Investing.com Poll: Will The Federal Reserve Cut Rates This Week? We Asked, You Answered!

Inside Investing | Jun 18, 2019 10:22AM ET

Investing.com Poll: Will The Federal Reserve Cut Rates This Week? We Asked, You Answered!

For our latest social media weekly poll, which ran both on Investing.com’s Facebook and Twitter accounts, we asked our users:

Will The Federal Reserve Cut Rates This Week?

The Federal Reserve's Federal Open Market Committee (FOMC) begins its two-day policy meeting on Tuesday, with a decision due Wednesday afternoon. The highly-anticipated meeting comes against the backdrop of rising trade tensions between Washington and Beijing as well as recent signals of slowing U.S. economic growth.

Breaking Down The Results:

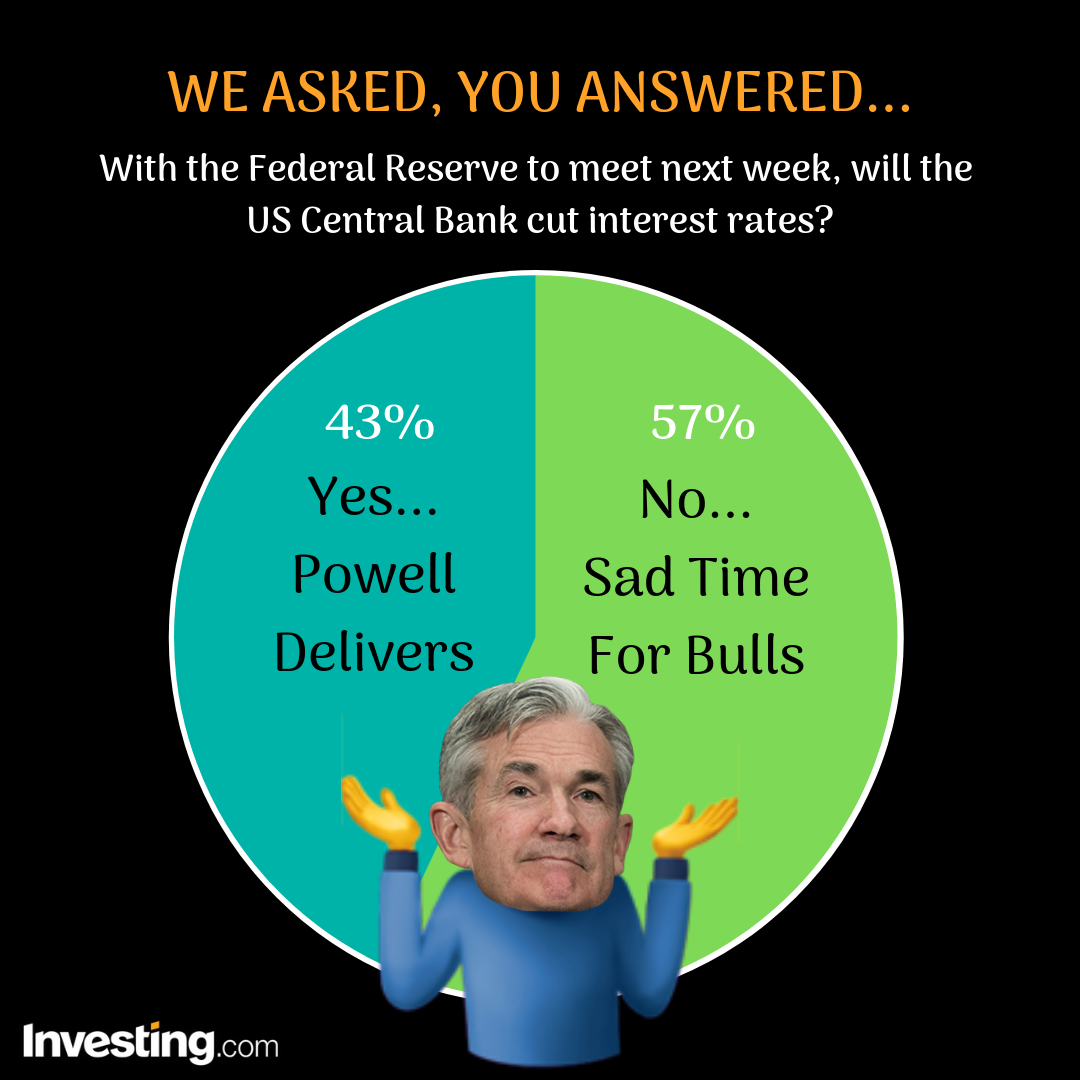

The poll results showed a clear majority not expecting the U.S. central bank to take any action on interest rates this week.

