Yuan Halts 3-Day Slide

MarketPulse | Aug 14, 2015 06:30AM ET

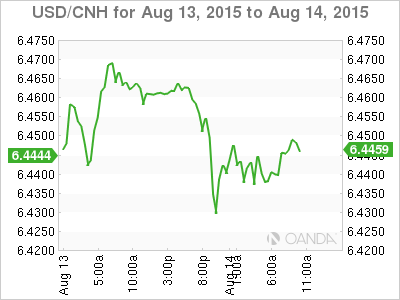

The yuan halted a three-day slide after China’s central bank raised its reference rate for the first time since Tuesday’s devaluation and said it will intervene to prevent excessive swings.

The onshore spot rate was little changed at 6.4003 per dollar as of 12:56 p.m. in Shanghai, after falling 3 percent this week. The People’s Bank of China said Thursday there’s no basis for depreciation to persist and that it will step in to curb large fluctuations. It followed up with a 0.05 percent strengthening of its daily fixing on Friday, after three cuts of more than 1 percent each.

China’s first major devaluation since 1994 surprised global investors and fueled concern that authorities are struggling to combat a slowdown in the world’s second-largest economy. Policy makers are trying to balance the need for financial stability against a desire for stronger exports and the yuan’s inclusion in the International Monetary Fund’s basket of reserve currencies.

“The PBOC sent its signal and people understand it’ll be very difficult to go against the PBOC’s will,” said Ken Peng, a Hong Kong-based strategist at Citigroup (NYSE:C), the world’s biggest currency trader. “The central bank will frequently intervene in the foreign-exchange market in the next three months because it needs to ensure the yuan is stable.”

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.