ProPicks AI: Understanding the "Why" Behind Every Stock Pick

What's New | Jul 02, 2025 07:59AM ET

The "black box" days of AI-picked stocks are over.

ProPicks AI is now fully equipped with maximum transparency into exactly how our AI thinks when selecting stocks with strong potential.

Have you ever wondered how AI services work behind the scenes? Ever questioned how it knows which metrics truly matter in today's dynamic market environment? You're not alone. Many investors are hesitant to follow AI-powered stock picking tools when they can’t understand the reasoning behind them.

ProPicks AI addresses this challenge head-on with newly added rationales that provide clear, detailed explanations for every stock addition and removal across all of our strategies. Now you can see precisely which factors our AI analyzed and prioritized when making each decision.

Our AI essentially functions as a super-powered stock idea generator, analyzing vast amounts of financial data and market information to identify patterns and trends that support strong investment opportunities.

"Investors deserve to know not just what stocks to consider, but why they should consider them," says Andy Pai, VP of Subscription Products at Investing.com. “This request kept coming up among investors in our product-focused interviews, so we knew we had to prioritize it. Now that it's out, ProPicks AI represents the full investment experience our audience have been asking for: Discover opportunities, understand rationales, decide with confidence.”

With the newly added rationales for each stock picked (or removed) by AI, you can:

- Understand exactly what drives each decision - No more guesswork about why a stock was picked

- Prioritize what truly matters - See which factors had the biggest impact on each decision

- Connect data with real-world events - See how financial metrics directly tie to specific company news—like linking a revenue surge to a major product launch or understanding margin pressure through supply chain disruptions reported in recent earnings calls

- Gain confidence in your choices - Make decisions with complete understanding of the AI's reasoning

- Learn what professional investors look for - Improve your own investment analysis skills by seeing which factors matter most

These rationals are available for all ProPicks AI strategies in all markets, including our local market strategies in Brazil, Canada, France, Germany, India, Italy, Korea, Mexico, Saudi Arabia, Spain, and Turkey.

Real Examples from ProPicks AI Stock Selections

Delta Air Lines Inc (NYSE:DAL ) - Added on June 1, 2025

Undervalued Growth with Premium Advantage

- Selected by our ML engine for exceptional performance in market positioning, growth potential, and attractive valuation metrics.

- Trading at a compelling P/E ratio of just 8.5, significantly below market averages, with analyst price targets ($60-100) suggesting substantial upside potential from current levels.

- Q1 2025 results demonstrate resilience with EPS of $0.46 beating expectations and record $14 billion revenue, driving positive market reaction.

- Revenue diversification strategy showing strong results: premium cabin revenue grew 7% while loyalty program revenues surged 11%, providing stability during economic uncertainty.

- Generated robust $1.3 billion in free cash flow during Q1 2025, supporting the company's 50% dividend growth and overall financial strength.

- Strong international bookings and new maintenance agreement with UPS provide additional growth avenues beyond core passenger operations.

Merck & Company Inc (NYSE:MRK ) - Removed on June 1, 2025

Market weakness amid uncertain outlook

- Rotated out as relative performance lagged behind other pharmaceutical opportunities in our model

- Stock price has experienced sustained pressure with notable declines across all timeframes (-9.8% monthly, -16% quarterly, -37% yearly) and currently sits at just 57% of its 52-week high

- Recent volatility stems from paused Gardasil sales in China (reducing revenues by $1.1B) and uncertainty around potential pharmaceutical tariffs (stock dropped 4.6% on announcement)

- Despite attractive valuation metrics (P/E of 11.2, dividend yield of 4.2%) and strong profit margins (77%), near-term growth outlook appears challenged with revenue guidance below consensus

- Solid pipeline and financial flexibility remain strengths, but model found marginally stronger alternatives given current market conditions. This change reflects portfolio rotation, not a sell signal.

If A Stock Is Removed, Should You Sell It?

It's important to note that when a stock is removed from a ProPicks AI strategy, it isn't necessarily a sign to "sell".

Our strategies have a fixed number of spots (N), meaning a stock can be removed simply because it was pushed to position #N+1. For example, in our “Beat the SP 500” strategy with 20 spots, a stock moving from position #20 to #21 is still potentially a good investment - it just means one other stock ranked slightly better according to our specific criteria.

