In this year’s write-up, I will review my 10-predictions for 2022. Anything can happen, but this exercise has a point. It helps me lay out a game plan and thought process for the path that may lie ahead this coming year.

10. Year Of Transition

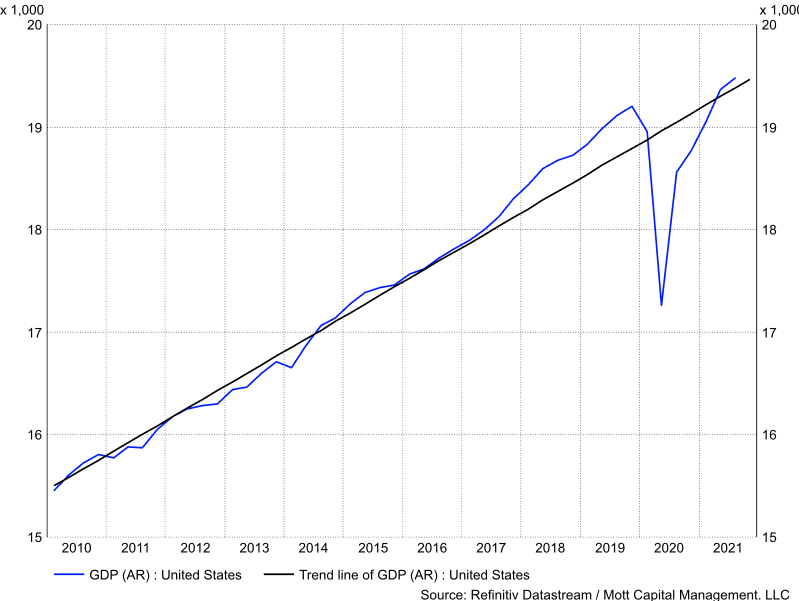

2022 will be a year of transition from the fast-paced return to growth in 2021 to trend growth in 2022, which means that growth rates in 2022 will be much slower than in 2021. In fact, with growth in 2021 coming in very strong through the end of the third quarter, GDP was above trend. Now without the support of a fiscal policy from the Federal government and the Fed turning more hawkish, it seems likely that growth in 2022 will come in slower than the 3.9% projected growth rate of a recent Reuters poll.

9. Slower Global Growth

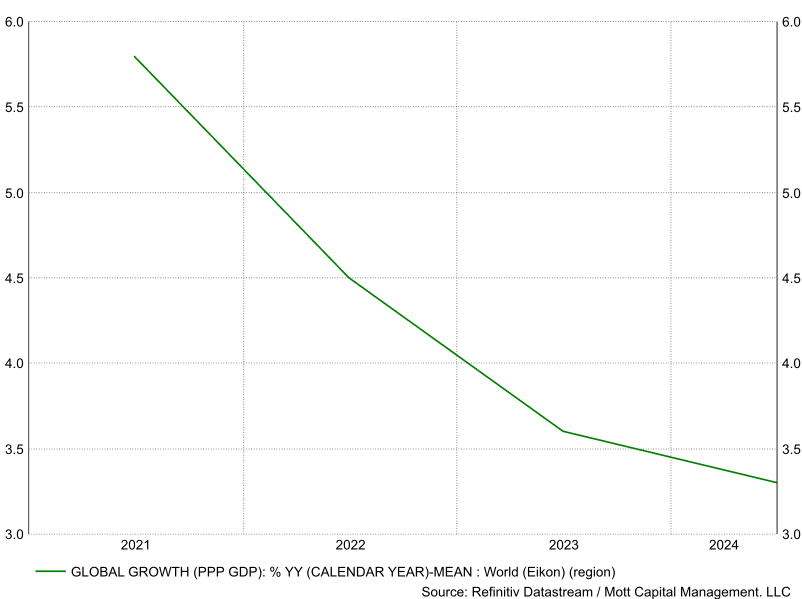

Slower than expected GDP growth in the US coupled with an economic slowdown in China is likely to weigh on global growth, which is forecast to see its growth rate fall to 4.5% from 5.9% in 2021.

8. Inflation Will Cool

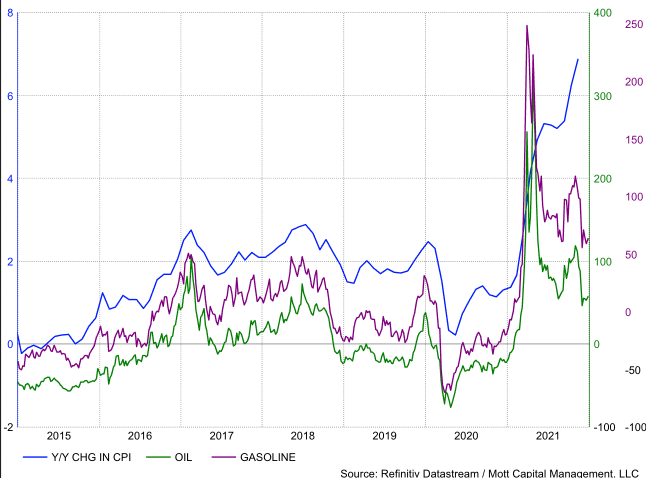

Inflation will begin to show signs of cooling as soon as the December CPI report in the middle of January, as oil and gasoline prices have fallen sharply since peaking in early November. Additionally, inflation rates will continue to moderate throughout 2022 as base effects wear off and supply chain issues ease.

