Telix Pharmaceuticals Ltd (ASX:TLX) is making progress on all fronts and recently announced that it has reached an agreement with the Japanese Pharmaceutical and Medical Device Agency (PMDA) to perform a 40-patient bridging study in Japan to support the approval of TLX250-CDx for the detection of renal cancer. Additionally, the company announced the details of its meeting with the FDA to discuss the NDA submission for illumet (TLX591-CDx), which appears to be near completion and may be submitted shortly.

Renal cancer significant in Japan

Rates of renal cancer in Japan are lower on an age-adjusted basis (7.2 per 100,000 vs 10.9 in the US), but this difference goes away when considering the ageing Japanese population (18.9 per 100,000 crude rate). It is therefore an attractive market for TLX250-CDx and other cancer diagnostics. GLOBOCAN 2018 estimates c 25,000 new patients will be diagnosed with the disease in Japan in 2020. We forecast that the product will achieve similar market share (20%) in Japan and have similar pricing (US$2,450) to our estimates for the product in Europe, which correlates to peak sales of US$6m.

Illumet NDA a go

The company released a summary of the minutes from its July 2019 meeting with the FDA to discuss the upcoming NDA submission for illumet. The FDA agreed that the company could use historical data gathered on the molecule to support a 505(b)2 application. This is important because it does not require the company to perform any additional burdensome trials. The FDA did have additional safety and efficacy data requests, but the company stated that these were already within the scope of its ongoing activities and that it will be submitting an NDA shortly.

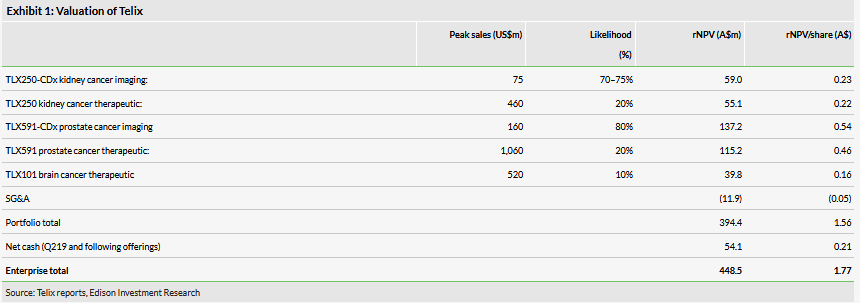

Valuation: A$448m or A$1.77 per basic share

We have increased our valuation to A$448m from A$443m, although it has remained steady on a per share basis (A$1.77 from A$1.78). The increase is driven by the addition of Japan to our model for TLX250-CDx, which increases the valuation by approximately A$6m. Additionally, we have rolled forward our NPVs, and the increase is offset by lower estimated net cash (A$54m) and the increase in shares (253m).

Business description

Telix Pharmaceuticals is a Melbourne-headquartered global biopharmaceutical company focused on the development of diagnostic and therapeutic products based on targeted radiopharmaceuticals or molecularly targeted radiation.

Renal cancer in Japan

The company announced on 30 August 2019 that it had formulated plans to initiate a clinical study of TLX250-CDx in Japan for renal cancer imaging. The imaging agent is currently already in the clinic in the pivotal Phase III ZIRCON study, which will be used to support approval for renal cancer imaging in the US and Europe. The company stated in the new announcement that it reached an agreement with the PMDA on the design of a bridging study in Japan with a planned enrolment of 40 patients to support an approval package that includes the ZIRCON data. Such bridging studies in Japan are a common requirement for companies that generate the majority of their clinical data outside of the country. The company stated that it plans to initiate the study within 60 days following the announcement, and that it should take six to nine months to complete.

The age-adjusted incidence rates for renal cancer are slightly lower in Japan than in the west: 7.2 per 100,000 vs 10.9 in the US and 8–12 in Western Europe.1 However, this difference is lost in the crude rate of the disease given the ageing population in Japan: 18.9 per 100,000 and similar in the US and Europe. GLOBOCAN 2018 estimates approximately 25,000 new cases of renal cancer in Japan in 2020, approximately a quarter of those expected in Europe in the same period.

FDA meeting on illumet: NDA submission upcoming

The company also recently announced in August 2019 the results from its meeting with the FDA to discuss the clinical development plan for its prostate cancer diagnostic illumet (TLX591-CDx). The meeting was held on 24 July and was regarding the upcoming submission of an NDA for the drug. Importantly, the FDA agreed that the drug could seek approval under the 505(b)2 pathway, which allows the company to use data that it did not gather to support the application. This is important because the product has been widely studied in the literature in over 10,000 patients, which the FDA said could be used in the application. There are other agreed safety and efficacy data requirements that were discussed, but the company simply stated that these were ‘consistent with Telix’s existing and ongoing clinical data capture activity.’ The company stated that it is filing an amendment to its drug master file (DMF) to include its US manufacturer, and will file the NDA shortly thereafter, and given this timeline, we assume that any outstanding requests by the agency are minor.

