How Trump Affected the U.S. Economy (and the Rest of the World)

Inside Investing | Jan 10, 2019 10:29AM ET

If there’s one thing his supporters and detractors can agree on - is that President Donald J. Trump is an anomaly in the U.S. political system. A non-politician who ran for office while running his mouth and won, to both the joy and ire of many Americans.

President Trump took office on January 20th, 2017 and during the last 2 years has been making huge changes to the U.S. economy, in great part by using his Twitter account, and as a result - to the rest of the world. In this post, we will discuss Donald Trump’s economy and how it impacted the U.S. and the rest of the world.

- In 2017, Trump’s tax cuts and deregulatory actions led to rapid growth in the U.S. and global economy

- In 2018, the U.S.-China trade war, combined with a very hawkish Federal Reserve policy, saw much of the previous year’s gains evaporate

- Trump’s use of Twitter turned from a market-booster into a market shaker

Donald John Trump - a Brief History

America’s 45th president was born June 14th, 1946, in Queens, New York. In 1964 he joined Fordham University and after 2 years at Fordham, he transferred to the Wharton School of the University of Pennsylvania. While at UP, he worked in his family’s real-estate business - Elizabeth Trump & Son. He graduated in 1968 with a BSc in economics. He continued to work in the family’s business and in 1971 he was made the president of the company, and his first act was to rename it to “The Trump Organization”.

Trump’s Economy - Tweetingly Turbulent

Almost as soon as his presidency began on Jan 21st, 2017, Donald Trump started making changes. Many of his first-year changes were the fulfillment of his promises to his constituents, like repealing the Obama-era Affordable Care Act (aka “Obamacare”). One of Trump’s promises was to cut taxes in the form of the Tax Cuts and Jobs Act (TCJA).

The TCJA and the Economy

The effects of the TCJA were felt in 2018, where American households got to keep more of their earnings thanks to reduced rates in most tax brackets, and corporations ended up paying 28% less in taxes, or $162 billion instead of $223 billion paid in 2017. This meant that companies got to keep more of their earnings and many employees received cash bonuses, which led to increased spending. However, it was expected that companies would use the extra capital to invest in growth, but it seems that instead, they preferred to give out bonuses.

The short-term effects were that the U.S. economy showed a 4.1% growth in the second quarter of 2018 (the fastest rate since 2014), but economists predict that these benefits may not last. The Tax Policy Center published a report stating that:

“TCJA will stimulate the economy in the near term. But, most models indicate that the long-term impact on GDP will be small. . . . It will make the distribution of after-tax income more unequal, raise federal debt, and impose burdens on future generations.”

It is estimated that in 2019, GDP growth would be 0.3%, but by 2023 the growth would essentially be non-existent.

Tax cuts also mean that the government gets less money, and CBO projections see the national debt going as high up as $1 trillion, possibly even in 2019.

Another key aspect of Trump’s first year in office was the plethora of deregulatory actions he has taken with the aim of revitalizing the U.S. economy.

Deregulation

Trump made it a central part of his presidency to remove regulations that, in his eyes, hinder economic growth. During his predecessor - Obama’s term, some 22,700 regulations were imposed, and Trump, a classic capitalist, believed that a smaller government and minimal intervention will allow market forces to move more naturally driving growth.

It is estimated that before Trump took office, the annual cost of regulations was $2 trillion. On January 30th, 2017, Trump enacted Executive Order 13771, stating that any executive department or agency who plans to publicly announce a new regulation to propose at least two regulations which will, in turn, be repealed.

The result was increased confidence form small businesses, and an increase in employment rates. In fact, by December 2017, U.S. unemployment rates were the lowest they have been in a decade. A couple of key deregulatory actions Trump has taken were:

- Partial reversal of the Dodd-Frank Wall Street Reform and Consumer Protection Act, meant to promote financial stability by improving accountability and transparency in the financial system.

- Eased emission limits on new coal plants, which led to a revitalizing of the coal mining industry, but raised environmental concerns.

By the end of 2017, the DOW rose by 24.33%, and it looked like almost every time President Trump tweeted about the stock market or the economy, the markets responded favorably, and despite the wide criticism he received, it looked like everything Trump does or says has the proverbial Midas touch.

On January 22, 2018, President Trump placed a 30% tariff on imported solar panels. China, a world leader in the manufacturing of solar panels, looked like the most obvious target of the new tariff. Later that day, a 20% tariff was imposed on the first 1.2 million imported washing machines. This was the first shot in a new trade war between the U.S. and China, which will dominate the global economy for the entirety of 2018.

The Trade War

The U.S.’ main stated reasons for the trade war is Chinese theft of intellectual property, advanced technology and trade secrets, and while the U.S. has been trying to address this since Bush Sr. was in office, all following presidents failed to solve the problem. During the first year of Trump’s term, he was goaded by Democrat leader Chuck Schumer to take a stronger stance on China, calling him a “98-pound weakling”. Trump, being a man who doesn’t like to be taken lightly, flexed his Twitter muscles at Beijing:

The beginning of 2018 saw the U.S. and China exchanging Tariffs, while both lodged complaints against each other to the World Trade Organization (WTO). In April 2018, Trump denied that the dispute was actually a trade war, saying:

"that war was lost many years ago by the foolish, or incompetent, people who represented the U.S."

