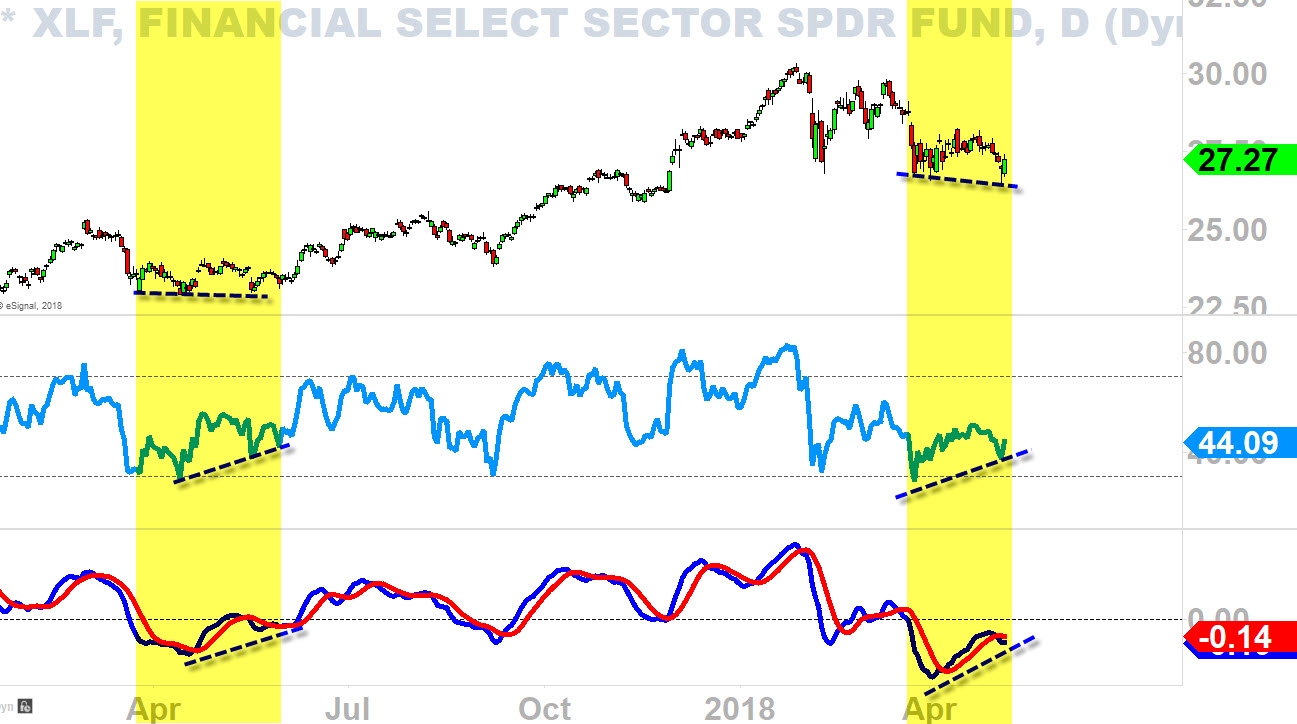

XLF: This Chart Implicates The Banks Have Bottomed

Kay Kim | May 06, 2018 11:06PM ET

This bullish divergence appearing here again today on Financial Select Sector SPDR (NYSE:XLF), ironically, very similar to May of last year (highlighted left).

Financial Sector (XLF) has seen about 12% corrections since when it peaked at 30ish on late January of this year. In the last few months this sector has been hovering slightly below 27-level, what it appears to be a consolidational price movement.

But what's more interesting about this price-action is, it is now forming bullish divergence yet again here today (which is similar to 2017 May).

Yes, this is a premature (early) stage of the divergence and for it to fully confirm, we would need to see the price clearing above 28-level and hold above. If we can do that, I do believe XLF can thrive for the next 5-6 months (of course, minor-term ups and downs along the way).

This is what I call, " stair stepping" pattern in a primary-term uptrend fluctuation. So basically, what it means is; stock goes up and comes down hits the prior resistance as new support, and it gets back up to hit new highs and pulls back to create new support while hitting the prior resistace; do this over and over again over the course of the multi-year, and you got this primary-term "stair stepping" pattern.

When this pattern occurs it tends solidify the trend as it accelerates to the upside. When you look at this weekly-chart below you can see that this primary-term uptrend is still in-tact and valid and healthy - thus, we are in a correctional phase in a primary-term uptrend before resuming back up as I believe XLF has bottomed.

My targeting analysis forecasts 34 to 36 level in about 6 months upon "confirmation" of the bullish divergence I covered earlier on this post.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.