- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is the European financial market Americanized yet?

Eight of the world’s 10 biggest companies (by market cap) are American, that’s why it’s not a surprise that big-name investors prefer U.S. stocks over their international counterparts.

This begs the question: Has the European financial market been Americanized?

To get the complete picture, Investing.com joined forces with SEMrush, an online visibility management and content marketing platform, to analyze whether European investors favor American stocks over their local equivalents. By combining our data of the most popular stocks in each country, with SEMrush’s data on keyword popularity, we’ve mapped the European investor's preference, by country.

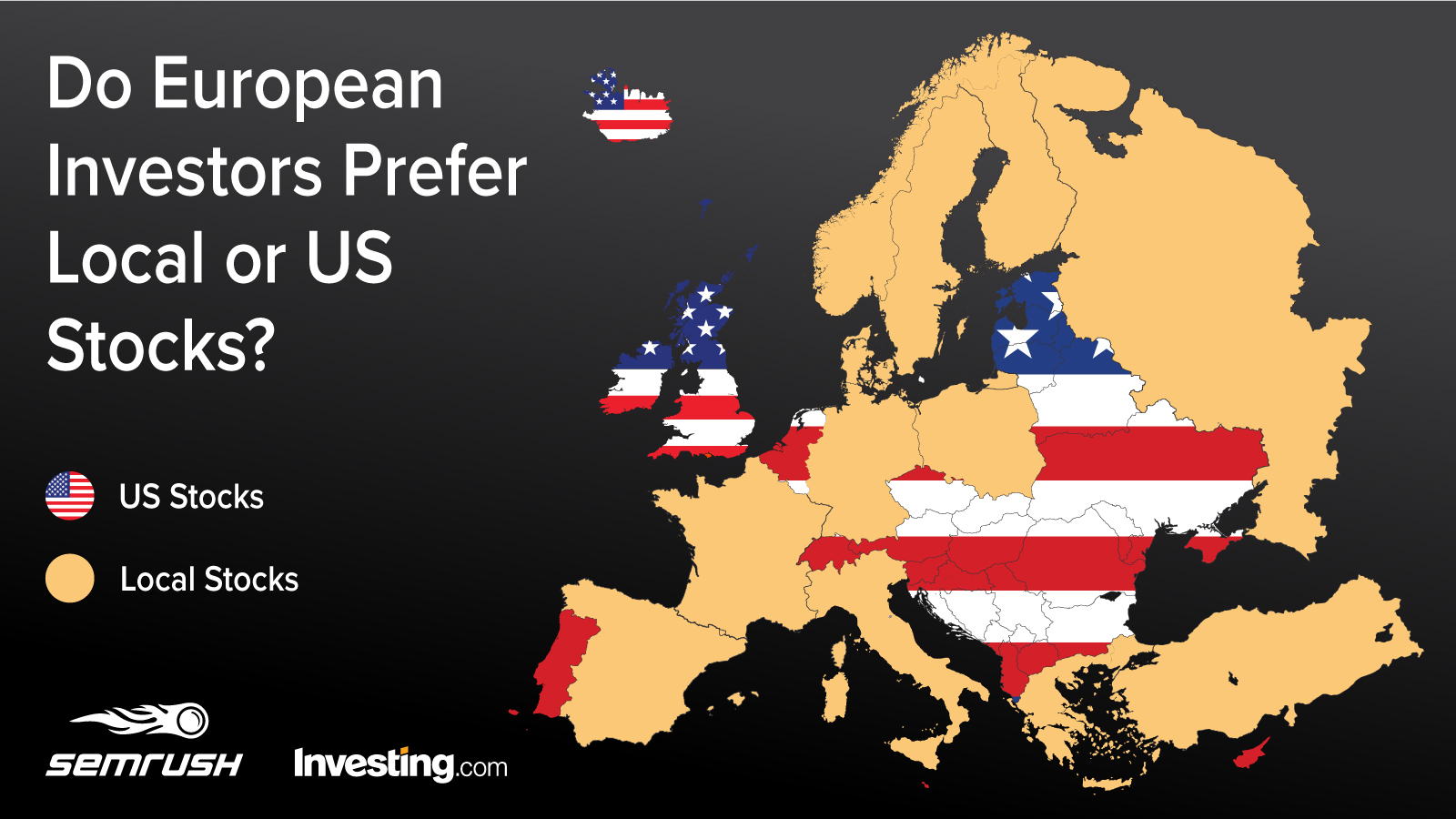

The results reveal that investors in smaller European countries generally favor American stocks, those in larger nations with more established local financial markets prefer to invest domestically.

