This year has been quite volatile for the tech-heavy Nasdaq composite. While the index scaled new highs in June, it lost most of that gain by early December.

The index was majorly impacted by the data privacy issues faced by behemoths like Facebook (NASDAQ:FB) , Alphabet’s (NASDAQ:GOOGL) Google, creating an environment of institutional sell-offs. The concern over data privacy called for increased regulation and strict monitoring of social media companies globally. Moreover, implementation of GDPR hurt growth in Europe.

Further, growing U.S. protectionism, tariff imposition on Chinese imports and the U.S. Federal Reserve’s hawkish stance related to interest rate hikes hurt the index.

Tariffs & Other Blows Disrupt Stock Market

On Aug 31, the United States and Canada delayed their negotiations on trade issues, leading to a drop in the stock market as a whole. Despite this, tech stocks like Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) helped the Nasdaq composite gain 0.26%.

However, the technology sector was jolted by the United State’s imposition over imports from China worth $250 billion ($50 billion in August & $200 billion in September) prompting a retaliatory tariff by China. The technology sector was hit the hardest, especially the chip stocks, as most of the demand came from China.

Moreover, rising interest rates led to losses for major technology companies, pulling the Nasdaq composite to correction levels. The persistent decline in DRAM and NAND pricing due to oversupply and weaker-than-expected growth in end-market demand, is creating a havoc in the semiconductor market. Lack of demand from cryptocurrency miners further hurt chip stocks like NVIDIA.

After going through a number of crests and troughs, by early December, the index lost what it gained through the year. Nonetheless, the composite has gained 2.8% year to date.

This gain can be partly attributed to a few tech stocks that have withstood the volatility witnessed by the Nasdaq in 2018.

Notably, rapid adoption of cloud computing, Internet of Things, wearables and Artificial Intelligence (AI) and its tools have been fuelling growth in the sector. The Technology Select Sector SPDR ETF (NYSE:XLK) XLK, which has returned 2.6% so far this year against the S&P 500 Composite’s decline of 0.9%, bears testimony to the fact.

Our Picks

Here we pick five stocks from the technology sector, which ended up outperforming the Nasdaq year to date. All these stocks sport a Zacks Rank #1 (Strong Buy) and promising prospects. You can see the complete list of today’s Zacks #1 Rank stocks here.

Synopsys, Inc. (NASDAQ:SNPS) shares have gained 5.3% year to date.

Synopsys benefited from solid growth in its EDA and IP businesses in 2018. Additionally, the acquisition of Cigital and Black Duck are establishing tactical quality relations with clients, leading to higher demand creation, cross-selling and a substantial rise in brand recognition.

In the past 60 days, the Zacks Consensus Estimate for its 2019 earnings has increased from $4.68 to $4.73, reflecting year-over-year growth of 11.47%.

Stratasys, Ltd. (NASDAQ:SSYS) shares have gained 3.7% year to date.

The company benefited this year from turnaround strategies, which include launching innovative products and strategic partnerships with the likes of Schneider Electric (PA:SCHN), The Boeing (NYSE:BA) Co. and Ford Motor (NYSE:F) Co. Moreover, promising prospects of the 3D printing market make us optimistic about the stock’s long-term performance.

In the past 60 days, the Zacks Consensus Estimate for its 2019 earnings has increased by 2 cents to 59 cents, reflecting year-over-year growth of 13.14%.

Intel Corporation (NASDAQ:INTC) shares have gained 3.7% year to date.

This year, Intel benefited from robust performance of the Data Center Group, Internet-of-Things Group, Non-Volatile Memory Solutions and Programmable Solutions Group. These segments form the crux of Intel’s data-centric business model. The company’s strategy of expanding TAM beyond CPU to adjacent product lines like silicon photonics, fabric, network ASICs, and 3D XPoint memory is also bearing fruit.

In the past 60 days, the Zacks Consensus Estimate for its 2019 earnings has increased by 7.5% to $4.57, reflecting year-over-year growth of 0.9%.

Ericsson (BS:ERICAs) (NASDAQ:ERIC) shares have gained 37.3% year to date.

The company has actively pursued three key areas, core business expansion, targeted growth, and cost and efficiency to fuel growth. At the same time, Ericsson also focused on stabilizing its IT, cloud and project portfolio, and re-establishing profitability in managed services by managing its existing contracts as well as investing in automation.

In the past 60 days, the Zacks Consensus Estimate for its 2019 earnings has increased by 57.7% to 41 cents, reflecting year-over-year growth of 47.32%.

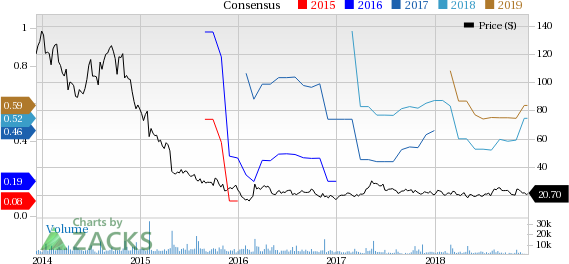

Attunity Ltd. (NASDAQ:ATTU) shares have gained 200% year to date.

Attunity is witnessing sales growth from both new and existing customers. The company’s robust product portfolio and key partnerships are helping it witness solid growth across all geographies. Growing demand among customers is a tailwind for the company.

In the past 60 days, the Zacks Consensus Estimate for its 2019 earnings has increased from 32 cents to 56 cents, reflecting year-over-year growth of 25.18%.

In addition to the stocks discussed above, would you like to know about our 10 top tickers to buy and hold for the entirety of 2019?

These 10 are painstakingly handpicked from over 4,000 companies covered by the Zacks Rank. They are our primary picks poised to outperform in the year ahead. Be among the first to see the new Zacks Top 10 Stocks >

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Attunity Ltd. (ATTU): Free Stock Analysis Report

Ericsson (ERIC): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

Stratasys, Ltd. (SSYS): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NASDAQ:NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research