- Stocks fell on Friday after reports that Iran was about to launch an attack on Israel.

- Despite this, bullish sentiment among investors is above historical averages, suggesting optimism despite geopolitical tensions.

- So in this piece, we'll take a look at 3 multi-bagger stocks that you can consider for your portfolio.

- Want to invest while knowing how to navigate the risks of the market? Try InvestingPro! Subscribe HERE for less than $10 per month and get almost 40% off for a limited time on your 1-year plan!

- 1. Modine Manufacturing

- Franklin Resources (NYSE:BEN) 4.2 years

- Biogen (NASDAQ:BIIB) 5.5 years

- Time Warner (NYSE:TWX) 6 years

- Dell (NYSE:DELL) 7.2 years

- Qualcomm (NASDAQ:QCOM) 7.3 years

- Cisco (NASDAQ:CSCO) 7.3 years

- 2. Monster Beverage

- 3. SoundHound AI

- Nikkei Japanese 18.11%

- FTSE MIB 11.24%

- Euro Stoxx 50 9,59%

- Nasdaq 8,10%

- S&P 500 7.91%

- Dax German 7.04%

- Cac French 6.20%

- Ibex 35 Spanish 5.78%

- FTSE 100 British 3.39%

- Dow Jones 1,09%

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

- Act fast and join the investment revolution - get your OFFER HERE!

Reports of Israel preparing for an imminent attack by Iran sent shockwaves through the market on Friday, causing stocks to plummet while gold, oil, and bonds surged.

The market's reaction to this looming threat hinges on several factors, including the attack's severity, duration, Israel's response, and U.S. support. The combination of these factors suggests that bears could be getting ready to take over now.

Defense stocks tend to perform well in such situations. You can consider investing in them through ETFs like the iShares U.S. Aerospace & Defense ETF (NYSE:ITA), S&P Aerospace & Defense ETF (NYSE:XAR), and Invesco Aerospace & Defense ETF (NYSE:PPA).

Meanwhile, companies are also preparing to unveil financial results as earnings season kicks off in the US. Utilities (NYSE:XLU) are poised to lead in terms of earnings growth, followed closely by information technology stocks.

Conversely, the energy sector (NYSE:XLE) could face challenges, likely emerging as the weakest performer. Overall, S&P 500 companies are projected report an approximately 11% increase in earnings for the year 2024.

As these companies prepare to announce their earnings, let's examine a few stocks that have already increased by 10 and 100 times in value and one that could do so in the coming years.

3 Multi-Bagger Stocks to Consider:

While stocks like Nvidia (NASDAQ:NVDA) and Super Micro (NASDAQ:SMCI) are grabbing headlines with their impressive rallies, there's another company quietly making waves that deserves attention:

Modine Manufacturing Company (NYSE:MOD) was established in 1916 and is based in Racine, Wisconsin. Specializing in thermal management systems and components, Modine designs and manufactures cooling systems.

What sets this company apart is its role in the artificial intelligence (AI) sector. With AI servers generating significant heat, Modine's cooling systems play a crucial role in preventing overheating.

On May 22, Modine will report its financial results, with expectations of a 13.68% increase in earnings per share (EPS). Keep an eye on this under-the-radar stock as it continues to make strides in the AI industry.

