Buffett’s Blunder and Other Great Mistakes

Inside Investing | Feb 28, 2019 05:02AM ET

Anyone who’s been following finance news recently has seen the story of how Berkshire Hathaway (NYSE:KHC ). This is not the first, or last time this will happen to investors, but remembering the truly big mistakes may help you avoid making similar mistakes in the future. Below you will find the 5 of the greatest investment mistakes, regrets, and bad decisions in recent history.

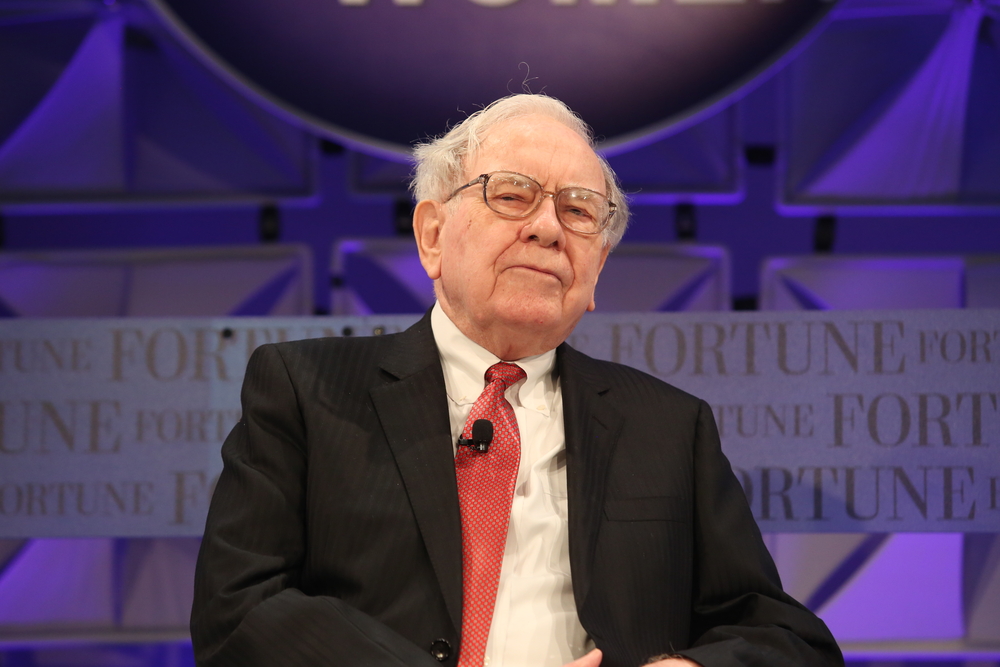

1. Buffett's (First) Berkshire Billions Blunder

Did you know that Warren Buffett first invested in Berkshire Hathaway all the way back in 1962? Back then it was just a failing textile company, Buffett bought a whole lot of shares, planning to profit when other textile mills close down. Seeing green, the company tried to squeeze more cash from Buffett, which angered the man. As a reprisal, Buffett bought the controlling share of the company and fired the CEO, then tried to make the business become profitable again for 20 years. When asked about it, Buffett said he estimates he lost some $200 billion on the business. WOW…

2. Not Taking a Bite of the Apple

Alongside the names Steve Jobs and Steve Wozniak, Apple (NASDAQ:AAPL ) had a 3rd founder - Ronald Wayne. Mr. Wayne had a pivotal role in the company during its first years, but after 11 days he decided that the company doesn’t have a future, he sold the 2 his share of the company for $800 (yes, that’s a mere eight hundred dollars). If he’d have kept his share, it would now be worth over $32.5 billion today. Sometimes you just have to HODL...

3. How 20th Century Fox Outfoxed Themselves

Back in 1977, a young and not very-well-known director called George Lucas released what was to be the first Star Wars movie. Back then, the executives at Twenty-First Century Fox (NASDAQ:DIS ) for just over $4 billion, and in 2018 the entire Star Wars franchise’ worth stood at a whopping $65 billion.

4. How $70,000 Turned to $1.1 Billion (Loss)

Back in 1983, Toshihide Iguchi was working as a portfolio manager in the New York branch of Japan’s Daiwa Bank (OTC:DSEEY ). Iguchi traded Federal Reserve Notes (FRN) but incurred losses worth $70,000. In an effort to conceal his losses and save his reputation, Iguchi kept his mistakes a secret for several years, as the losses kept growing. In 1992, Iguchi blamed what was now a $350 million loss on 2 junior traders, prompting a federal investigation that found nothing. By 1995, Iguchi’s losses amounted to over $1 billion. Feeling the burden on his conscience, Iguchi sent a confession letter to the bank president and eventually was arrested. Talk about not knowing when to cut your losses…

5. Not Getting Excite(ed) Enough for Google

Most of you won’t remember this, but back in 1999, the search-engine war was still raging. The giants of that time included Yahoo!, Excite, and Altavista, with Google (NASDAQ:GOOGL )), is worth $777 billion. Talk about a lost investment...

So, what was YOUR worst investing decision? Tell us in the comments.

You may also like:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.