Investing.com Poll: Do You Think Bitcoin Will Break Above $20K Before The End Of The Year?

Inside Investing | Jul 04, 2019 09:39AM ET

For our latest social media poll, which ran both on Investing.com’s Twitter accounts last week, we asked our users:

Do You Think Bitcoin Will Break Above The $20,000-Level Before The End Of The Year?

Bitcoin has been on a tear this year, with prices of the world’s most valuable cryptocurrency rallying more than 200% to their highest levels in about 18 months.

It was last at $11,764.00 on the Bitfinex exchange as of 8:30AM ET on Thursday. It rose to its best level since January 2018 at $13,764.00 on June 26, after having started the year at around the $4,000-level.

While prices have yet to rebound anywhere near an all-time high around $20,000, Bitcoin's impressive rally has sparked hopes among crypto enthusiasts that a new bull run is getting started after it ended last year down more than 73%.

Breaking Down The Results:

Surprisingly, the poll results showed that most thought Bitcoin will end the year below the $20K-level.

Overall, when taking votes from both Facebook (NASDAQ:TWTR ) into account, 54.5% of users thought Bitcoin will fail to reach the key $20,000-mark, while 45.5% said Bitcoin will power ahead to new highs by the end of the year.

Out of the 1,480 votes recorded on Facebook, 851 users, or 57.5%, said prices of the world’s biggest digital currency will end 2019 below $20,000.

On the other hand, 629 users, or about 42.5%, voted that Bitcoin will surge above $20K.

The results we saw on Investing.com’s Twitter account showed a much closer picture.

Of the 540 votes recorded, 275 users, or around 51%, said Bitcoin will close the year below $20K.

Meanwhile, 265 users, or 49%, thought it will manage to settle above that level on December 31, 2019.

Behind The Numbers:

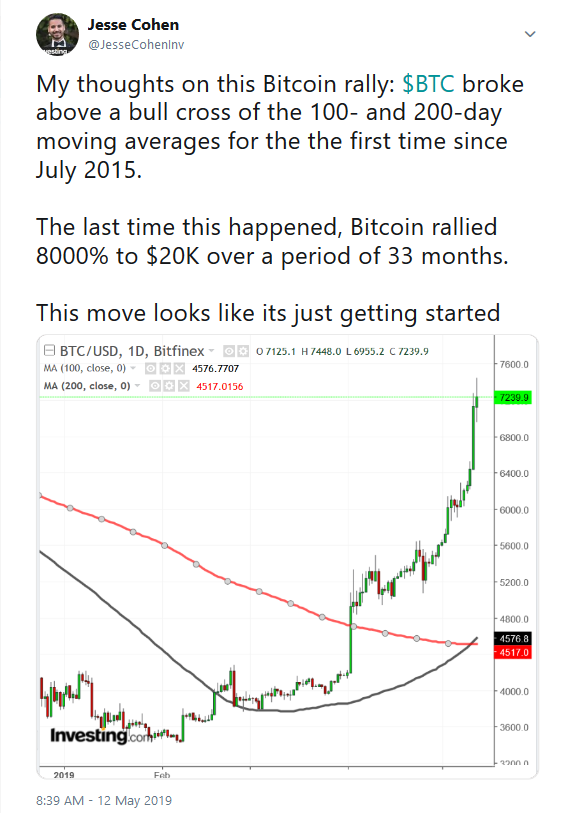

Jesse Cohen , Investing.com’s Global Markets Analyst, said the cryptocurrency’s technical levels are “looking much better” since prices broke above a bull cross for the first time in almost four years.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.