He added:

"Now we have a trade deficit of $500 billion a year, with intellectual property (IP) theft of another $300 billion. We cannot let this continue.”

With the implementation of new tariffs on Chinese and EU automakers, Trump shook the global supply chains. Companies that were used to importing and exporting materials and products suddenly had to deal with a new reality, where the cost of imported supplies jumped 15%-25%.

Staple American companies, such as Harley Davidson, moved much of their production outside of the U.S. to reduce costs, a move that went against Trump’s promise to focus on “America First”. Trump went to Twitter in a series of tweets, denouncing Harley Davidson’s decisions. It’s said that changes Trump made disrupted around 1% of all global trade, but those impacted by that 1% were hit hard.

In December Trump and his Chinese counterpart Xi Jinping meeting and agreeing on a temporary 90-day reprieve, giving both countries breathing-room for negotiations. World markets released a sigh of relief, only to be replaced by a new gasp of fear as Trump Tweeted his now infamous “Tariff Man” tweet:

Will 2019 see the war escalating or abating?

A Whole New NAFTA

Another surprising move Trump made was ripping up the old North American Free Trade Agreement - a 20-year-old trade agreement between The U.S., Canada, and Mexico.

The original agreement was created to make these countries more competitive in the global marketplace and is considered to have been a great success. If you’re wondering why would the U.S. seek to change a successful agreement, one reason is that the agreement led to a reduction in U.S. jobs (something Trump promised to tackle), but Trump’s main reason for exiting NAFTA was reducing the trade deficit between the U.S. and Mexico.

Both countries held bilateral negotiations June to August 2018, while Canada was left out. On August 27th, U.S. and Mexico announced that they reached an understanding. Negotiations with Canada began in August, and initially, were unfruitful. Frustrated, Trump announced that unless Canada agrees to his demands by September 30th, he will abandon NAFTA altogether.

On the final day of Trump’s deadline, Canada signed a preliminary agreement with the U.S., ending the 2-months long spat. Later on, the agreement was renamed the “United State Mexico Canada Agreement”, or USMCA for short.

Trump’s announcement in May that he will reimpose sanctions on the Iranian regime drove oil prices up to $72 a barrel, but that price level didn’t last. Analysts who were expecting current sanctions to resemble Obama-ear sanctions soon found out that Trump intends on much harsher sanctions.

As a result, the price of oil rose, which created popular pressure on Trump to reduce the cost of oil. In reaction to public sentiment, Trump put pressure on OPEC to increase oil production, focusing on Saudi Arabia, and the tactic worked. By mid-October, oil prices were dropping, hitting $42 on Christmas Eve.

