COVID-19 threatens to disrupt Christmas spirit, reveals survey on personal finance

What's New | Dec 24, 2020 08:17AM ET

From a personal finance perspective, COVID-19 could be the proverbial grinch that steals Christmas in 2020.

It stands to reason that the personal finance woes typically associated with the pandemic, including job loss and instability in the financial markets, would affect consumers’ spending habits around the holidays. As we approach Christmas day, millions of Americans are out of work and at risk of losing their homes. Yet COVID-19 has also spurred unprecedented government financial assistance for businesses and individuals.

Does the government support offset consumers’ personal finance concerns, or is the pandemic’s destabilizing impact the overriding factor shaping spending behavior?

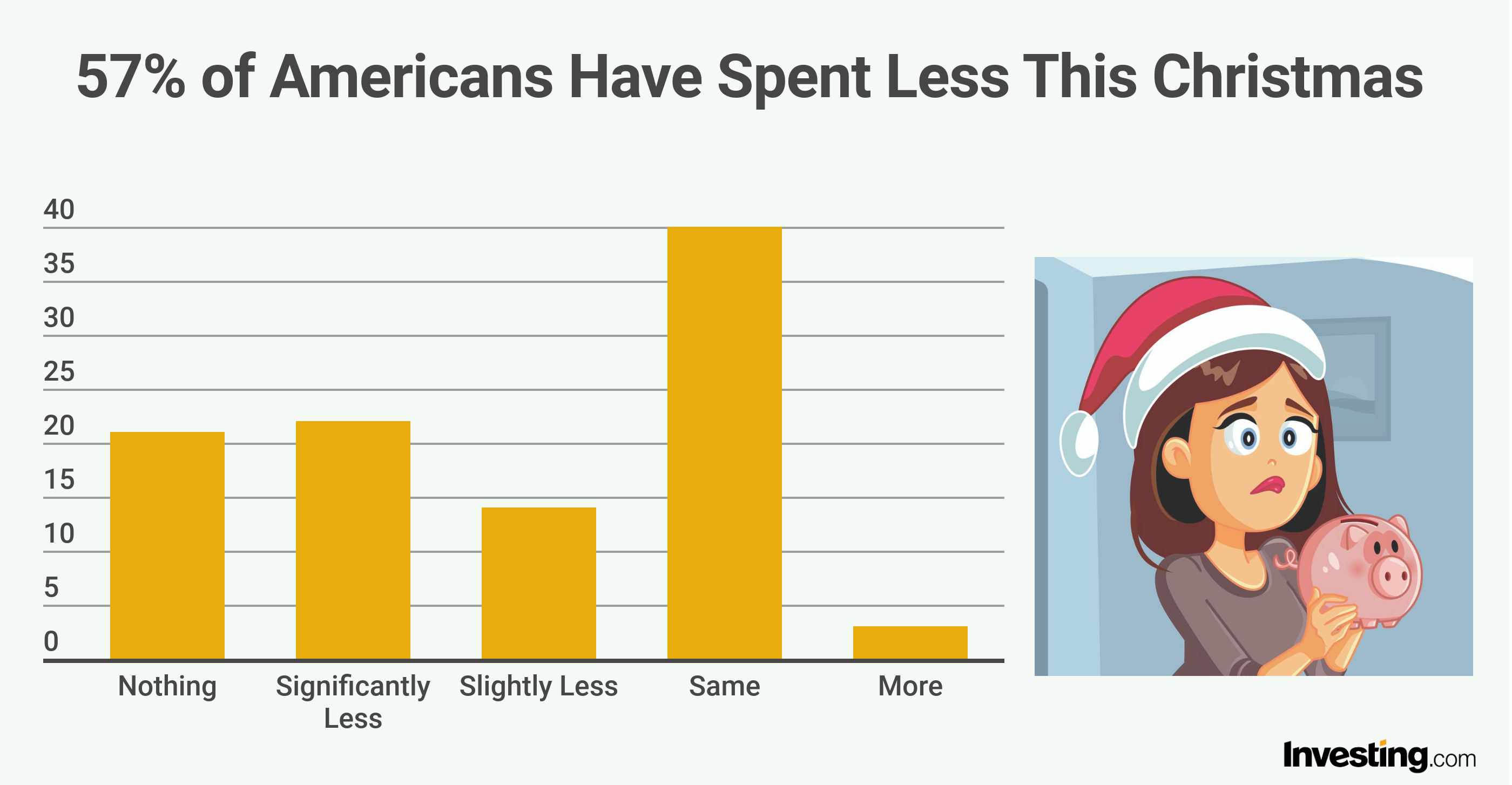

According to new survey data compiled by Investing.com on the effect of COVID-19 on personal finance in the U.S., the pandemic has in fact led to more cautious consumer behavior this holiday season. Approximately 57 percent of the poll’s 2,651 respondents said they have decreased their Christmas spending, including 21 percent who stated they “won’t be able to purchase anything this year.”

“The upcoming holiday season will likely be very different for families across the United States when compared to previous years,” said Jesse Cohen, senior analyst at Investing.com. “Not only will holiday gatherings be smaller, but the economic impact of the COVID-19 pandemic will mean that holiday shopping and spending on gifts is out of reach for many Americans this year.”

“It seems evident that without additional stimulus support, the economy - and Main Street retailers - will continue to struggle with the negative effects of the ongoing health crisis,” Cohen added.

