Investors Largely Indifferent to President Trump’s Coronavirus Diagnosis

What's New | Oct 09, 2020 07:21AM ET

Even for 2020, the past week has been quite the rollercoaster. President Donald Trump was admitted to Walter Reed National Military Medical Center on Friday after testing positive for coronavirus, only to be released on Monday to receive the remainder of his treatment at the White House. Responding to the uncertainty over the President’s health, US stock futures plunged early last Friday, but the Dow finished the day down just 0.5% as the White House sought to ease concerns.

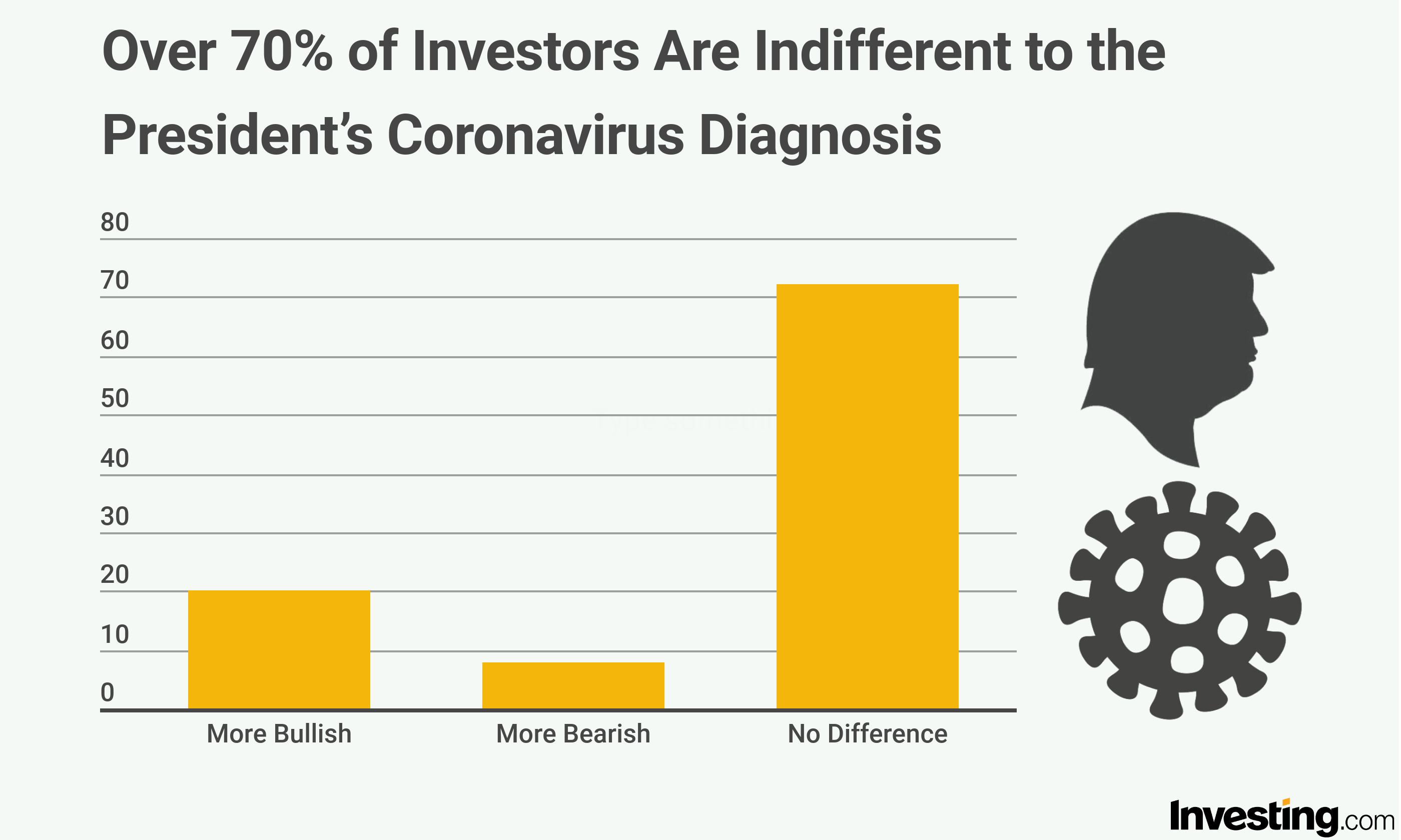

According to a survey of 1,164 Investing.com users in the U.S. conducted on Monday, October 5, over 70% of investors are indifferent to the President’s coronavirus diagnosis and see no need to react or change course on their investments. Furthermore, 20% of investors reported a more bullish approach, with the President in recovery from the virus upon the survey being conducted.

“The initial downward move was nothing more than a knee-jerk reaction to the dramatic headlines,” said Jesse Cohen, senior analyst at Investing.com. “As the hours and days progressed it became clear that President Trump was not in a life-threatening situation, easing worries over a sudden deterioration in his health.”