Removals can also occur when a stock simply no longer meets our specific strategy criteria.This can include:

- Index removal: Once a stock is removed from the S&P 500 index itself, it would automatically exit our "Beat the S&P 500" strategy as well, since this strategy specifically selects from S&P 500 constituents.

- Market cap changes: When a stock's market capitalization shifts outside the mid-cap range (typically $2-10 billion), it would be removed from our "Mid-Cap Movers" strategy - whether it grows into a large-cap stock or shrinks to small-cap classification.

- Portfolio changes: If Warren Buffett's Berkshire Hathaway sells a stock from its portfolio, that stock would naturally exit our "Best of Buffett" strategy, which curates the highest-potential stocks from Buffett's holdings.

In fact, some stocks that are removed from one strategy may be added to another that better matches their current profile. We recommend considering your overall investment goals, time horizon, and portfolio composition when making buy or sell decisions based on our strategy changes.

Match Stocks to Your Investment Style

One of the most powerful benefits of ProPicks AI is that it helps you identify stocks that align with your personal investment approach. Different investors prioritize different qualities in potential investments, and now you can easily spot stocks that match your specific criteria:

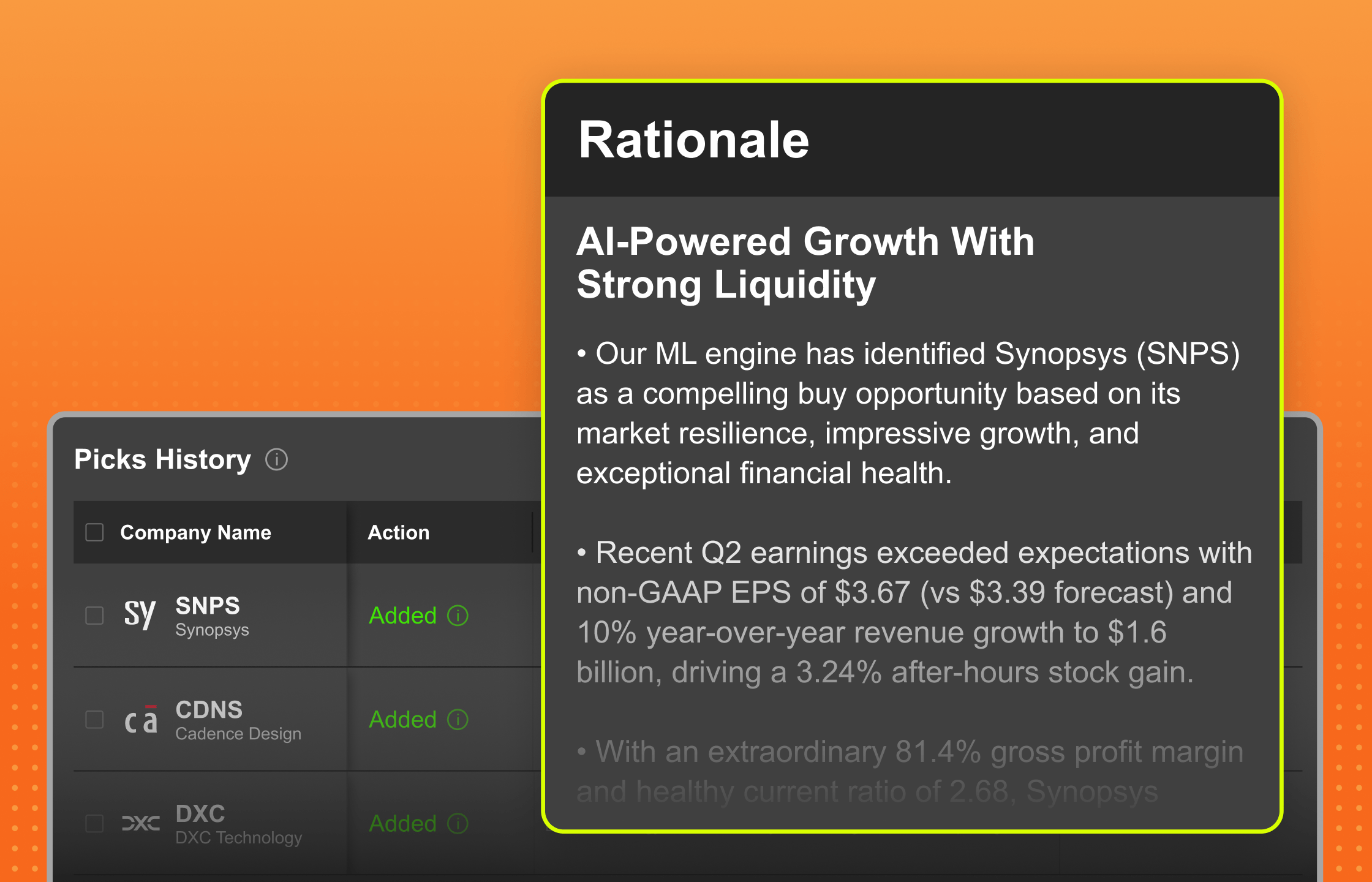

For Growth-Focused Investors: If you're seeking high-growth companies, look for rationales that highlight revenue growth outpacing industry averages, expanding market share, and new product launches with strong adoption rates. Rational examples for Synopsys (SNPS) "AI-Powered Growth With Strong Liquidity":

- Recent Q2 earnings exceeded expectations with non-GAAP EPS of $3.67 (vs $3.39 forecast) and 10% year-over-year revenue growth to $1.6 billion, driving a 3.24% after-hours stock gain.

- The company's Design IP segment is booming (+21% year-over-year), while its expanding $8.1 billion backlog signals robust future revenue potential.

- Strategic positioning in AI-powered chip design and 3D-IC technologies, plus partnerships with industry leaders like NVIDIA, creates multiple growth avenues that align with major semiconductor industry trends.

For Value-Oriented Investors: If you prefer undervalued companies with solid fundamentals, pay attention to rationales mentioning attractive price-to-earnings ratios, strong cash flow generation, and potential catalysts for valuation correction. Rational examples for Centene Corporation (CNC) "Undervalued Growth With Strong Fundamentals":

- Centene Corp. stands out as a compelling opportunity with a remarkable PEG ratio of just 0.25, indicating its growth potential is significantly undervalued.

- Trading at a P/E of 8.4 (well below market averages) despite posting impressive quarterly revenue growth of 16.6%, the stock offers both value and growth characteristics.