7. Rising Rates Will Help The Dollar

Rising short-term rates and Fed Fund futures will help to strengthen the dollar, with the Dollar Index pushing higher to around 97.75. The stronger dollar, will help to put more downward pressure on inflation rates.

6. Stronger Dollar Will Cap Oil Prices

A strong dollar will cap oil prices, keep the commodity in check, along with increasing supply, will push oil down to around $54.

5. Yield Curve Will Flatten Dramatically

With inflation rates showing signs of cooling, and expectations for the Fed to begin the monetary tightening process, the 2-year yields will rise and approach 1%, while the 10-year yield remains around 1.5%. It will cause the yield curve to flatten dramatically, resulting in the spread between the 10-2 falling to approximately 50 bps. However, this will reverse by year-end, and the curve will begin to re-steepen and head back above 1%.

4. Flattening Curve Could Weigh On Reflation Sectors

The flattening yield curve will weigh heavily on the reflation sectors of the equity market. Specifically, bank stocks will suffer the most as concerns over slower growth lead to weaker loan growth and weak net interest income.

3. Fed Will Remain Committed To Fighting Inflation

Despite the falling inflation rates, the Fed will remain committed to fighting inflation. The stock market has given the Fed the green light to end the taper, which will likely lead everyone to believe that the Fed will raise rates in March. However, the equity market seeing inflation rates easing and growth slowing, will worry that global demand is slipping, resulting in a 2018 style meltdown. It will cause the Fed to pause the rate hiking process and hold off on its first rate hike until December of 2022.

2. Growth Stocks Will Struggle

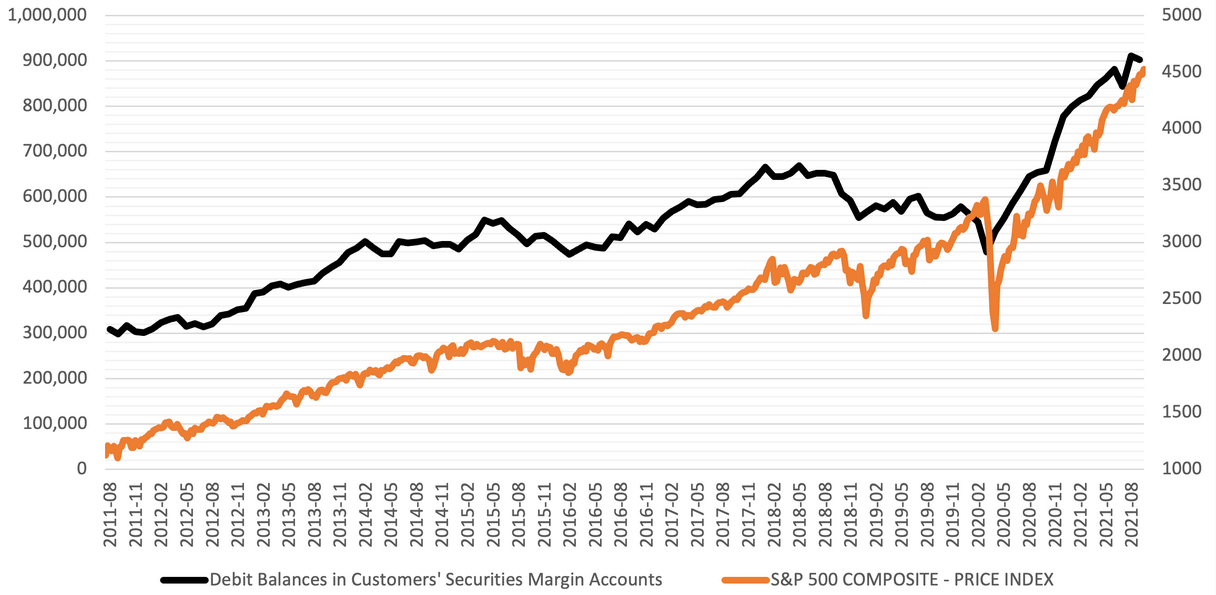

Even with rate hikes put off until December, growth stocks will struggle in 2022. QE will have ended, and those ultra-easy financial conditions that have already turned tighter will make it harder for investors to access that leverage that helped fuel the epic equity market move higher off the March 2020 lows.

1. Worst Year For S&P 500 Since 2008

The S&P 500 will struggle all year; with signs of slowing growth and QE no longer supporting the equity market, earnings multiples will compress, falling from their historically high levels of around 21.5 to a historical average of about 17. It will result in the S&P 500 having one of its worst years since 2008, trading down to 3,800, a drop of almost 21%.

Have a happy and healthy new year!