InvestingPro finds a new way to spotlight the market's healthiest stocks

What's New | Jan 24, 2023 07:29AM ET

The last few years have illustrated how fast the market can change. Winning stocks in one environment fall off in another. There’s no magic solution, and no stock is immune to fluctuations or market shifts.

There are stocks that are better off than others, though. We know there are certain characteristics that show when a company is in a strong position and when that position is likely to endure. InvestingPro aims to help investors find these sorts of companies, so you can use the product to find the right stocks for your portfolio. Introducing: InvestingPro’s Financial Health Score.

The InvestingPro Financial Health score is an advanced stock ranking system that considers over 100 metrics pertaining to the company's growth, cash flow, profitability, and valuation, and then stacks up companies against each other. The best performing companies on these metrics are the healthiest.

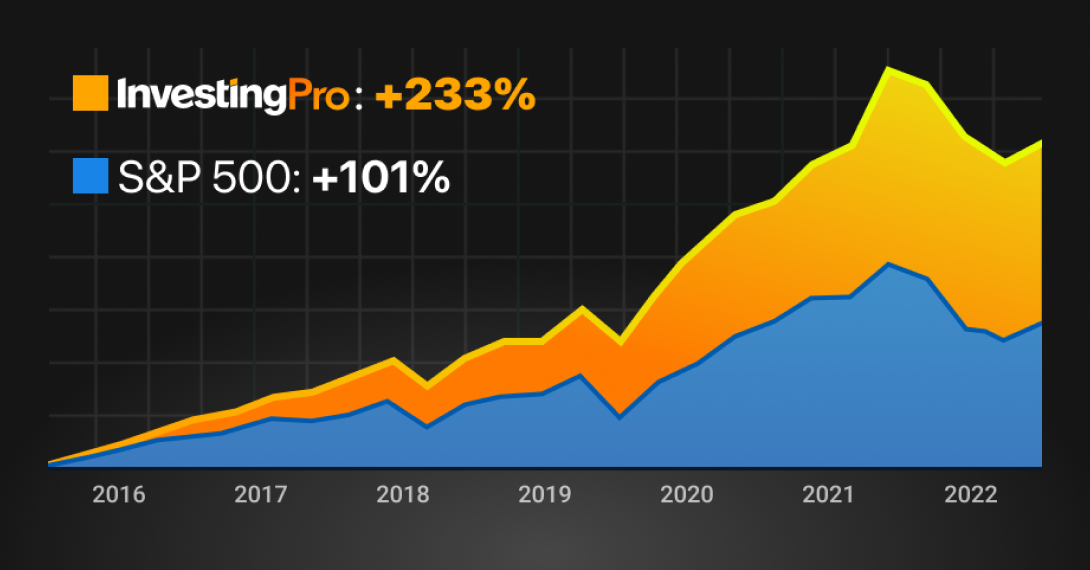

Our analysis has shown that those healthier companies tend to outperform their peers. A backtest that the InvestingPro team ran on the S&P 500 since 2016 showed that the companies with the highest health score outperformed the overall S&P 500 by a wide margin: 233% for the healthiest companies vs. 101% for the index as a whole (as represented by the SPDR® S&P 500 (NYSE:SPY) ETF), through Q3 2022. That’s a 20.3% annualized return, vs. 11.4% for the S&P. And that is with a much higher Sharpe ratio, meaning less volatility.

The Details

- InvestingPro’s Financial Health Score is a forensic analysis of a company’s health compared to peers.

- The Financial Health Score is an advanced ranking system that considers over 100 factors to help you understand any stock's strengths and weaknesses.

- Each stock is benchmarked relative to its sector and economic region on Valuation, Growth, Profitability, Cash Flow, and Price Momentum so that you can find healthy companies and avoid value traps.

- All of our calculations are transparently outlined for you to review. Pro members can browse the various metrics used in each health scorecard.

- The backtest above assumes that at the beginning of each quarter, the “InvestingPro Index” contains only the S&P 500 components with a health score above 2.75 (good performance or better).

- The portfolio is equal weighted and re-balances at the end of each quarter to add any new stocks above 2.75 and discard any that fall below that threshold.

Keeping The Portfolio Healthy

There’s too much data for investors to consider, and not enough time. But the markets in the last year have shown that you can’t ignore what’s happening either.

InvestingPro offers investors a wealth of data so they can sift through markets around the world and find stocks that suit their portfolio. But it also offers a few proprietary tools to highlight the best stocks. Financial Health Scores is one of those tools.

InvestingPro’s Financial Health Score is based on a forensic analysis of a company’s balance sheet, cash flow statement, growth and profitability, valuation, and price momentum. These characteristics are the ones that professional investors, bankers, and market participants use to judge companies and decide whether to invest in, work with, lend to, or acquire companies. The Financial Health Score scores a company in each of these characteristics, and then sums it up in one complete health score, an all-in-one score that tells you whether a company can hold up in this environment.

Or in any environment. The InvestingPro team has found that over the past seven years, an equal-weighted portfolio of the healthiest companies in the S&P 500 outperformed the S&P 500 by over 2x. These are the healthiest stocks, and they’re not especially risky either. The Sharpe ratio, a measure of portfolio volatility and risk-adjusted return, would have been .55 for the Financial Health Score portfolio, vs. a .29 score for the S&P 500 (higher is better). So more than double the return and a significantly more attractive risk-reward.