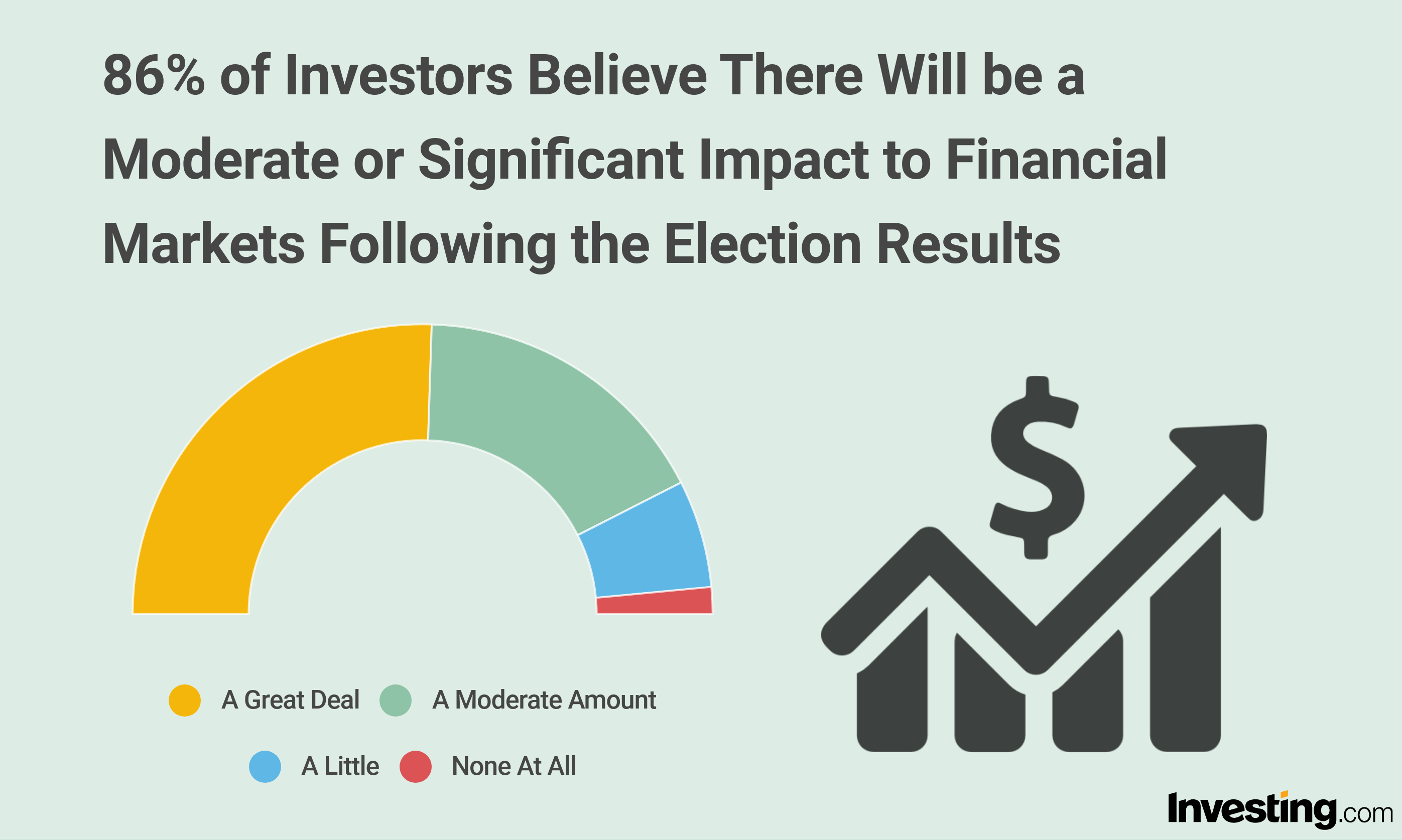

“Overall, the election result - and whether the winner will introduce a fresh round of stimulus - are far more important factors likely to influence the market in the coming weeks,” Cohen added.

