Investing.com Poll: Gold or Oil? Which Will Perform Better Through The End Of 2019?

Inside Investing | Jul 16, 2019 05:31AM ET

For our latest social media weekly poll, which ran on both Investing.com’s Twitter accounts from June 30 to July 7, we asked our users:

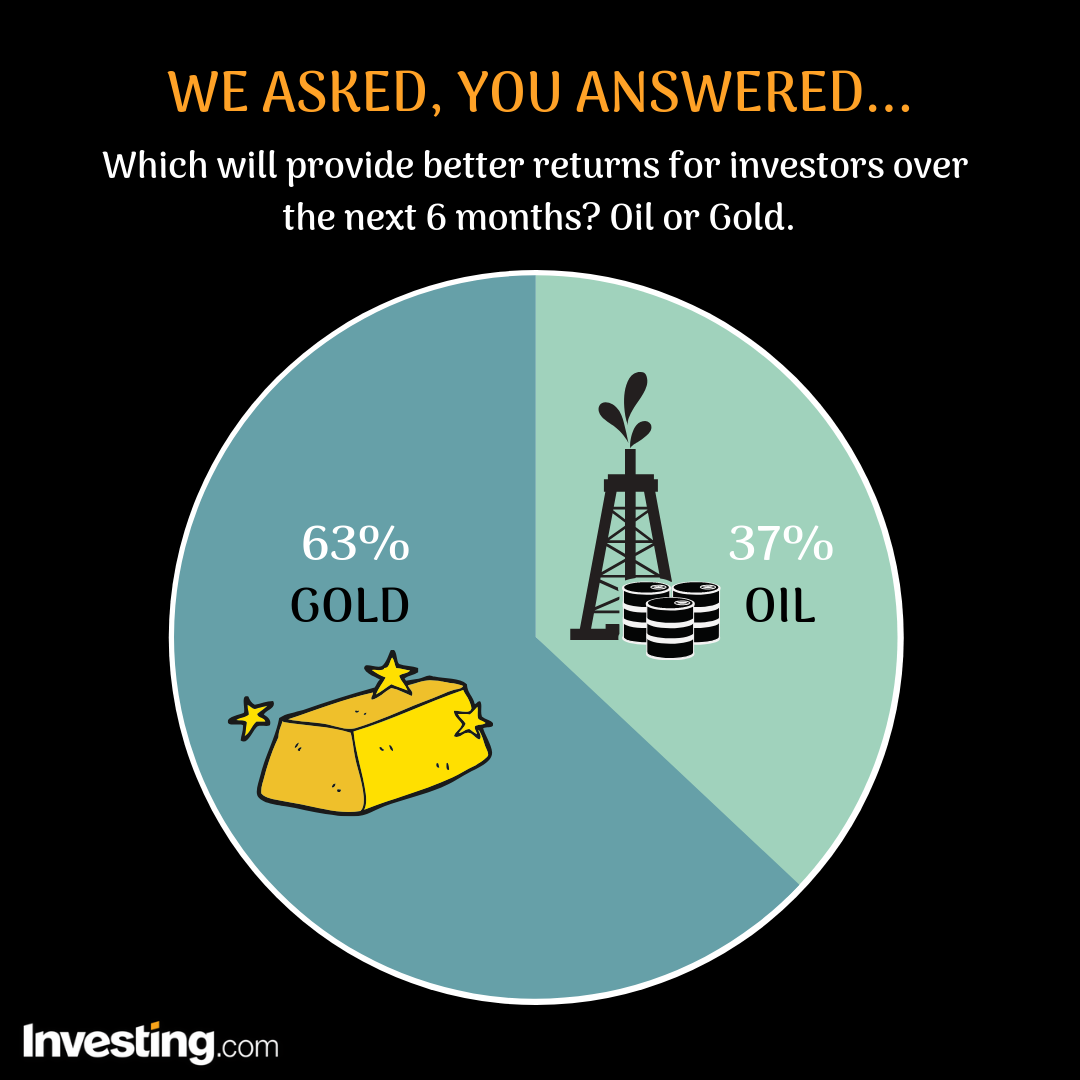

Gold or oil? Which will provide better returns for investors over the next 6 months?

Gold bulls are back in control as prices of the precious metal have soared around 10% since the start of the year to currently trade near their highest level since September 2013.

Not to be outshined, oil has also been on a tear this year, with West Texas Intermediate crude futures gaining around 34% in 2019.

The commodities have been two of the best-performing assets in the first six months of the year. The question is which will provide the better returns in the next six months.

Breaking Down The Results:

In a rather surprising outcome, the poll results revealed a clear majority that expected gold to outperform oil through the end of the year.

Overall, when taking votes from both Facebook and Twitter into account, 63% of users voted that gold will provide better returns for investors over the next six months.

Only 37% said oil will be the better investment in the months ahead.

Out of the 1,767 votes recorded on Facebook, 1,100 users, or 63%, said gold will outperform oil.

In contrast, just 667 users, or about 37%, voted that oil will be the better investment of the two in the six months ahead.

The results we saw on Investing.com’s Twitter account underlined the same view.

Of the 882 votes recorded, 547 users, or around 62%, said gold will outshine oil through the end of the year.

Meanwhile, 335 users, or 38%, said they expected oil will outgain gold.

Behind the Numbers:

Gold futures were at around the $1,420-level on Thursday, not far from a six-year high of $1,439.95 touched on July 3.

Investors have gotten gold fever on improved prospects for easier monetary policy from the Federal Reserve, with markets currently pricing in a 100% probability of a rate cut in July, according to Investing.com’s Fed Rate Monitor tool.

Mounting geopolitical tensions between the U.S. and Iran as well as lingering uncertainties over the U.S.-China trade front have also lured investors into gold.

Meanwhile, U.S. WTI prices rose to a six-week high of $60.93 a barrel this morning.

Oil prices have been supported for much of 2019 by efforts by the Organization of the Petroleum Exporting Countries (OPEC) and non-affiliated allies like Russia, who have pledged to withhold around 1.2 million barrels per day (bpd) of supply this year to prop up markets.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.