Global ETF Survey 2023: Results and Insights

What's New | Jun 14, 2023 02:48PM ET

Earlier this year, we requested support from you, the readers at Investing.com, to gather your insights for a survey related to ETFs .

In addition to generating STT ), and Investing.com, helped raise funds for the victims of the earthquake in Turkey.

With your support, we were able to raise approximately US$5,500 to donate to this initiative. We would like to take the time to thank you for your input, and share some of the key insights gathered.

The survey provides a comprehensive overview of the current usage of ETFs and insights into how the industry is expected to evolve in the coming years. Here are highlights drawn from the data:

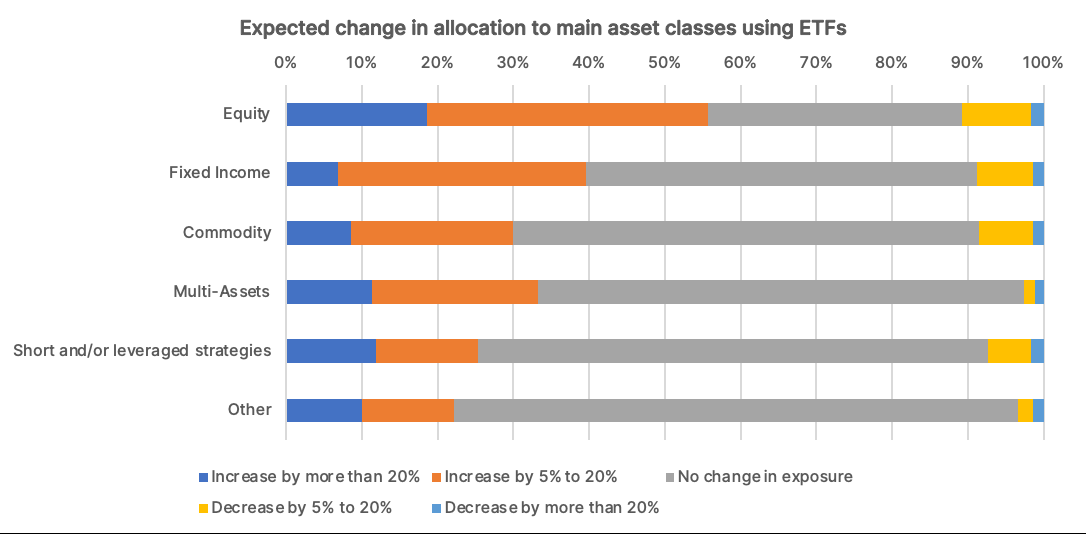

● Investors’ interest in ETFs remains high, with 56% of respondents planning to increase their exposure to Equity ETFs and 40% to Fixed Income in the next 2 to 3 years.