Focusing on the election

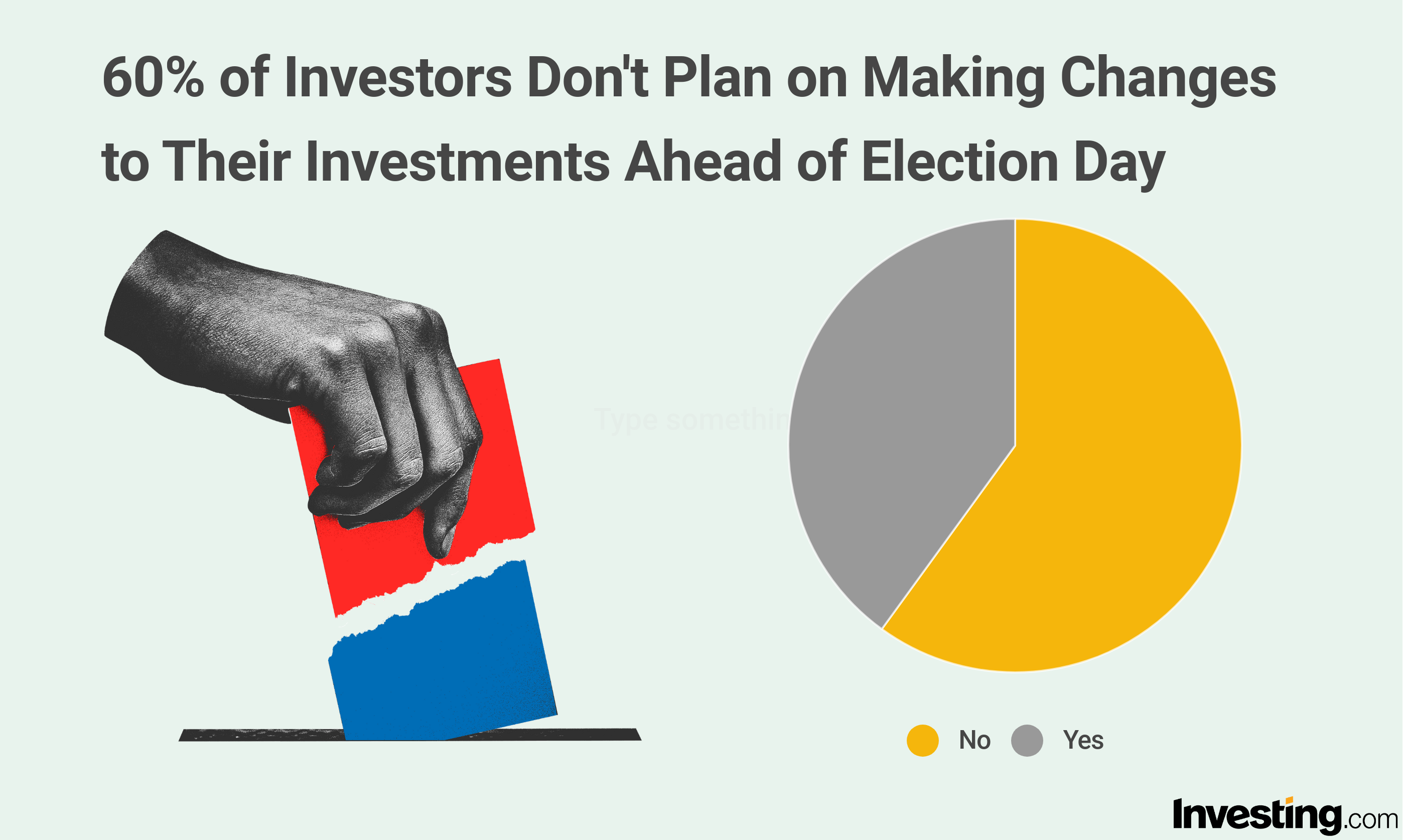

With a hotly contested election less than 30 days away, investors were far more concerned about the time period after the November 3rd election day. Sixty percent of respondents have no plans to make any changes to their investments ahead of election day, while 86% believed there would be a moderate or significant impact to financial markets following the results.

Investors were also in agreement that a Trump victory would provide the better outcome for U.S. financial markets, with 65% of respondents believing this to be the case and just 16% seeing former Vice President Joe Biden as a better outcome for the markets.

It’s no surprise then, that 53% of investors believe the performance of the stock market over the past 4 years will be the key to Trump being reelected. That said, nearly half of those surveyed believe his administration's response to COVID-19 posed the biggest threat to Trump’s chances of a second term.

“Just before the coronavirus outbreak in February, it appeared that President Trump may have had the 2020 Presidential election locked up,” Cohen stated. “However, in the months since, the pandemic has thrown Trump for a loop and significantly hurt his chances for reelection. With Joe Biden now firmly in the driver’s seat, the market will start to focus on what a Democratic win would mean for taxes and regulation.

So what sectors do investors feel bullish about if President Trump is re-elected into a second term? Technology (23%) was the industry investors believed would continue to soar under the current President, followed by the industrial (20%), energy (19%) and financial (17%) sectors. As for Vice President Biden, nearly 50% of investors anticipate that environmental stocks will perform best under his leadership, followed by healthcare (23%).

Investments in response to the uncertainty of the USPS