Overall, when taking votes from both Facebook and Twitter into account, 57% of users thought the Federal Reserve will leave rates on hold, while 43% said they expected a rate cut.

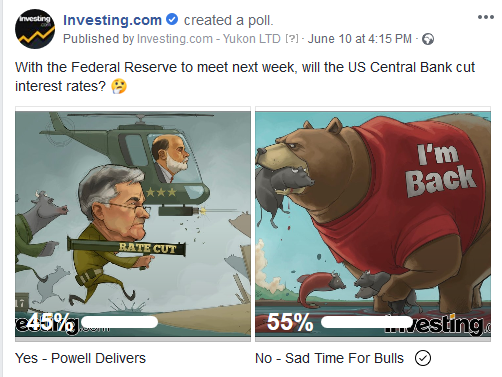

Out of the 647 votes recorded on Facebook, 358 users, or 55%, said that Powell will disappoint the bulls and keep rates at current levels.

In comparison, 289 users, or about 45%, voted that Powell will end up delivering the rate cut markets so desperately want.

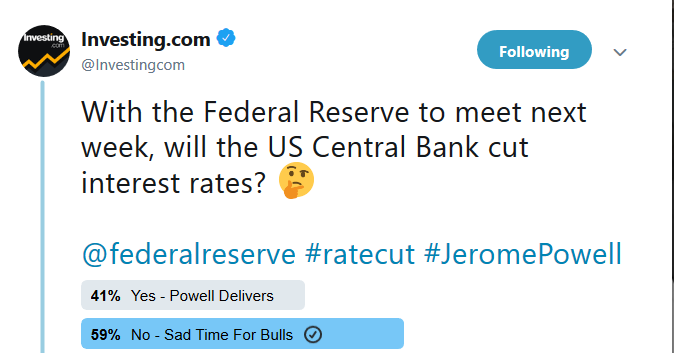

The results we saw on Investing.com’s Twitter account echoed the same sentiment.

Of the 273 votes recorded, 161 users, or around 59%, thought the Fed won’t act.

Meanwhile, 112 users, or 41%, said a rate cut was coming.

Behind the Numbers:

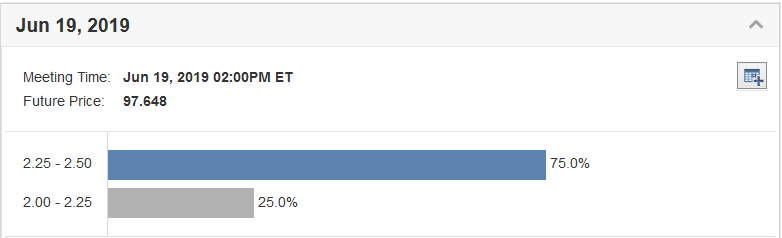

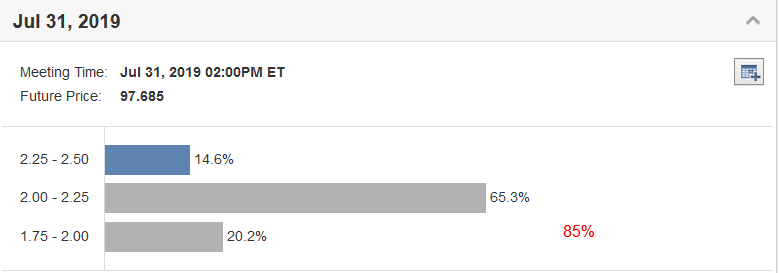

Investor expectations of a Fed rate cut at this week’s meeting currently stand at 25%, according to Investing.com’s Fed Rate Monitor Tool. The market gives an 85% chance of a cut at its July meeting.

With expectations running high, markets could experience disappointment if the Fed fails to send strong enough signals of imminent easing.

Global financial markets were jolted in May, when mounting fears over the worsening trade war between the United States and China drove equities lower.

However, bets that central banks around the world would turn more accommodative have helped spark a rally in risk-related assets so far this month.

In the beginning of June we asked: After global stocks suffered a selloff in May will June be better for the bulls?

Out of the combined 1,342 votes recorded both on Facebook and Twitter, 603 users, or roughly 45%, said they were bullish coming into June.

In comparison, 739 users, or about 55%, said they were bearish and thought June would be a rough month for stocks.

Whether the June rally continues depends mostly on what the Fed will say tomorrow.

Be the first to comment on

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.