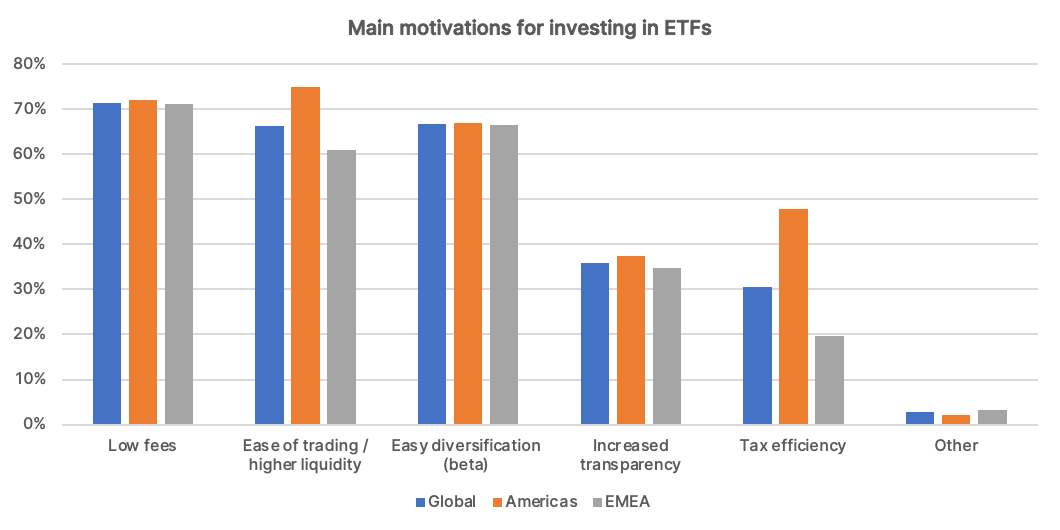

● ETFs have gained popularity among investors because they offer attractive features like low fees, easy diversification, and accessibility. Tax efficiency also plays an important role in ETF popularity in the Americas.

● Active strategies continue to build pace globally. The percentage of respondents having between 6% and 40% of their portfolio invested in actively managed ETFs is higher than ever.

● Investors are ready for Active ETFs, especially in the Americas, where they also use these products for Fixed Income and Thematic investing, while interest is mainly on equity in Europe. Nearly 80% of respondents in the Americas stated they would be more inclined to invest in an active strategy if packaged as an ETF rather than a mutual fund.

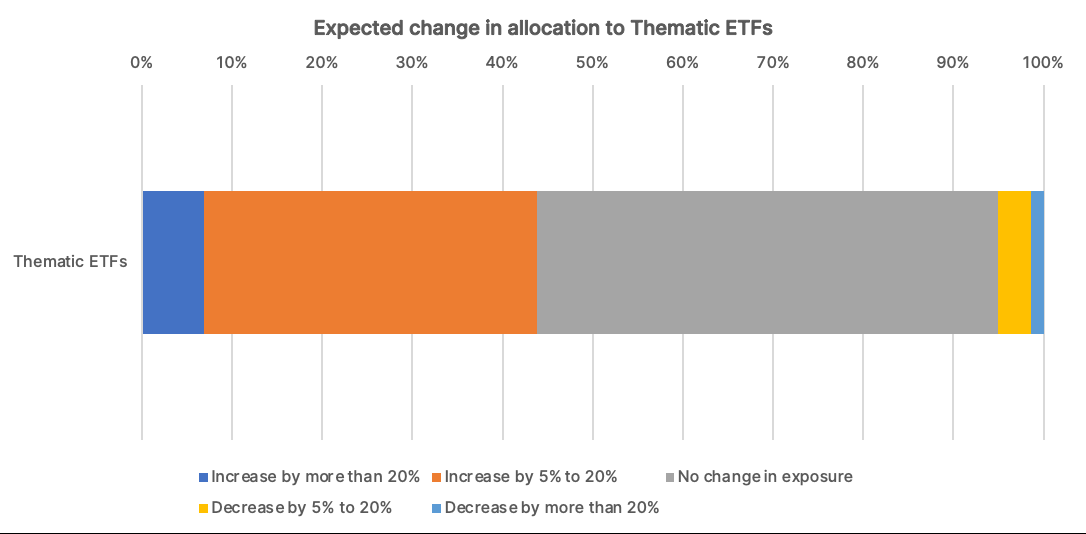

● Thematic investing strategies are all the rage, with 40% of respondents anticipating an increase in their allocation over the next few years, mainly for diversification and long-term strategies.

● ESG investing faces greenwashing concerns, and investors expect increased transparency; 60% of respondents have cited the inconsistencies of ESG analytical grids and guidelines as the main hurdle to investment.

● Investors look for Crypto solutions (single and multi-cryptocurrencies strategies) wrapped into ETPs as an easy way to access this market and get rid of wallet management issues.

The full report , available for free on etfcentral.com, details the key findings and ETF trends from over 500 professional investors who manage almost $900 billion of assets through ETFs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.