The full breakdown is as follows:

Investors favor local stocks—Russia, Germany, Spain, Italy, France, Greece, Sweden, Norway, Finland, Denmark, Poland, Turkey

Investors favor U.S. stocks—United Kingdom, Switzerland, Netherlands, Austria, Portugal, Belgium

And also — Hungary, Macedonia, Ukraine, Romania, Belarus, Bulgaria, Iceland, Czech Republic, Serbia, Ireland, Lithuania, Latvia, Croatia, Estonia, Albania, Kosovo, Cyprus, Malta, Monaco, Slovakia, Liechtenstein, Moldova, Bosnia and Herzegovina, Montenegro, Slovenia.

“It makes sense for traders in a country like Germany - a true European powerhouse - to take up the most interest in their own local “homegrown” companies like Volkswagen, Bayer, and Deutsche Bank,” states Jesse Cohen, U.S. Markets Analyst at Investing.com. “[The] same goes for France, Italy, Russia, and Spain, respectively Europe’s third, fourth, fifth, and sixth largest economies. On the flip side, investing in U.S. stocks that are traded on Wall Street has become much easier in terms of accessibility thanks to trading apps and online brokers, a development which may have led to a spike in interest in U.S.-based stocks, specifically in Eastern European countries, such as Croatia, Serbia, and Albania.”

Yet the elephant in the room is the UK, as investors in Europe’s second largest economy buck the trend in our analysis through their preference for American stocks over local investments.

“There are two things at play here,” says Clement Thibault, Senior Analyst at Investing.com. “First, culturally, the UK and the U.S. have historically been more similar than the U.S. and the rest of Europe. While many European investors may be too proud to look for more attractive returns on the other side of the pond. Second, Brexit uncertainty is definitely a big factor here, and UK investors being more interested in U.S. stocks does point to a lack of confidence and fear of uncertainty regarding the future of the UK's economy.”

To gain further insight, Investing.com also asked its experts throughout Europe to weigh in and help explain these trends uncovered in the data.

This is what they had to say…

Robert Zach, Investing.com’s German correspondent:

“Germans prefer investing in local stocks because they've grown up with so many big-name brands, such as Commerzbank, Deutsche Bank, Daimler, and Volkswagen, and there’s a trust and familiarity that’s been created.”

Sara Busquets, Investing.com’s Spanish correspondent:

“The Spanish market has proven to be safe and reliable, so investors prefer companies that they already know, such as Banco Santander or Telefonica. We do have big names here, so they don’t feel the need to buy abroad.”

Sweden, Norway, Denmark, and Finland are the other outliers in our analysis, with investors from each country favoring local stocks, despite not being European powerhouses. Is there something in the air in Scandinavia that’s keeping local investors interested in the home front?

"With relatively high income equality, large, tax-financed welfare programs, powerful unions, good education systems and relatively low unemployment rates, the benefits of living in Scandinavia have long been touted," said Thibault. "In fact, according to the 2018 World Happiness Report, four out of the top five happiest countries in the world are from the region. With all things considered, it’s no surprise to see Scandinavian investors preferring to look inward."

So, to revisit the initial question, is the European financial market Americanized yet?

Yes, over 70% of the countries in Europe are indeed choosing to invest in the American market rather than locally. However, the biggest economies in Europe are still happy investing domestically and haven’t quite jumped aboard Uncle Sam’s ship, at least not yet.

Do European Investors Prefer Local or US Stocks?

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.