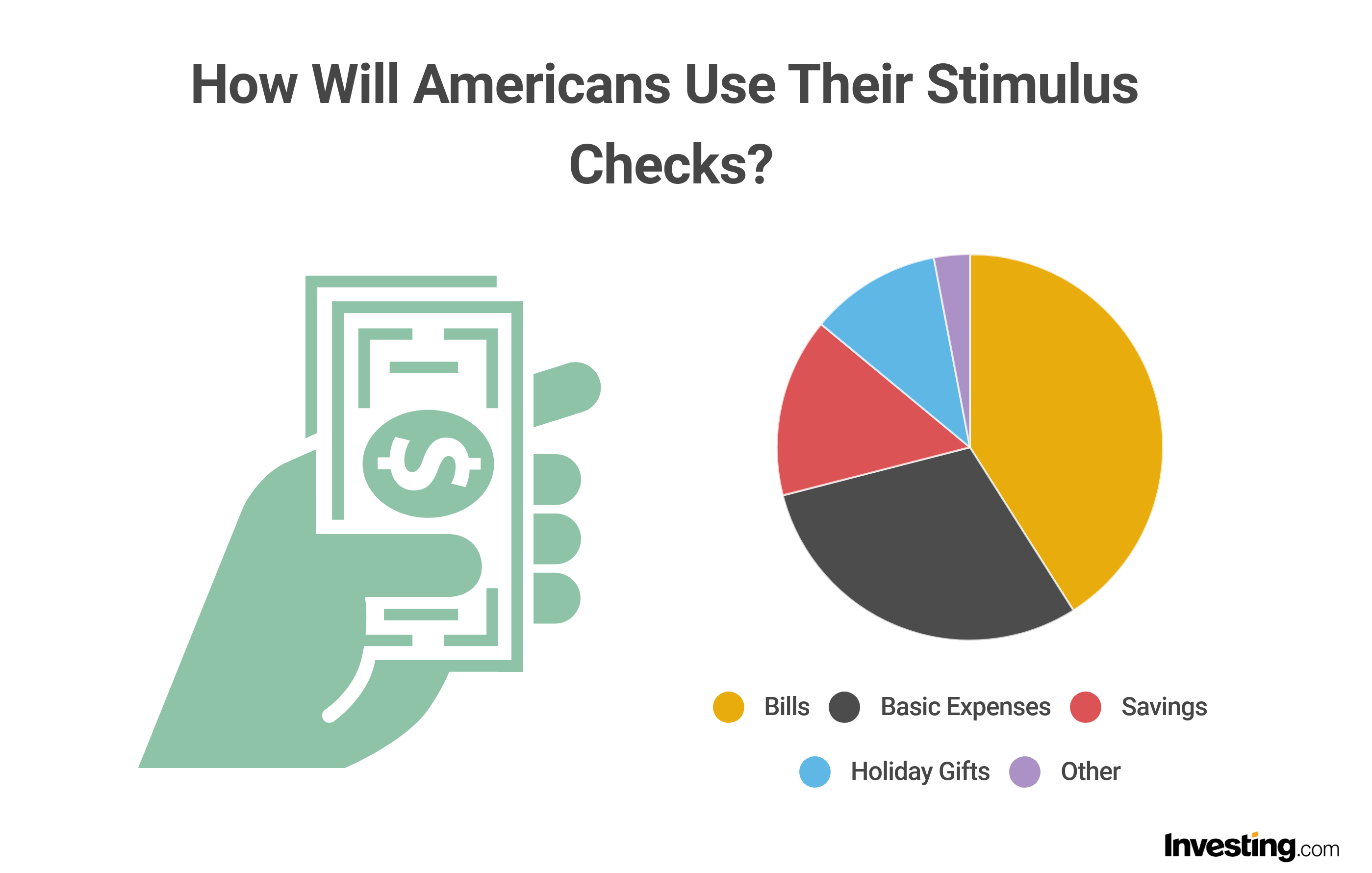

With Congress failing to quickly reach a deal that would send more money to struggling families, a second stimulus package was finally approved on Sunday night. However, there’s little to suggest this will have much of an impact on consumer spending this Christmas, with just 11 percent saying that they would use their stimulus check on holiday shopping. Over 70 percent of Americans said that they would use the check to either pay off bills (41 percent) or help cover basic expenses (30 percent).

“Following months of back-and-forth haggling, U.S. lawmakers finally came to an agreement on more fiscal aid which will provide much-needed financial breathing room for millions of Americans,” Cohen noted. “The potent combination of stimulus and vaccine optimism has investors looking past a tough winter to a better spring and summer ahead.”

