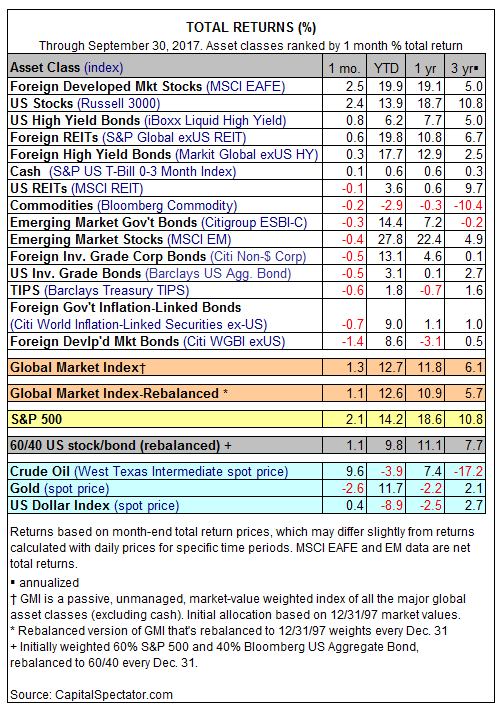

Stock markets in the developed world delivered the leading performances for the major asset classes in September. The rest of the field posted a mix of modest gains and losses last month. The biggest setback unfolded in foreign government bonds in developed markets.

Developed-world foreign equities, by contrast, posted the strongest run for the major asset classes in the closing month of the third quarter. The MSCI EAFE Index bounced back in September with a strong 2.5% gain after posting a fractional loss in the previous month. The US stock market was a close second-place performer: the Russell 3000 Index gained 2.4% last month, which marks the benchmark’s 11th consecutive monthly advance.

Foreign government bonds in developed markets suffered the biggest monthly loss in September. Citi World Government Bond Index ex-US fell 1.4% last month, the deepest decline in ten months.

Despite the headwinds, the Global Market Index (GMI) posted its tenth straight monthly gain in September. GMI, an unmanaged benchmark that holds all the major asset classes in market-value weights, advanced a solid 1.3% last month. Year to date, the index is higher by an impressive 12.7%.