“Essentially” Oversold But Danger Abounds

Dr. Duru | Jun 21, 2013 06:11AM ET

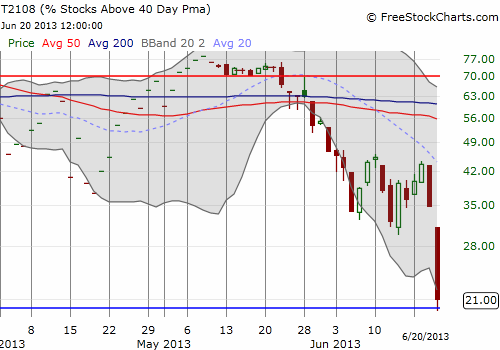

: 21.0% (intraday low of 19.9% – essentially oversold)

VIX Status: 20.5 (retested level that launched summer swoon in 2011)

General (Short-term) Trading Call: Scale into longs for short-term bounce from oversold conditions

Active T2108 periods: Day #1 under 30% (underperiod), Day #2 under 40%; Day #20 under 70% (underperiod)

Commentary

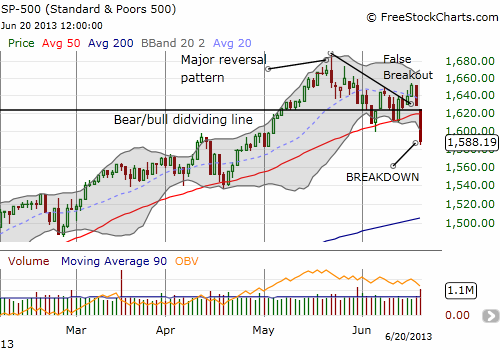

If I had a bearish bias coming into today, I would have collected a large payday on ProShares Ultra S&P 500 (SSO) puts. Even sticking with the older plan of playing a breakdown from the wedge would have yielded great results today as the S&P 500 (SPY) gapped down exactly under the bear/bull dividing line and sold off in a near straight line from there. However, just as I did not play the breakout (thank goodness for wariness ahead of the Fed meeting!), I did not play the bearish angle of today’s breakdown as I was on watch for oversold conditions.

Today’s 2.5% loss on the S&P 500 (SPY) was the index’s largest loss since a 3.7% plunge November 9, 2011. T2108 plunged in response with a gut-wrenching 39.6% loss down to 21%. This was T2108′s largest one-day loss since a 49.1% plunge on May 21, 2010 where T2108 hit an amazingly low 9.7%. The 52.0% 2-day plunge was T2108′s largest since a 56.1% 2-day loss on August 8, 2011 when T2108 closed at 11.5%. Since 1990, there have only been 18 occurrences of T2108 dropping at least as much as it has done in the past two days. Like today, all of these plunges happened below both the 20 and 50DMAs. At its low for the day, T2108 hit 19.8%, oversold conditions (the picture-perfect and sharp bounce from oversold levels tells me I am not the only one watching these levels closely!). Put this all together and not only is T2108 quasi-oversold, but it is also essentially (classically) oversold.

The sheer scale of what happened today took me off-guard. I did not think the market would hit oversold conditions until next week and certainly not drop with such ferocity!

As on previous occasions with the potential for (quasi) oversold conditions, I ran the T2108 Trading Model (TTM) to look for an early start on trading. As I noted in an earlier post, I learned that sensitivity analysis is important in interpreting the results. I have not yet adjusted the code to accommodate multiple scenarios, but I did run the model several times throughout the day. The results were VERY instructive. I tweeted some of these (in chronological order):

- If $SPY closed here, #T2108 model projecting 72% odds of up day tomorrow. Model surprisingly only depends on #T2108 close. Will monitor.

- Technicals worse, #T2108 model still has 72% odds of $SPY up Fri. Model now only depends on #VIX % chng. Will continue sensitivity analysis.

- Odds shot up to 82%. Model looking sufficiently robust. Depends on #VIX and #T2108 close. Scaling into $SSO calls. #120trade

- #T2108 model dropped odds of up day tomorrow to 64% (not so good). So I am thinking I get another opp to add to $SSO calls at lower prices.

- #T2108 model final odds for up day tomorrow = 68%. Borderline. Decision tree reduced to 1 node. Conditions ripe for $SPY gap down buying opp

Not only did I check the projections, I checked the best model for the classification algorithm. Each one had a different feature: single node, or dependent on just a close above a threshold on the VIX change and/or a threshold for the T2108 close. No threshold was ever even close to levels current at the time. The preponderance of predictions for an up day gave me the confidence to start scaling into SSO calls even ahead of official oversold conditions (think of this as a play on quasi-oversold). I started small, using July calls. My intention with these plays is always boom or bust, so I like buying some time premium in case a scenario unfolds that just requires more time; I set the capital at risk like a stop loss.

The day ended with a projection of a 72.2% chance of an up day tomorrow (June 21st). The model is a single node because the entire “problem space” only contains 18 cases. And these 18 cases are remarkably similar to the current one. Of these 18 cases, the S&P 500 closed down only 5 times the following day. The range of returns has been extremely wide: as low as -6.6% on August 8, 2011 to +6.3% on November 21, 2008. Thirteen (13) of the eighteen (18) cases have occurred since 2007, one in 2011, and none in 2012. the AAPL bottom will hold, it seems a gut-wrenching retest of those lows is in the cards…perhaps even BEFORE July earnings.

Note again that the “Apple Trading Model” (aka ATM) is working well in this case with AAPL getting progressively weaker going into the end of the week. After selling out of my puts, I dipped early into an AAPL call expiring NEXT Friday.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SSO calls, long AAPL shares and calls

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.