Fed Rate Monitor Tool Tells You What to Expect from FOMC Decisions

What's New | Aug 01, 2016 06:30AM ET

We’re excited to announce the launch of a handy, yet sophisticated tool – the Fed Rate Monitor – that calculates the expectations for rate hike changes.

Every one to two months, the Federal Open Market Committee (FOMC) – the governing body responsible for US monetary policy – meets to analyze the US and global economies and decide whether to raise, lower, or hold, interest rates. Their decisions often have quite a big effect on global markets and any trader is liable to be exposed if caught unprepared. But now, traders can use our tool to quickly familiarize themselves with market expectations and plan their speculative/futures trades accordingly.

You can access the tool by navigating from the main menu to Tools > Fed Rate Monitor Tool.

Here’s how the tool looks:

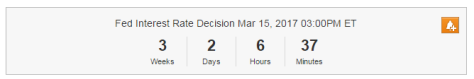

At the top of the page is the countdown to the next Fed interest rate decision. Traders can use the orange Create Alert icon in the top-right corner to send themselves a reminder ahead of the event.

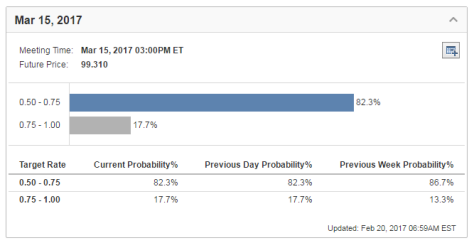

Next comes the section describing the expectations of the Fed’s decision, which is calculated based on the prices of 30-day Fed Fund Futures.

In the example below, the next futures contract price is 99.310, and based on the tool’s internal calculation, that leaves an 82.3% chance of the interest rate holding steady at 0.50-0.75 and a 17.7% chance it gets raised to 0.75-1.00. The more futures contracts there are until the Fed meeting in question, the more data the Fed Rate Monitor Tool can provide.

Traders can use the Add to Calendar icon at the top-right of this section to add this event to their personal calendar.

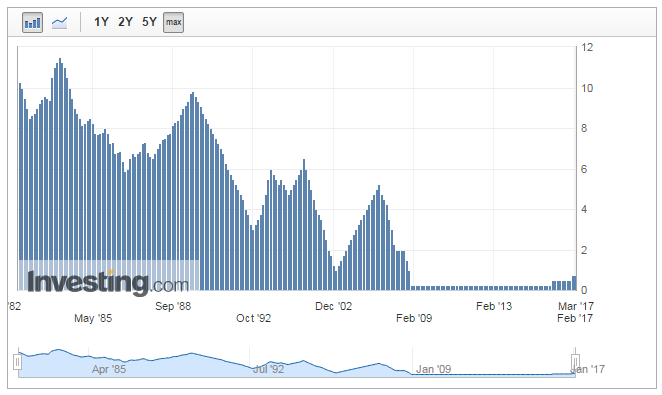

Finally, there is a histogram of previous Fed interest rate decisions.

Enjoy the new tool! You can access it here and stay informed of Fed rate expectations.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.