Valuation

We have increased our valuation to A$448m from A$443m, although it has remained steady on a per share basis (A$1.77 from A$1.78). The increase is driven by the addition of Japan to our model for TLX250-CDx, which carries a valuation of approximately A$6m. Our assumptions for the region are similar to other geographies. We assume the product will be reimbursed similarly in Japan to Europe (at US$2,450 per test). We assume similar peak penetration (20%) and royalty rates (30%) as other geographies.

Our probability of success for Japan is 70%, as opposed to 75% in the US and Europe. We assume that the results from the ZIRCON study will be the main driver of approval and assume a 75% chance of success for this, and include a small risk for the bridging study, bringing the total risk adjustment for the Japanese program to 70%. Additionally, our valuation is lifted by rolling forward our NPVs and is offset by lower estimated net cash (A$54m from A$58m following the most recent financial report) and an increase in shares (253m from 249m).

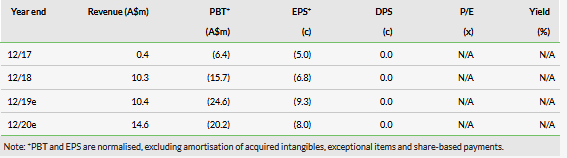

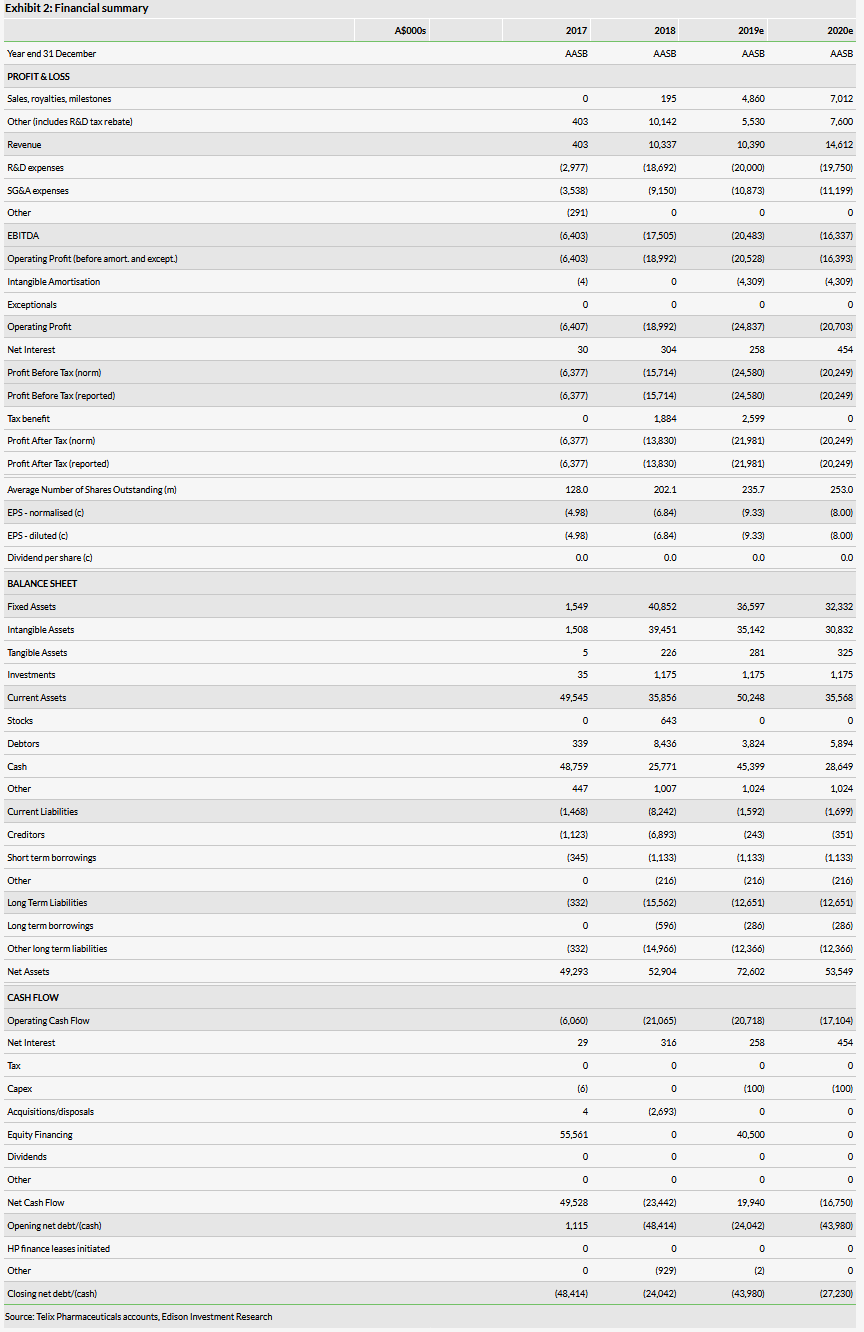

Financials

We have updated our model for the Q219 financials, which includes accounting adjustments for R&D rebates among other details, but has a minimal cash impact on 2019 estimates, and otherwise our forecasts remain unchanged. Subsequent to the end of the period, the company raised A$40m through a direct offering and A$5m through the company’s share purchase plan, resulting in an estimated net cash of A$54m. We expect this to be sufficient for the company to reach profitability in 2022, and do not expect the company to need additional capital.