Yen Pairs Test Key Support As ‘Phase One’ Sits On A Knife's Edge

City Index | Nov 21, 2019 12:19AM ET

Whilst the constant stream of hot and cold trade headlines risk trade-tease fatigue among market participants (for which I am guilty as charged…), it’s possible we’re at an inflection point which could impact risk sentiment, one way or another.

A phase one deal is looking less and less likely and has all but been pushed back into next year. Trump has been quite vocal that he expects to get the deal he wants with China or the tariffs delays will be removed. So, reports today that China isn’t “stepping up” should be taken seriously as it indicates that the Chinese aren’t concerned with the tariffs, and are in no rush to sign the phase one trade deal Trump so desperately wants.

Add into the mix that Trump is considering signing the Hong Kong peace treaty (which China has condemned yesterday) and we have all the ingredients for the trade deal to fall apart whilst equities remains just off their record highs and JPY pairs are testing key lows.

We noted previously that several JPY pairs pointed towards a ‘risk reversal’, and the anticipated corrections have since come to fruition. Yet now we see that these corrections could turn into something more sinister if key support levels are broken. And perhaps a trade deal, or lack of could be the trigger.

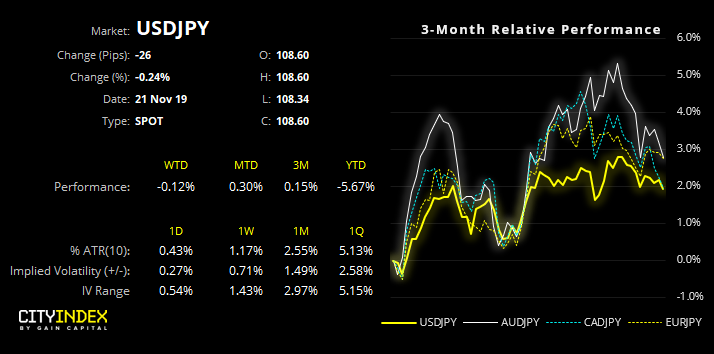

USD/JPY: The bearish wedge remains in play and a lower high has formed to suggest a change in trend is at least trying to occur. Yet we clearly need support to break with momentum (and likely soon) for this scenario to remain alive.

AUD/JPY: There’s potential for a bearish wedge to form, although the pattern is still within its infancy so would require at least one more cycle higher. Besides, price action is already considering a break of the lower trendline and is clearly taking notice of resistance at 74.32.

CAD/JPY: The interesting thing with CAD/JPY is that it’s about to either confirm of invalidate two potential patterns; a bullish and a bullish channel. The bullish channel was flagged in prior analysis and perfectly marked the top of its rally through October, and price action is now testing the lower bounds of the bullish channel and bullish wedge.

- However, we we’re bullish on AUD/CAD over the near-term, CAD/JPY could be the better short than AUD/JPY is we see broader JPY strength.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.