I’ll preface this by saying that, philosophically, I’m a fan of precious metals. I’d love to see them thrive and prosper. They are, as many have pointed out, the only real insurance against the insanity of central bankers.

However, metals have been in a bear market since September of 2011 (and how many assets can you say that about? Not many). I have made some posts lately suggesting that maybe – just maybe – they are starting to find firm ground. On Friday morning, yet again, the floor was knocked out from beneath gold, plunging to levels last seen in the depths of the financial crisis. That's the equivalent of seeing a quote of 700 on the S&P 500. It’s a big deal.

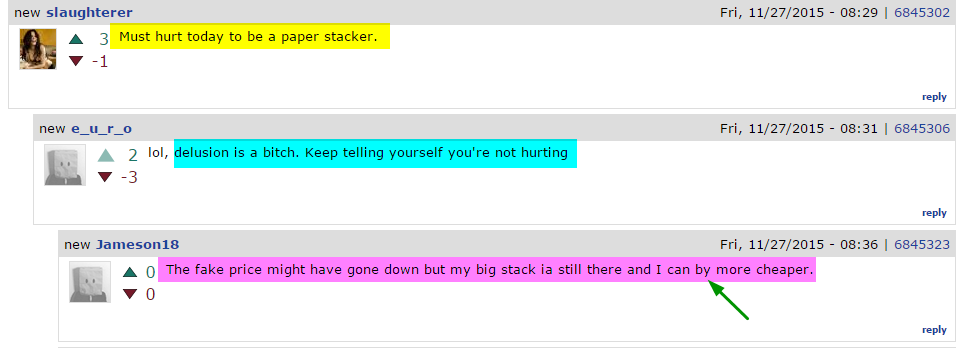

In spite of this, our kook friends are relying on that old psychological standby: that those “stacking” actual metal have nothing to worry about because the “paper” market doesn’t reflect reality. That, indeed, the market is being manipulated by malicious sellers (just to pull a page from the Chinese script). To wit, here are some comments from Friday morning’s ZH post about gold’s tumble:

I’ve pointed this out before, but the fact that one’s “stack” hasn’t changed physical size due to market forces (which would actually be kind of cool, let’s face it) doesn’t mean its value has not, in fact, diminished. That would be the equivalent of some poor soul waving his Zynga (O:ZNGA) share certificate that he bought a few years ago saying that since it is still 8 1/2 by 11 inches, it hadn’t really changed. It has.

The market reflects reality and the “stackers-versus-paper” dichotomy isn’t just wrong, but is actually kind of pathetic.