Over the past few months, President Trump and his ally US Postmaster General Louis DeJoy have been outspoken about the severe financial troubles to the US Postal Service (USPS) and their concerns of widespread mail-in voter fraud in the upcoming election. As a result of enormous operating losses ($78 billion since 2007), and receiving only $10 billion of the $75 billion they requested in aid earlier this year, the USPS is experiencing significant delays and challenges as we approach the largest mail-in voting election in our country’s history by far.

We asked investors, with the future of the USPS under threat, if private mail carriers like FedEx (NYSE:FDX), UPS, DHL, and even Amazon (NASDAQ:AMZN) would see a spike in investment interest. The answer was ‘yes,’ with 65% of survey respondents indicating that these mail carriers would see a boost in interest from investors amid the USPS turmoil. Furthermore, over 60% said they’d trust private mail carriers, such as Amazon and FedEx, with their own mail-in ballot.

Looking further ahead

No matter the outcome of the 2020 US election, investors do believe the economy is on track to improve with over 60% of survey respondents sharing this sentiment. They were, however, more split on how long it will take for the US economy to show a complete recovery; 43% believed we could see it happen in the next year, while 16% believed it won’t happen in the upcoming term, whether it’s Trump or Biden in the driving seat.

Latest comments

You make a lot of good points, but it would be much easier to be able to assess the issues outlined in this blog post if the streaming charts were working. Your streaming charts are not working. You need to prioritize fixing your streaming charts above all else. as that is how many of us do quantitative analysis which then allows us to better understand the rich analysis that you provide in these blog posts. Good post otherwise, but I cannot be sure until I am able to get to my charts. Hopefully that get's solved soon. Keep up the great work! ... (Read More)

Nov 19, 2020 06:25PM GMT· Reply

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.