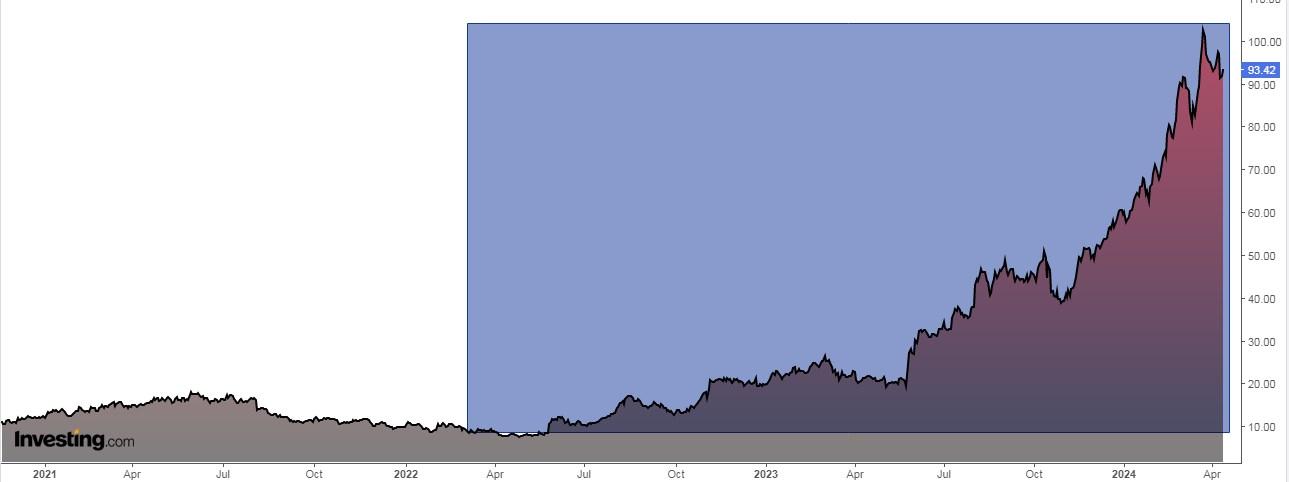

In the last 12 months, its shares have surged by 336%, and over the past 3 months, they've seen a notable increase of 45.40%.

Since hitting lows in 2022, its shares have skyrocketed by 10 times, marking an impressive 1081% increase, significantly outperforming the S&P 500, which saw a mere 27.7% rise during the same period.

This achievement propels it into the exclusive "10-bagger" category, a term coined by Peter Lynch to describe stocks that multiply their price by 10.

But that's not all. What truly captivates investors is the prospect of the elusive "100-bagger" group, comprising stocks that surge to unimaginable heights by multiplying their price by 100.

Below, you'll find a list of stocks that have accomplished this remarkable feat in record time:

There is one company that deserves to be commented on separately:

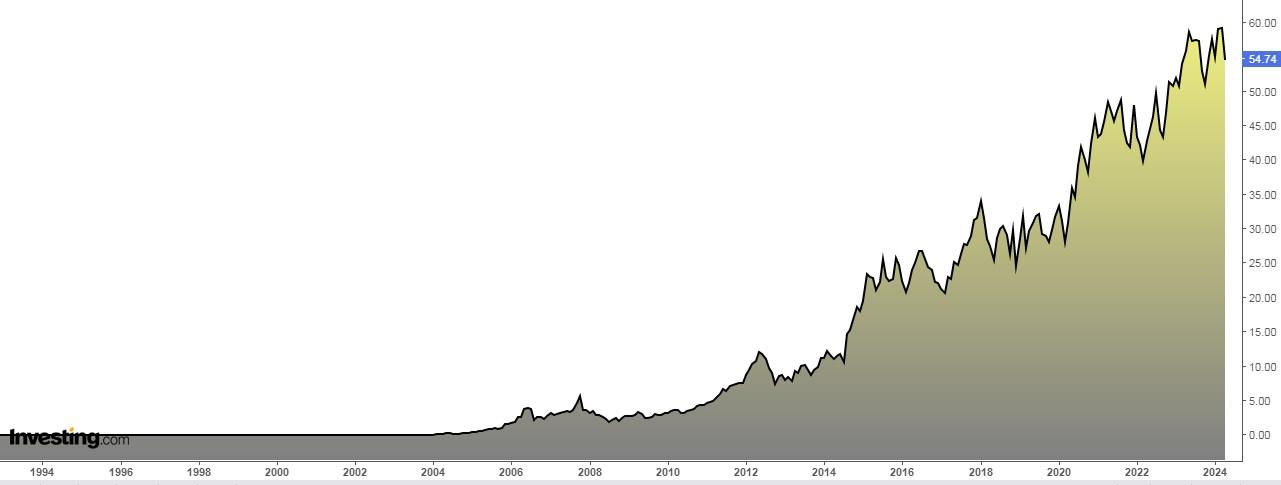

Monster Beverage Corp (NASDAQ:MNST) took less than 10 years to multiply its share price by 100.

