Hamburgers & Cicadas - What HBO’s Silicon Valley Got Right About Historical Data

Inside Investing | Nov 05, 2018 03:13AM ET

In the first season of the HBO series Silicon Valley, Peter Gregory - an eccentric owner of a VC, orders a bunch of hamburgers, but instead of eating them, he just stares at them.

When we finally get back to him later in the episode, Peter states that he wants to invest in sesame seeds.

A confused aid asks him why, and Peter replies that a certain species of cicada that only emerges every 18 years is about to emerge again, and this species favors sesame as food, leading to a world shortage in sesame, which means that the price of the tiny seeds is about to skyrocket.

You may not get that Peter Gregory moment, but investors with a keen eye and attention to details will be able to find trends and possibly even predict upcoming financial events (it’s almost like knowing the lottery numbers in advance).

Using our Historical Data tool, users can check any financial instrument on Investing.com and see the related historical data (going back as far as 1980). Registered users can download this data into an Excel file for later review and analysis.

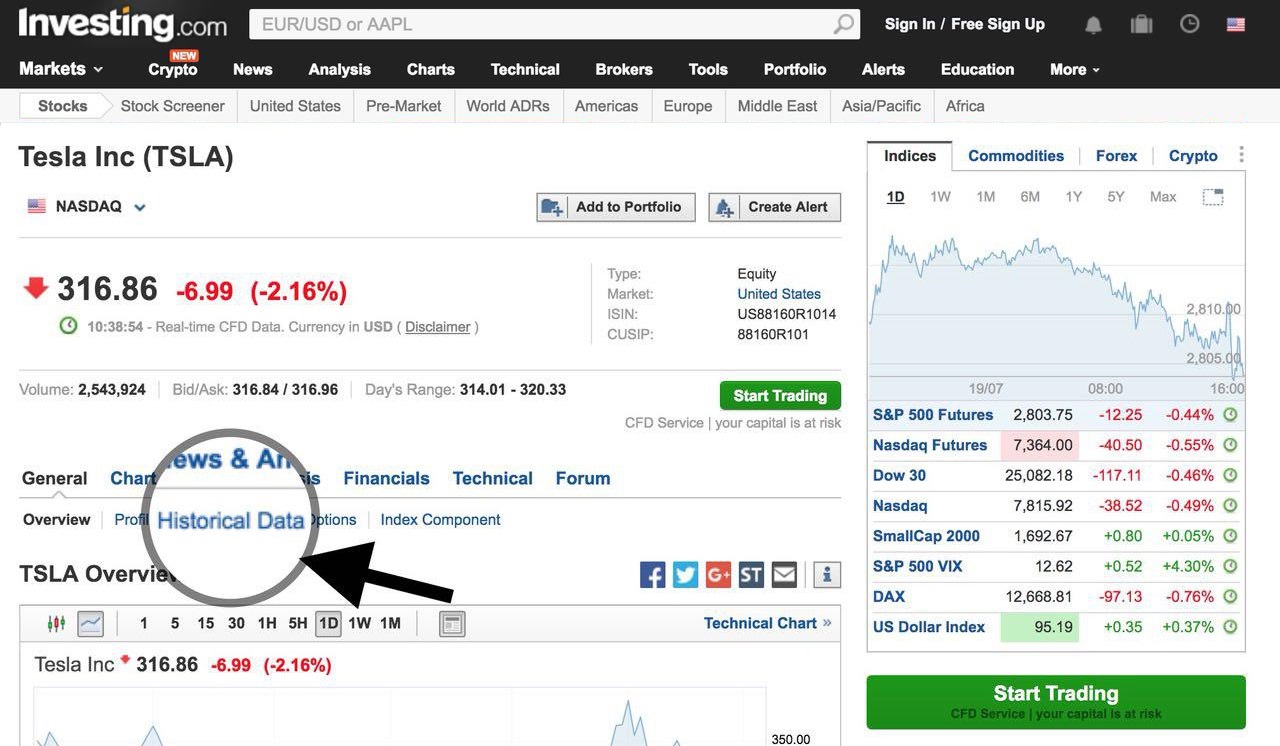

Need help finding the historical data? - Simply select the financial instrument you’re interested in, in this case, we chose the Amazon.com stock:

Select the ‘Historical Data’ option, choose your desired dates range, hit ‘Apply’ and review the data on our site, or download it to your device.

And there you have it - as far as 30+ years of historical data on stocks, bonds, indices and cryptocurrencies at your fingertips.

Now, imagine what you may be able to figure out on your own...

Be the first to comment on

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.