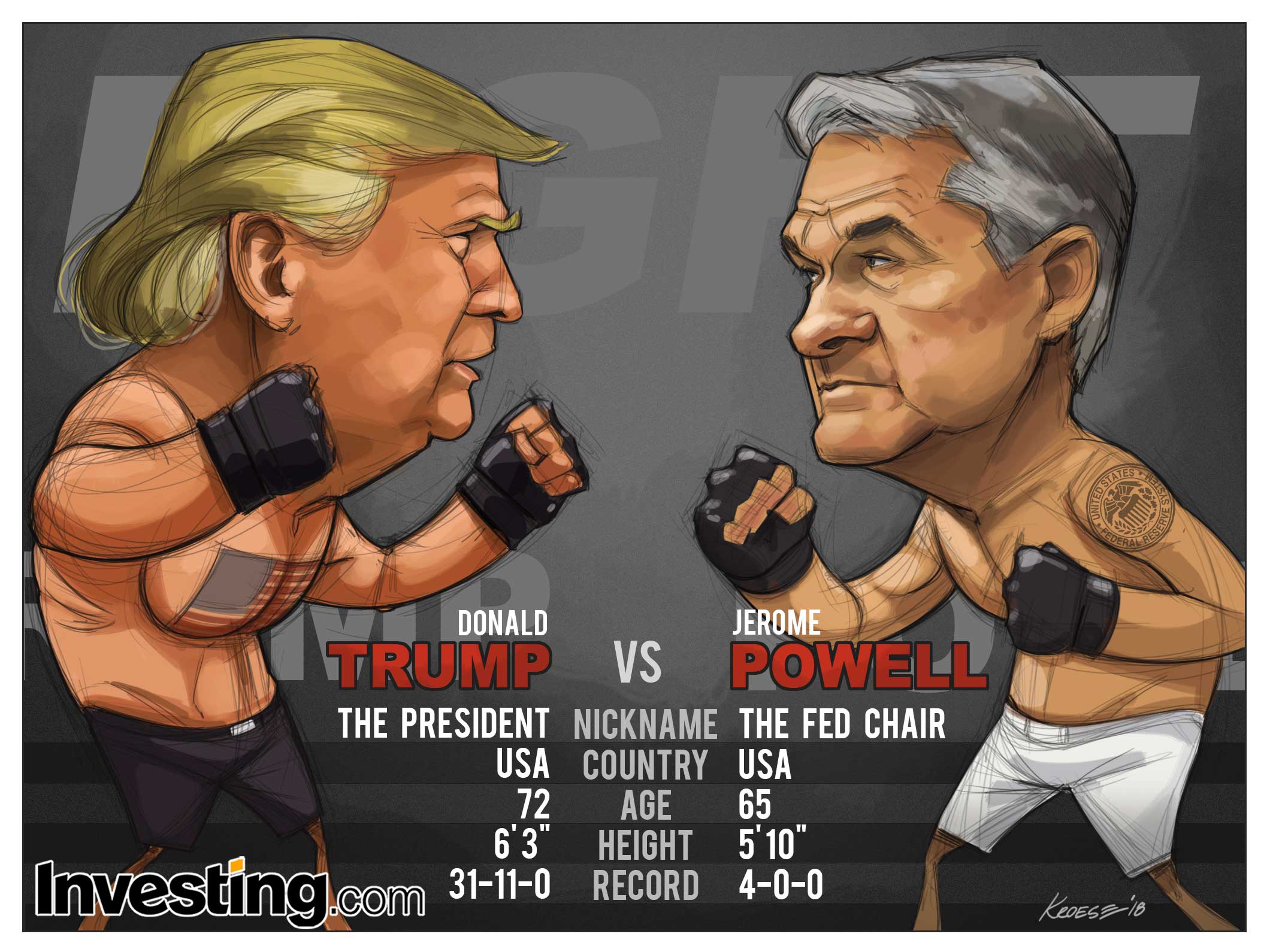

The Fight with the Fed

January 2018 saw the departure of previous Federal Reserve chairman Janet Yellen, known for not liking to rock the boat. In her stead, Trump appointed Jerome Powell as the new chairman. Powell is often referred to as “hawkish” in his approach to the economy, and Trump was not a huge fan of this approach, so the pick was confusing, to say the least. Some suspect that Trump purposefully chose Powell as a scapegoat, in case his economic plans were less than successful. By July 2018, Trump started tweeting about the Fed’s rate hikes, saying:

By late December, rumors were floating around that Trump is not pleased with the downturn the economy has taken, blaming Powell’s rate hikes and wanting to fire him. Trump has since taken a step back, stating that the reason for the hikes is that the economy is doing well and suggesting the Fed will realize they made a mistake and lower rates back soon.

From Stock Market Darling to Grinch

Throughout the first half of his presidential term, Trump has tweeted from his personal account several times a day. This tactic worked in making him seem more connected and transparent to his constituents, and his economy tweets often helped bolster investors’ confidence.

However, Trump’s unpredictability seems to have shaken the faith many investors put in him and his business savviness. As a result, Trump’s tweets now seem to elicit a more cautious reaction from investors, sending individual stocks and the markets into turmoil, with the most recent indication being the “Tariff Man” tweet.

Has Trump lost his Midas touch, or will 2019 see the Tweeter-in-Chief regaining his 280-character magic once again? Will the rest of Trump’s term be like his first year or his second year?

Latest comments

D. T. has never admitted any mistakes and there have been tons of them and as the noose tightens around his and his childrens' necks he will make a lot more. His reckoning is getting closer by the day and he will go down as the worst president in U.S. history. He has destroyed relationships with most of our allies and only thinks about himself. I can't wait to celebrate when he resigns like Nixon! ... (Read More)

Jan 13, 2019 03:59PM GMT· Reply

All I can see he is a smart business person and every ups and down of the stock market will give profit to Trump government and organisation either way. That's the beauty of being a president while with good corporate experience.. . If he creates jobs, should not the working class be grateful. Now I see the reason he is so adamant to build the border wall, its create more jobs and also stop illegal workers from entering US without proper paper and thus create more jobs for US citizen and those who enters US via a legal way.. . 2 cents opinion from far east (Malaysia) and free from political interest. Hisyamizan ... (Read More)

Jan 13, 2019 09:26AM GMT· Reply

Trump is a destabilizing influence, both in America and Globally. His America only policies are simply a non-starter. The global genie has been out of the bottle for decades and Trump cannot turn the clock back to the Truman era, on which his economic beliefs are founded. His obnoxious approach to international relations has made him a laughing stock around the world. His trade war policies are driving much of the world directly into the arms of China. The result will be that China and India will dominate the world and America will become insignificant. Hopefully, mores sensible leaders will be able to reign Trump in before he completely ruins America and many of it former allies. ... (Read More)

Jan 09, 2019 11:53PM GMT· Reply

Trump is a global destabilizing influence and needs to be brought to check very soon. His America only policies are a non-starter in global economics. The globalization genie has been out of the bottle for decades and the small minded Trump should not be allowed to ruin the American economy by trying to eliminate global trade. Certainly, China should not be allowed to steal IP, but to suggest that a negative balance of trade with China is a problem just underlines how little Trump and his draconian advisors understand. Trump is just driving the rest of the world directly into the arms of China and the result will be a US that is weaker with China and India poised to dominate the world. ... (Read More)

Jan 09, 2019 11:47PM GMT· Reply

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.