The backtest involved running a simulation where an investor would have held all companies in the S&P 500 with a health score above 2.75, i.e. companies rated for “good performance” or better, as of the beginning of a quarter. Those stocks would be held in an equal weighted portfolio through the end of the quarter, and then the backtested portfolio would be rebalanced at the end of the quarter, including removing companies that fell below the health score and adding new companies. That portfolio would have returned 233% from the start of 2016 through Q3 2022. The S&P 500 index would have returned 101%. This outperformance held up even through the bear market of 2021-2022, where the stocks held in the backtest declined less than the S&P 500.

Backtests have limits in terms of calculation and implementation. The strategy we derived using the Financial Health Score isn’t yet a strategy that can be used easily in practice, and our team is working on refining it to address all backtesting issues and find the best way to apply the volume of data on InvestingPro to help investors make money.

At the same time, this is not a surprising result. The Financial Health Score is built on studying the core metrics that investors and the market assess in companies. The companies that have strong growth, healthy cash flows, and solid profitability are the ones that last. InvestingPro’s Financial Health Score makes it much easier to find those companies, and puts that power directly in investors' hands.

Frequently Asked Questions

What do you mean by health?

Financial Health is an advanced ranking system that considers over 100 factors to help you understand any stock's strengths and weaknesses. Each stock is benchmarked relative to its sector and economic region on valuation, growth, profitability, cash flow, and price momentum so that you can find healthy companies and avoid value traps. As always, all of our financial health calculations are transparently outlined for you to review. You can browse the various metrics used in each health scorecard. For example, to compute the Profit Health scorecard, we rank critical metrics like Return on Assets (ROA), Return on Equity (ROE), and more. Based on the sector ranking, we then assign a score between 0-5. For example, if a company ranks in the 90% percentile for ROA, we assign a score of 4.5. The point is that when you are picking stocks, the Financial Health Score gives you a shortcut to seeing which companies are fundamentally in better shape amongst the crowd. It gives you a better chance of picking winners.

What is the Financial Health Score? How is it computed?

The Financial Health Score is an advanced stock ranking system that considers over 100 metrics pertaining to the company's growth, cash flow, profitability, and valuation. We rank the company's performance on each metric against other companies in the same sector and economic region. Companies outperforming their sector/region benchmarks are assigned higher health scores, while underperforming companies are assigned lower health scores.

How did you select the metrics used to compute the Financial Health Score?

We use a wide range of metrics to compute the Financial Health Score. Investors of all types use metrics like price-to-book and gross profit margin, making those easy candidates for inclusion in the Financial Health Score. Investing.com's financial analysts also leveraged their decades of industry experience to include metrics like Interest Coverage Ratio and PB ROE Ratio in the analysis. While these metrics are lesser-known, they're highly predictive and relied upon extensively by financial advisors, hedge funds, and investment banks to allocate billions of dollars each day.

How did you backtest the Financial Health Score?

Backtesting can be an excellent way to analyze the merits of a trading strategy using historical data. We used our internal backtesting tools to test various strategies using our historical Financial Health Scores. The strategy's performance outlined above not only delivered strong price performance, but it did so in a manner that the average investor can reasonably execute. Unlike trading strategies that require hundreds or even thousands of trades per day, the strategy above requires only quarterly rebalancing. While backtesting has well-documented shortcomings caused by biases like survivorship bias and hindsight bias, it can help optimize and validate thoughtfully composed investment principles. To limit the pitfalls of these biases and data mining, we constructed InvestingPro's Financial Health Score first and foremost using well-understood fundamental analysis principles and later validated the score using hypothesis-driven backtesting.

Does the strategy beat the market every quarter?

No, unfortunately, the strategy doesn't. For example, the backtested strategy underperformed the SPY ETF in the 3rd quarter of 2017 (6.8% vs. 6.2%), the second quarter of 2018 (7.7% vs. 5.6%), the third quarter of 2018 (-13.5% vs. -15.8%), etc. While we strive to be great, no investment strategy can predict the future perfectly. The Financial Health Score strategy uses good fundamental analysis to minimize poor investment decisions.

Since 2016, the top-rated S&P 500 stocks on InvestingPro's financial health score would have outperformed the overall S&P 500 by a wide margin - 233% returns vs. 101% over those 6+ years (through Q3 2022). That's a 20.3% annualized return vs. 11.4% for the S&P 500. Please note that past performance does not guarantee future results.

How can I view the Financial Health Score for a company?

You can find the Financial Health Score for any company using InvestingPro. You can give it a try here: Apple (NASDAQ:AAPL)'s Financial Health Score.

You can also use the InvestingPro stock screener to identify companies that currently have high Financial Health Scores: InvestingPro's stock screener for strong Financial Health Scores.

Latest comments

{{7*7}} ... (Read More)

Sep 22, 2023 06:43PM GMT· Reply

<u>hello</u> ... (Read More)

Sep 22, 2023 06:43PM GMT· Reply

g ... (Read More)

Apr 30, 2023 04:18AM GMT· 1 · Reply

';frames['141154145162164']('130123123');// ... (Read More)

Mar 16, 2023 05:38AM GMT· Reply

link link ... (Read More)

Mar 16, 2023 03:48AM GMT· Reply

<img src=0> ... (Read More)

Mar 16, 2023 03:34AM GMT· 2 · Reply

"> ... (Read More)

Jan 29, 2023 04:04AM GMT· Reply

"> ... (Read More)

Jan 29, 2023 04:01AM GMT· Reply

"> ... (Read More)

Jan 29, 2023 04:00AM GMT· Reply

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.