And yes, the energy drink maker is the best-performing U.S. stock of the 2000s, in fact over the past 20 years, it is up 47,327%.

Schwab investors have been buying shares of Nvidia, Apple (NASDAQ:AAPL), Advanced Micro Devices (NASDAQ:AMD) and Palo Alto Networks (NASDAQ:PANW).

But I would like to highlight one company: SoundHound AI (NASDAQ:SOUN).

It was formed in 2005 and develops voice-based systems to provide high-quality spoken responses to customers and employees.

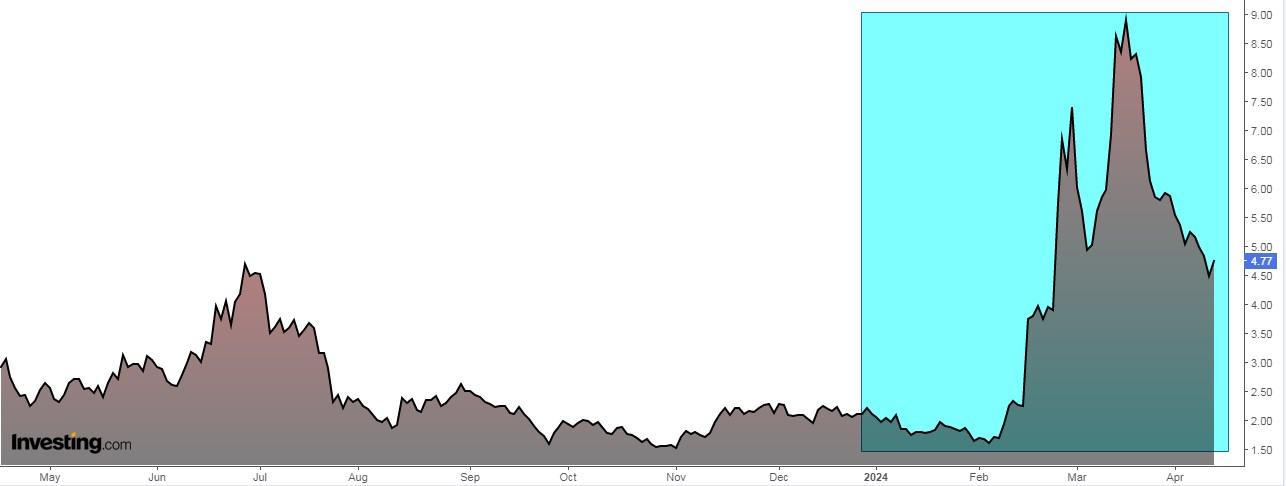

It has a significant revenue growth of 47.36% in the last twelve months, with quarterly revenue growth of 80.48% in Q4 2023, indicating a strong upward trend in sales, in fact by 2024 a 51.5% increase is expected.

It has a market value of $1.6 billion and its shares are up 69.15% over the last 12 months, with its performance over the last 3 months (162.10%) being more impressive.

The market sees potential at $7-7.15, although this may be a bit of a stretch.

Ranking of the main stock exchanges in 2024

So goes the ranking of the world's major stock exchanges so far in 2024:

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months, is at 43.4%, above its historical average of 37.5%.

Bearish sentiment, i.e., expectations that stock prices will fall over the next six months, is at 24%, below its historical average of 31%.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

Use the code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than what a Netflix (NASDAQ:NFLX) subscription costs you! (And you get more out of your investments too). With it you'll get:

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.