Year End Review: Small Cap Stocks

Craig Adeyanju | Jan 17, 2017 06:19AM ET

Small cap stocks have been on fire this year, and it looks like 2017 could be an even better year for them when Trump takes office in January. The Russell 2000 Index ended 2016 up 19.48%, and outperformed the S&P by nearly 10% and the Nasdaq-100 Index by over 10%.

There were a number of reasons why the small-cap space outperformed mid- and large-caps in 2016. 2017 is a big year for U.S. small-caps due to the potential change in regulations and planned corporate tax rate cut. Trump’s plans could boost small-cap companies’ revenues and earnings, which would push their share prices higher.

Trump has a protectionist mindset and argues for less global trade, U.S. small-cap stocks could generate more sales since smaller companies tend to generate only a minor portion of their earnings from overseas sales. Less global trade will squeeze mid- and large-cap companies’ profit margins, and in turn, this would benefit small-cap companies’ margins.

Now, Trump’s tax reform is one of the main factors that should boost small-cap stocks. Trump’s tax plan was one of the main focus points of his campaign, and it’s his main priority for the first 100 days as U.S. President. What does this mean for small cap stocks? Higher potential gains.

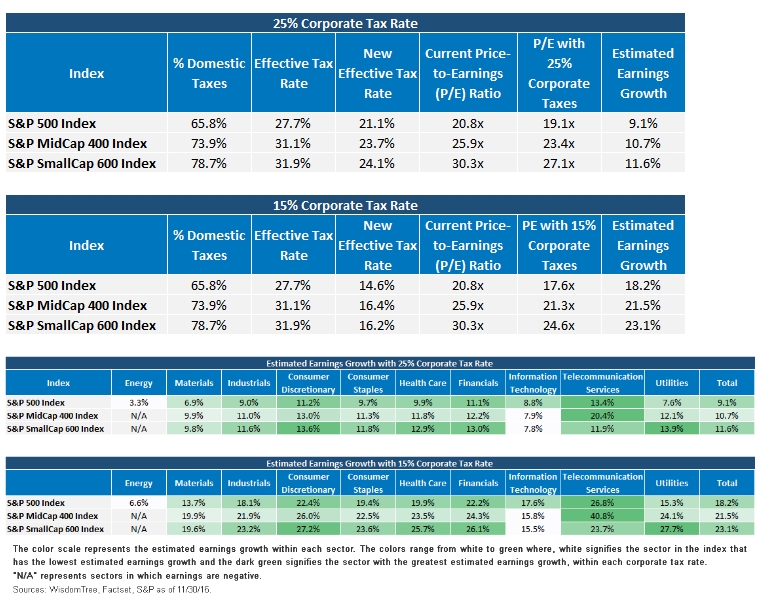

Small caps are typically taxed in the U.S. at a higher tax bracket than mid- and large-cap companies with sales overseas. If Trump is able to lower corporate taxes significantly, the valuations in small cap names would look highly attractive .

Take a look at the analysis above, if the new effective tax rate falls to approximately 15%, the S&P SmallCap 600 Index earnings are estimated to grow by 23.1%, while the S&P 500 Index earnings are estimated to grow just by 18.2%.

That being said, let’s take a look at some of the memorable trades in the small cap space, in 2016.

A Small-Cap Stock Expert Weighs in on the Performance

One small cap expert, Jason Bond, who has various training programs and provides newsletters, capitalized on a small-cap stock in 2016. Jason wasn’t always a small-cap expert. However, with hard work, dedication and a good mentor, he went from being a New York state elementary school teacher with no net worth and a massive student loan debt to an expert in the space.

According to Jason Bond, he anticipates a good first-half performance from stocks in 2017. He stated in a report,

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The AppI anticipate a good first-half for stocks in 2017, with FANG (NASDAQ:FANG) stocks underperforming, while industrial, commodities, defense and gold stocks leading the way. I mention gold stocks in my short list, because I also anticipate consumer price inflation to accelerate during the first six months of 2017.

Now, Jason Bond had an impressive trade in Fannie Mae in November 2016, and here’s a look at its performance during the fourth quarter of 2016. Bond got long this stock after the election results came out. However, nearly a year ago, he suggested that Trump fully understood how shareholders of Fannie Mae suffered due to the US government. That’s not too hard to conclude, and is why the stock soared following his win at the polls.

Federal National Mortgage Association (Fannie Mae)

Fannie Mae (OTC:FNMA) was one small-cap stock that had impressive returns in 2016. FNMA ended 2016 up an impressive 137.80%, outperforming many large cap stocks. Now, this meteoric rise was primarily driven by Trump’s unexpected win and selection of former Goldman Sachs partner Steven Mnuchin as the next U.S. Treasury Secretary. Mnuchin aims to privatize FNMA and Feddie Mac under the Trump administration, which should increase FNMA’s profit margins.

Large hedge funds were also in on the action. Pershing Square (NYSE:SQ) and Paulson & Co. bought large stakes in both FNMA and Freddie Mac, expecting that these government sponsored enterprises would be privatized.

Now, FNMA surged from approximately $1.70 per share to $5 per share in just a matter of weeks, but slightly pulled back thereafter, as shown in the chart below.

Source: TradingView

Advanced Micro Devices (NASDAQ:AMD) Inc.

2016 was a great year for Advanced Micro Devices Inc (NASDAQ:AMD) shareholders. AMD ended up an astonishing 295.12% in 2016. Additionally, it’s up 370.22% over the past year, as of January 13, 2017.

Take a look at AMD’s impressive move in 2016:

Source: TradingView

The stock is still trending higher, and it’s starting to get more competitive with its rival chipmakers, Intel, Nvidia and Qualcomm. AMD unveiled its innovative Zen microprocessor technology during the summer of 2016, and it’s expected to be released to the public during the first quarter of 2017. AMD’s new release coupled with the potential corporate tax cut should increase its profit margins, and in turn, its stock price should rise.

The Chemours Company

The Chemours Company (NYSE:CC), a spin-off from DuPont (NYSE:DD), generated remarkable returns in 2016. Chemours Co. ended up a remarkable 314.37% in 2016, and significantly outperformed major indices. Additionally, as of January 13, 2017, Chemours was up an immense 657.88% over the past year. Again, this was fueled by Trump’s corporate tax plan, as well as his CEO as the head of Manufacturing Council . The selection of Dow Chemical CEO Liveris to head Manufacturing Council could benefit the chemicals industry with the potential deregulations.

The markets were quick to price this in, as shown in the chart here:

Source: TradingView

The Bottom Line

Small cap stocks outperformed mid- and large-caps in 2016, and 2017 should be better for the small cap space. Now, the spectacular move higher was primarily fueled by Trump, and if all his plans are properly executed, small cap stocks could continue their remarkable run.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.