3 Of The “Strangest" ETFs That Need to Be on Your Radar

Inside Investing | May 20, 2019 08:07AM ET

Exchange-traded funds (ETFs) have taken the investing world by storm in recent years. According to research firm ETFGI, there are 5,024 ETFs trading globally, with 1,756 based in the U.S. alone.

It’s no surprise then that ETF managers are doing all they can to make their funds stand out from the rest of the crowd, whether that means giving it a “strange” name or investing in a “strange” industry.

But first let’s ask, what exactly is an ETF?

In short, an ETF is a security that tracks stock indices, commodities, bonds, or baskets of other assets, but trades like a common individual stock.

There are various types of ETFs available to individual investors and traders that can be used for either income generation or to hedge risk in an investor's portfolio.

So without further ado, here are the three ETF’s we found to be the “strangest” that offer investors and traders potential for significant gains.

Remember: Like beauty, “strange” is in the eye of the beholder.

In case you like “strange” investments…

UFO

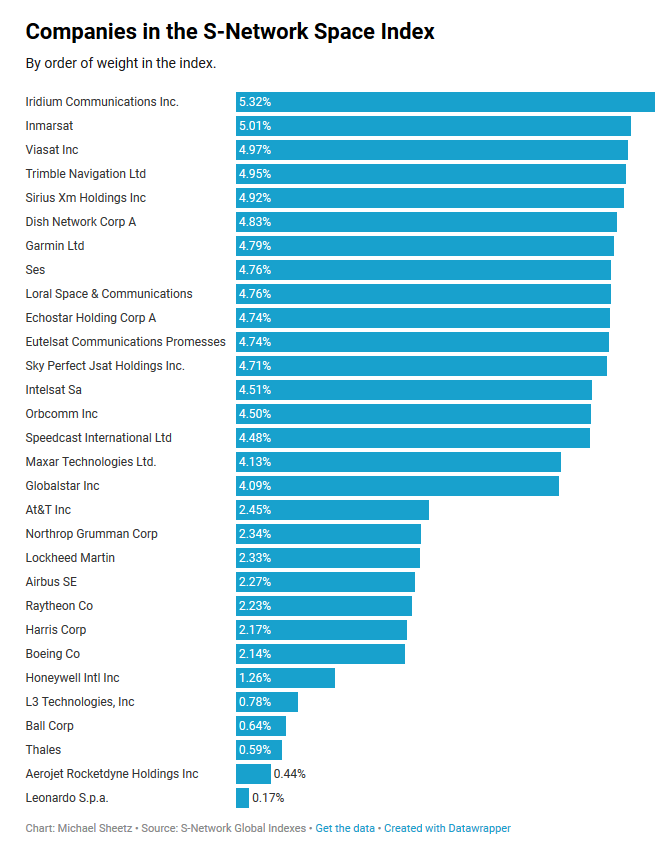

The Procure Space ETF (Ticker: UFO) of 30 companies gives market players a way to invest in the burgeoning space economy.

The fund, launched on April 11, includes everything from satellite communications firms – such as Iridium Communications, Inmarsat, Viasat – to industrial manufacturers – Garmin, Airbus, Honeywell (NYSE:HON ) – and more.

According to Andrew Chanin, co-founder and CEO of ProcureAM, UFO focuses as much as possible on “pure play” space companies, with around 80% of the constituents deriving most of their revenue from space businesses.

“UFO provides, compared to other types of investment vehicles, a relatively low cost and diversified away to invest in this specific theme,” Chanin said.

UFO is up nearly 4% since its inception.

YOLO

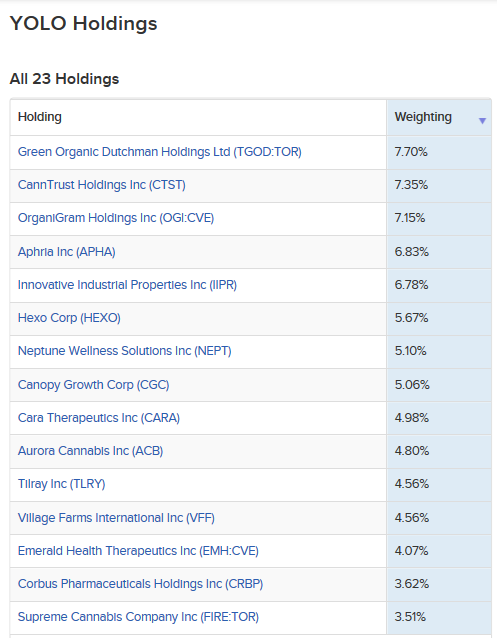

The AdvisorShares Pure Cannabis ETF (Ticker: YOLO) is an actively managed marijuana-themed exchange-traded fund with nearly $15 million assets under management.

The ETF, which made its trading debut on April 17, is backed by BNY Mellon. It will typically hold between 20 and 40 stocks and focus on mid- and small-cap companies involved either directly or tangentially in the cannabis space, such as Aurora Cannabis, Canopy Growth, and Tilray.

The fund "seeks long-term capital appreciation by investing in both domestic and foreign cannabis equity securities", according to Maryland-based AdvisorShares. "YOLO is designed to fully-invest for pure cannabis exposure under the guidance of a deeply experienced portfolio management team navigating the emerging cannabis marketplace."

It might be too soon to judge the performance of this ETF — YOLO has gained roughly 1% since it began trading.

IPO

The Renaissance IPO ETF (Ticker: IPO), with $37 million in assets under management, is designed to provide investors with exposure to a portfolio of U.S.-listed newly public companies ahead of their inclusion in core equity portfolios, according to Renaissance Capital.

The fund holds the largest, most liquid newly-listed U.S. publicly-traded companies. "Sizable" IPOs, such as the recently-listed Pinterest (NYSE:PINS ) and Zoom, are added on a fast entry basis. Companies are then removed from the ETF two years after their initial trade date, when they become seasoned equities.

Its top holdings include Elanco Animal Health, VICI Properties, Okta, and Spotify (NYSE:SPOT ) Technology.

IPO is up around 51% since it began trading back in October 2013.

What all this means to you…

When taking all of the above into consideration, some of these so-called “strange” ETFs are definitely worth a look and should be on your radar. Just be sure to do your research beforehand and are fully aware of the risks as well as the potential rewards of making such an investment.

No matter what, you can be sure of one thing: any investment that’s as unique as some of these are could be fun to follow.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.