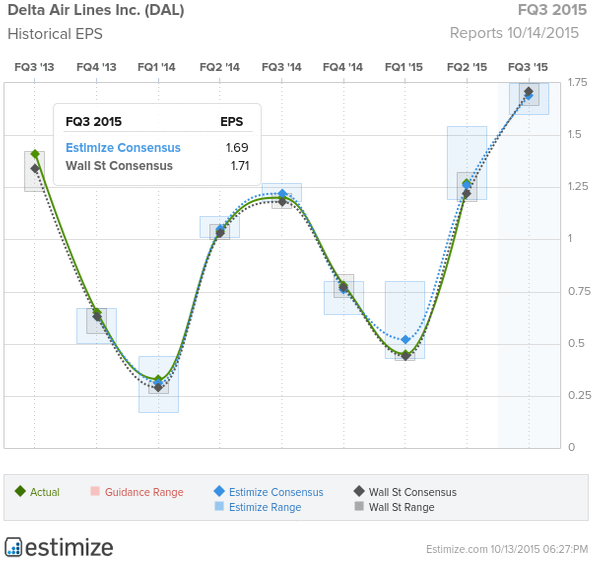

Delta Air Lines (N:DAL), the #3 U.S. airline in terms of traffic, has been outcompeting its rivals for the last several years. However for Q3 the Estimize community is expecting EPS to be lower than the Wall Street consensus. The Estimize consensus is anticipating EPS of $1.69 and revenue of $11.13 billion while Wall Street is expecting higher earnings and revenue of $1.71 and $11.12 billion, respectively.

Oil Prices

The airlines are no doubt benefiting from weak oil prices. For a large airline company like, Delta, fuel tends to be the second largest operating cost behind labor. The company projects the average price of fuel per gallon to be $1.80 to $1.85. Last year, prices were hovering around $2.90. However, oil prices are making a comeback, having surged 25% in the past month.

The Unit Revenue Conundrum

For Delta and all other major airlines, the PRASM (passenger revenue per available seat mile) metric is critical. This unit revenue measures how much money an airline earns per mile flown by a passenger. According to company guidance, Delta is expecting a loss in this category of 4.5-5.5% for this quarter. Though better than the initial 6% loss prediction, the Atlanta based commercial airliner is positive that numbers will increase every quarter. Be on the lookout for any growth this December.

Industry Overview

The first half of 2015 was not great for the airline industry as a whole. Even though oil prices were low, currency headwinds ultimately offset any gains. Additionally, ticket prices and airfares have been falling as the major airlines have been sparring for customer loyalty.