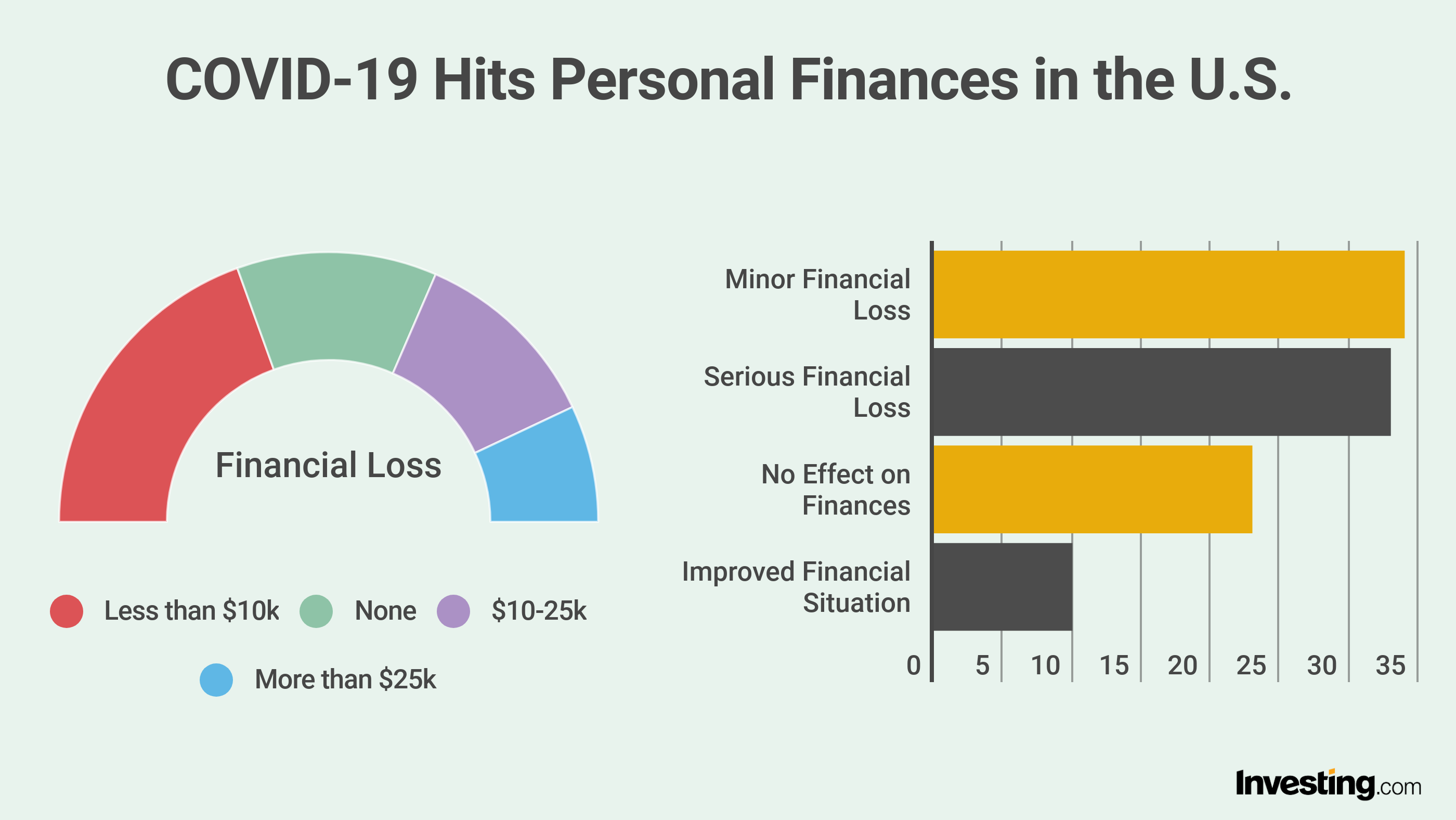

Two-thirds (67 percent) of Americans reported that the pandemic has caused some form of financial loss, with 33 percent describing their loss as “serious” and 34 percent as “minor.” Regarding the extent of their financial loss, 62 percent reported losses of less than $25,000, including 39 percent under $10,000. Only 14 percent experienced a loss of more than $25,000.

Ultimately, the psychological effects of COVID-19 on personal finance could be as significant as the pandemic’s actual impact on individuals’ bottom line, or even potentially more significant. Seventy-seven percent of Americans said the pandemic’s financial implications have made them more anxious, exceeding the 67 percent of respondents who reported tangible financial loss.

Further, despite the country beginning it’s vaccination drive last week, our respondents are bracing for the continuation of these financially challenging times, with 76 percent expressing some level of concern about their finances for as long as the pandemic persists.

“Despite the challenging times ahead, there is light at the end of the tunnel,” Cohen said. “Positive announcements on the vaccine front from the likes of Pfizer (NYSE:PFE), and Moderna (NASDAQ:MRNA) have boosted hopes that life could return to some sort of normalcy in the months ahead.”

Considering the pandemic’s impact on consumers’ mindset as well as on their actual spending patterns, COVID-19 poses a serious threat to disrupt this year’s Christmas spirit. Let’s hope that a vaccine or other breakthrough can restore the holiday cheer in time for December 2021.

Latest comments

Awesome article, here is another good one, 7 Deadly Mistakes to avoid on Robinhood, http://www.SmartOptions.ai/post/options-trading-robinhood ... (Read More)

Feb 14, 2021 08:30PM GMT· Replygreat ... (Read More)

Feb 02, 2021 03:02PM GMT· ReplyHas anyone heard of Bee Network, it's a new mobile app which was launched on December 3rd 2020. The idea is it mines a cryptocurrency, for free, called Bee coins, it already has over 1 million users so there could be potential for growth. And it's all completely free which could cause large number of people to download it. Does anybody have any thoughts on if it could increase in value? Also if anyone wants to download it, as zero cost and potential reward, you need a referral code and I would appreciate it if you used mine (simpo10) ... (Read More)

Jan 14, 2021 03:30PM GMT· Reply

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.