Despite macroeconomic headwinds, in its closing update Focusrite (LON:TUNE) has confirmed consensus beating FY19 revenue (c £84m vs our forecast £79.8m) and EBITDA, reflecting the success of its global growth strategy and strength of the brands. The launch of the third-generation Scarlett product ranges in July has been well received, with further significant releases anticipated in H1 FY20. After including the recent £16.2m acquisition of ADAM Audio, net cash stood at £14.9m (FY18: £22.8m). We raise our FY19 and FY20 PBT forecasts by 4% and 3% respectively.

A strong finish to the year

Focusrite has released an upbeat closing update for FY19 confirming revenue of c £84m, ahead of market expectations (Edison FY19e: £79.8m). This includes growth of c 10% (6% CCY) in the existing business plus six weeks of revenue for the recently acquired ADAM Audio studio monitor business. EBITDA is also expected to be ahead of market expectations (Edison FY19E: £16.3m) with margins having remained broadly consistent with the prior year. Robust cash generation resulted in net cash of £14.9m at 21 August, after taking into account the £16.2m acquisition of ADAM in July (FY18: £22.8m).

A healthy pipeline of significant new product releases

The results are testament to the success of Focusrite’s global growth strategy, despite macroeconomic headwinds, and the strength of the core brands. The third-generation Scarlett range of products was released in July and has been well received. Scarlett accounts for c 75% of Focusrite’s divisional revenue and is particularly popular in the US. Product development and innovation remain at the heart of the business, with further significant releases anticipated in H1 FY20.

Forecasts upgraded for FY19 and FY20

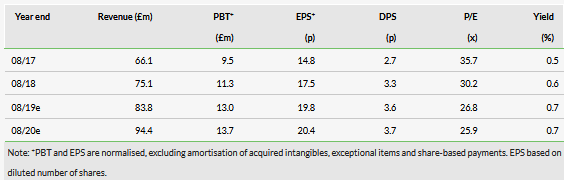

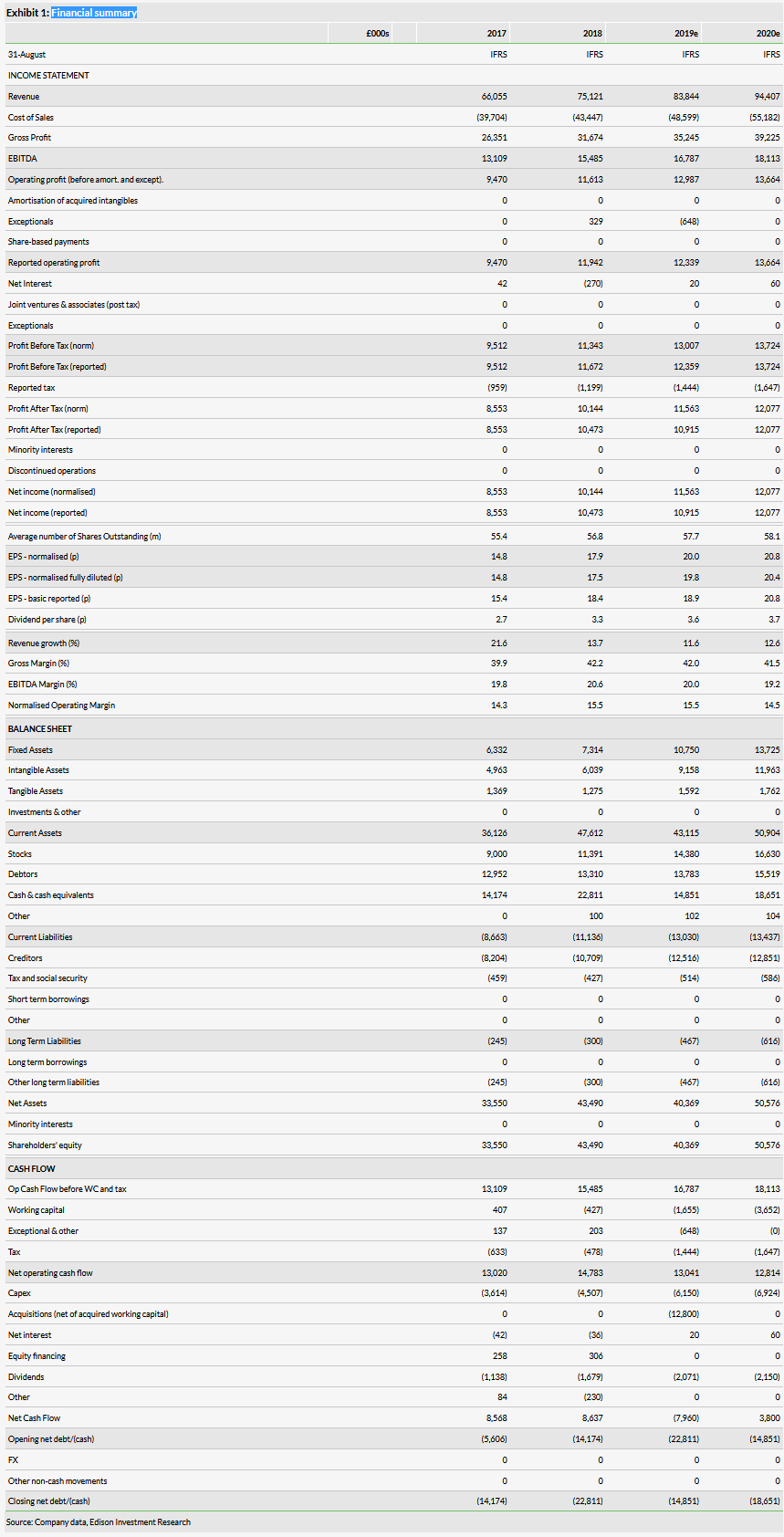

We raise our FY19e PBT by 4% to £13.0m to reflect company guidance for sales and margins. Our FY20e PBT increases by 3% to £13.7m, after factoring in conservative sales growth assumptions across Focusrite’s markets and broadly stable margins for the core business. As before, we also include a full year of revenue and earnings for ADAM Audio, but cautiously assume that Focusrite’s current distribution of third-party studio monitors ceases (c £3m of revenue).

Valuation: Slightly ahead of the current share price

Our DCF-based valuation increases to 544p per share (previously 530p) to reflect the conservative uplift to our forecasts.

Business description

Focusrite is a global music and audio products group supplying hardware and software used by professional and amateur musicians, which enables the high-quality production of music.