- Recent Q1 earnings exceeded expectations by 22% ($2.90 vs $2.38 forecast), demonstrating operational excellence and financial strength.

- With analyst fair value estimates averaging $77.50 (37% above current price) and recent contract wins in Nevada, Centene offers substantial upside potential.

For Income-Seeking Investors: If dividend yield and income are your priorities, focus on rationales that emphasize consistent dividend payment history, strong cash flow coverage, and management commitment to returning capital to shareholders. Rational examples for Amgen (AMGN) "Strong Growth with Attractive Valuation":

- The stock offers compelling value with a PEG ratio of just 0.47, indicating it's potentially undervalued relative to its growth rate, while providing a generous 3.3% dividend yield.

- With 15.6% revenue growth (LTM) and 15.9% EBITDA growth, Amgen demonstrates strong fundamental performance while maintaining impressive 69% gross margins.

- Recent positive developments strengthen the bull case: IMDELLTRA showing superior survival results in lung cancer trials, FDA approval of UPLIZNA as the first treatment for IgG4-RD, and Q1 earnings that beat expectations..

For Quality-Focused Investors: If business quality and financial strength are most important to you, aim for rationales highlighting industry-leading margins, strong return on invested capital, and competitive advantages protecting the business. Rational examples for Fortinet (FTNT) "Strong Growth With Industry-Leading Margins":

- Industry-leading profitability metrics stand out with an 81.3% gross margin and 31.4% operating margin – far exceeding industry averages.

- Revenue growth remains robust at ~14% year-over-year, while EBITDA has surged an impressive 47%, demonstrating strong execution and operating leverage.

- The company's innovative AI security features and expanding partnerships strengthen its competitive position and create protective moats around the business.

- By matching the factors highlighted in ProPicks AI with your investment preferences, you can more effectively filter our AI’s selections to find stocks that best suit your personal strategy.

Where to Find Rationales for Featured ProPicks AI Stocks

The rationales for each stock featured in ProPicks AI are available to all InvestingPro subscribers:

- Navigate to any ProPicks AI strategy page

- View the detailed rationale for any stock addition or removal

Rationals are currently available on the Investing.com website, with mobile app support coming in future updates.

—

Experience the power of ProPicks AI today and see exactly how our AI thinks when selecting winning stocks.

Subscribe to InvestingPro to get started.

Got feedback about ProPicks AI? We'd love to hear your thoughts.

Share your experience with us by reaching out to our support team anytime.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.